For years, the public narrative surrounding Bitcoin mining has centered on one idea: that miners consume tremendous amounts of electricity and pose a threat to grid stability. The image of massive industrial data centers humming around the clock has fueled intense criticism and concern. Yet beneath these headlines, a deeper and far more complex reality has been unfolding. In states like Texas and countries exploring large-scale renewable integration, Bitcoin miners are no longer viewed simply as heavy energy users. Instead, they are emerging as valuable partners in supporting grid reliability and even helping reduce electricity costs for everyday consumers.

This shift is rooted in something surprisingly simple. Bitcoin miners can turn their machines off almost instantly, making them an unusually flexible type of energy user. When the grid is strained and electricity prices surge, miners can shut down within seconds. Conversely, when there is an oversupply of renewable energy—especially wind and solar power—they can absorb that excess by operating at full strength. In technical and economic terms, this makes them flexible loads, capable of responding to real-time grid conditions in ways that conventional industrial facilities cannot.

The potential impact of this flexibility is significant. If miners operate under smart policies and well-designed market rules, they can reduce peak demand, lower price volatility, and help transmit the benefits of renewable energy more efficiently across the system. Under those conditions, Bitcoin miners can lower your power bill by reducing the need for expensive backup power plants and by stabilizing wholesale energy markets. But this outcome depends entirely.

How Bitcoin miners consume electricity

Bitcoin mining involves specialized hardware known as ASICs. These machines compete to solve complex mathematical puzzles, and the process consumes large amounts of electrical energy. What sets miners apart from almost every other industrial sector is their sensitivity to electricity prices. The profitability of mining hinges entirely on the gap between power costs and the market price of Bitcoin. For this reason, miners naturally seek out the cheapest electricity available, whether that means off-peak nighttime power, surplus renewable generation, or electricity from remote regions where demand is low.

Another defining characteristic of Bitcoin mining facilities is the speed at which they can ramp their power consumption up or down. Since mining operations do not depend on fixed schedules or production cycles, operators can curtail their usage with astonishing speed. A manufacturing plant cannot decide to halt production for an hour simply because wholesale electricity prices are high, but a mining farm can. A hospital certainly cannot shut down its equipment to help stabilize the grid, but miners can suspend their operations instantaneously without harming their infrastructure or business model.

This unique combination of price sensitivity, operational flexibility, and digital automation positions Bitcoin miners as ideal candidates for grid programs designed around demand-side management. In the context of a modern energy system facing rapid growth in renewable generation, miners function like programmable sponges, soaking up energy when it is plentiful and releasing it back into the system when scarcity threatens.

Why modern energy grids need flexible loads more than ever

Electric grids were historically built around a straightforward idea: supply must constantly match demand. For decades, utilities dealt with predictable daily patterns of consumption and relied on controllable generation such as natural gas, coal, or hydroelectric plants. But the energy landscape is changing dramatically.

The rise of renewable energy sources, especially wind and solar power, has created new challenges for grid operators. Renewable generation is abundant when the wind blows or the sun shines, not necessarily when people need electricity. This can create significant surpluses during midday or overnight periods, followed by sudden shortages during cloudy days, calm evenings, or extreme weather events.

At the same time, new data centers, electric vehicle adoption, and industrial growth are pushing electricity demand to levels that many grids were never designed to handle. This combination of fluctuating supply and rising demand makes grid stability more delicate than ever. When demand spikes sharply—such as during a heatwave when air conditioners run nonstop—the grid can become stressed, forcing utilities to activate gas-fired peaker plants. These plants are extremely expensive to operate and contribute significantly to carbon emissions.

Conversely, during periods of energy surplus, power prices can crash to zero or even become negative. Negative pricing signals that there is too much electricity and not enough demand to absorb it. In these moments, renewable energy must be curtailed—effectively wasted—because the grid cannot maintain balance unless excess supply is cut off.

This is where flexible demand becomes invaluable. Energy systems increasingly require users who can increase or decrease consumption rapidly, providing a counterbalance to the volatility of renewable generation. Very few industries can operate this way because most require consistent, uninterrupted power. Bitcoin miners, however, are uniquely capable of responding with the speed and precision needed in modern grid environments.

Demand response and Bitcoin mining: A powerful alignment

The concept of demand response refers to programs in which electricity consumers adjust their usage in response to grid conditions, price signals, or emergency events. Traditionally, these programs have relied on large commercial operations or industrial facilities that might reduce consumption during peak periods. Yet participation has always been limited because most industries cannot afford meaningful interruptions.

Bitcoin mining changes the equation by introducing a class of energy users whose operations are inherently flexible. Since the profitability of mining fluctuates with power prices, miners are already inclined to shut down when electricity becomes expensive. This natural economic behavior aligns perfectly with the goals of demand response programs. In many cases, miners do not need elaborate incentives; market prices alone drive them to act in ways that support grid stability.

