The cryptocurrency mining landscape has evolved dramatically, and finding the best ASIC miners for Bitcoin 2025 requires careful consideration of multiple factors including hash rate, energy efficiency, and return on investment. With Bitcoin’s network difficulty continuing to increase and mining rewards becoming more competitive, selecting the right ASIC miner can make the difference between profitable operations and financial losses.

This comprehensive guide examines the top-performing ASIC miners available in 2025, helping both newcomers and experienced miners make informed decisions about their mining hardware investments. Whether you’re planning a small-scale home mining operation or considering industrial-scale mining farms, understanding which miners deliver the best performance per dollar spent is crucial for success in today’s competitive Bitcoin mining environment.

Why ASIC Miners Dominate Bitcoin Mining in 2025

Application-Specific Integrated Circuit (ASIC) miners have become the gold standard for Bitcoin mining due to their specialized design and unmatched efficiency. Unlike general-purpose CPUs or GPUs, ASIC miners are built specifically for the SHA-256 algorithm used in Bitcoin mining, delivering superior hash rates while consuming less electricity per terahash.

The Bitcoin network’s increasing difficulty has made it virtually impossible for casual miners using consumer hardware to compete effectively. Modern ASIC miners can achieve hash rates measured in terahashes per second (TH/s), far exceeding what traditional computing hardware can deliver. This efficiency translates directly into better profitability and shorter payback periods for serious miners.

Energy efficiency has become the primary differentiator between mining hardware models. The most competitive miners in 2025 achieve efficiency ratings below 30 watts per terahash (W/TH), representing significant improvements over older generation equipment that consumed 50-100 W/TH or more.

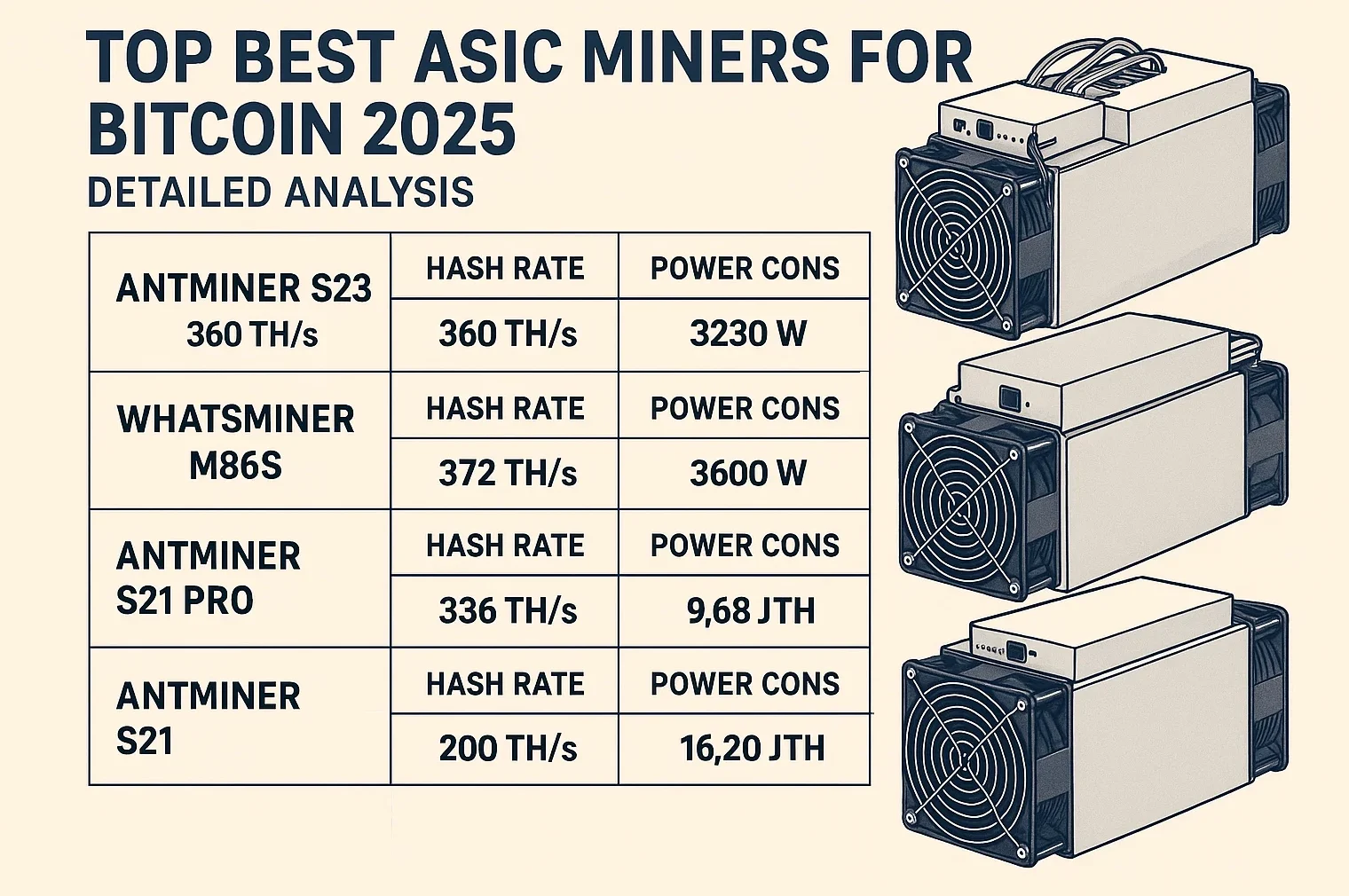

Top Best ASIC Miners for Bitcoin 2025: Detailed Analysis

Antminer S21 Pro Series: Leading the Pack

The Antminer S21 Pro stands out as one of the most impressive ASIC miners available in 2025. Manufactured by Bitmain, this powerhouse delivers exceptional performance with a hash rate of approximately 234 TH/s while maintaining an energy efficiency of around 15.0 J/TH (joules per terahash).

Key specifications include a power consumption of roughly 3,510W, making it suitable for operations with access to affordable electricity. The S21 Pro features advanced cooling systems and improved chip architecture that enhances both performance and longevity. Mining farms worldwide have reported impressive reliability rates with this model.

The price point typically ranges between $4,500-$6,500 depending on market conditions and availability. When calculating return on investment, the S21 Pro often demonstrates payback periods of 8-14 months under favorable electricity costs and Bitcoin price conditions.

WhatsMiner M60S+: High-Performance Alternative

MicroBT’s WhatsMiner M60S+ represents another top contender in the ASIC mining space. This miner achieves hash rates up to 240 TH/s with power efficiency around 16.5 J/TH, positioning it competitively against other flagship models.

The M60S+ incorporates advanced thermal management systems that help maintain optimal operating temperatures even in challenging environments. Its robust build quality and proven track record make it a preferred choice for many professional mining operations.

Pricing for the M60S+ typically falls in the $5,000-$7,000 range, with availability varying based on global supply chain conditions. The miner’s excellent efficiency ratings often result in strong profitability metrics for operators with access to low-cost electricity.

AvalonMiner A1466: Balanced Performance and Value

Canaan Creative’s AvalonMiner A1466 offers a compelling balance of performance and affordability. With hash rates reaching 150 TH/s and power efficiency of approximately 23 J/TH, it provides solid performance for miners seeking cost-effective entry points into professional mining.

This model has gained popularity among smaller mining operations and individual miners due to its reasonable pricing and reliable operation. The A1466 typically costs between $3,000-$4,500, making it accessible to a broader range of miners while still delivering competitive performance.

The miner’s modular design allows for easier maintenance and potential upgrades, extending its useful life compared to some competitors. Many operators report consistent performance and minimal downtime with proper maintenance.

Profitability Analysis: Calculating Your Mining Returns

Understanding profitability requires analyzing several key factors beyond just hash rate specifications. Electricity costs represent the largest ongoing expense for mining operations, typically accounting for 60-80% of total operational costs.

Current Bitcoin network difficulty and block reward mechanisms directly impact daily mining revenue. With Bitcoin’s block reward halving events occurring approximately every four years, miners must plan for potentially reduced rewards over time while hoping for corresponding increases in Bitcoin’s market value.

Mining pool fees typically range from 1-3% of gross mining revenue, representing another factor in profitability calculations. Choosing reputable pools with reliable payouts and reasonable fee structures can significantly impact long-term returns.

Equipment depreciation and replacement costs should factor into long-term planning. ASIC miners typically maintain competitive performance for 2-4 years before newer, more efficient models make replacement economically advantageous.

Power Efficiency: The Key to Long-Term Success

Energy efficiency has become the most critical factor determining mining profitability in 2025. Miners with superior efficiency ratings maintain profitability even during periods of lower Bitcoin prices or increased network difficulty.

The relationship between hash rate and power consumption varies significantly between models. While some miners achieve higher absolute hash rates, their power consumption may result in lower efficiency ratings that impact overall profitability.

Cooling requirements add additional energy costs beyond the miner’s rated power consumption. Effective cooling systems are essential for maintaining optimal performance and preventing thermal throttling that reduces hash rates.

Location plays a crucial role in maximizing efficiency benefits. Miners operating in regions with cooler climates can achieve better overall system efficiency through reduced cooling requirements and improved heat dissipation.

Setting Up Your Mining Operation

Proper infrastructure planning is essential for successful ASIC mining operations. Electrical capacity must accommodate not only the miners themselves but also cooling systems, monitoring equipment, and safety margins for peak consumption periods.

Ventilation systems require careful design to manage heat output effectively. Modern ASIC miners generate substantial heat that must be expelled to maintain optimal operating temperatures and prevent equipment damage.

Network connectivity and monitoring systems enable remote management and performance optimization. Reliable internet connections ensure consistent mining pool connectivity and minimize downtime that reduces profitability.

Security considerations include both physical security for valuable mining equipment and cybersecurity measures to protect mining operations from potential attacks or unauthorized access.

Maintenance and Optimization Strategies

Regular maintenance schedules help maximize ASIC miner lifespan and performance. This includes cleaning dust from cooling systems, checking electrical connections, and monitoring performance metrics for signs of degradation.

Firmware updates from manufacturers often include performance improvements and bug fixes that can enhance mining efficiency. Staying current with official firmware releases while avoiding unauthorized modifications helps maintain warranty coverage and system stability.

Temperature monitoring systems provide early warning of potential problems before they cause equipment failures. Maintaining optimal operating temperatures extends equipment life and ensures consistent hash rate performance.

Performance tuning options vary between manufacturers and models. Some miners offer adjustable power modes that allow operators to optimize for either maximum hash rate or improved efficiency depending on local conditions.

Future-Proofing Your Mining Investment

Technology advancement continues at a rapid pace in the ASIC mining industry. Next-generation chips promise even better efficiency ratings and higher hash rates, potentially affecting the competitive lifespan of current equipment.

Scalability considerations become important as mining operations grow. Choosing equipment that integrates well with existing infrastructure and allows for efficient expansion can reduce long-term operational complexity.

Resale value retention varies significantly between manufacturers and models. Established brands with strong track records typically maintain better resale values, providing additional protection for mining investments.

Market timing affects both equipment availability and pricing. Understanding supply cycles and demand patterns can help miners acquire equipment at favorable prices while avoiding periods of severe shortage or inflated pricing.

Conclusion

Selecting the best ASIC miners for Bitcoin 2025 requires balancing performance, efficiency, cost, and long-term viability factors specific to your mining operation goals and constraints. The Antminer S21 Pro series leads in pure performance and efficiency, while alternatives like the WhatsMiner M60S+ and AvalonMiner A1466 provide compelling options for different budget and performance requirements.

Success in Bitcoin mining depends not just on choosing the right hardware, but also on proper planning for infrastructure, electricity costs, and ongoing operational management. The miners highlighted in this guide represent the current state of the art in ASIC technology, offering pathways to profitable mining operations when deployed with appropriate supporting systems and cost management.

READ MORE: Best Bitcoin Mining Machines 2025 Top 10 ASIC Miners for Maximum ROI