In more advanced scenarios, miners can integrate directly with grid operators through automated systems that respond to frequency changes, real-time pricing, or emergency signals. When grid frequency drops—signaling stress or imbalance—miners can power down in seconds. When frequency stabilizes or power becomes abundant again, they can resume operations without delay.

From the grid’s perspective, this makes miners function similarly to virtual power plants, but in reverse. Instead of injecting energy into the grid, they remove demand. The outcome is the same: improved stability, reduced risk of blackouts, and smoother price dynamics during periods of volatility.

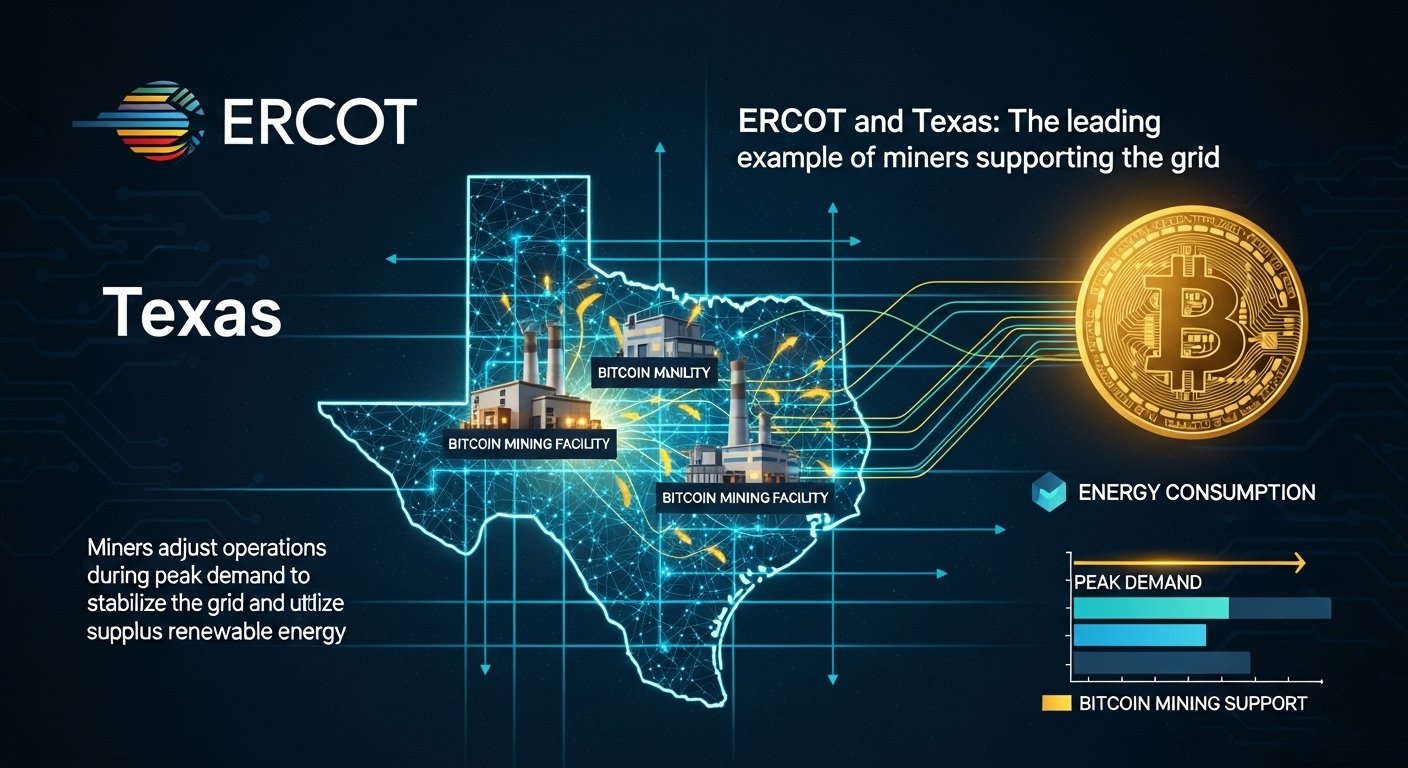

ERCOT and Texas: The leading example of miners supporting the grid

Texas has become the world’s most closely studied case of Bitcoin miners interacting with an energy grid. The ERCOT grid operates with unique characteristics. It is largely independent from the rest of the United States, making the supply-demand balance more challenging. At the same time, Texas has experienced explosive growth in wind and solar generation, leading to some of the most volatile electricity prices in the country.

These conditions have made Texas a magnet for Bitcoin miners, who are attracted by the availability of low-cost power and a regulatory environment open to innovation. What has emerged is a dynamic relationship in which miners sign agreements to act as large, flexible loads, giving ERCOT the ability to curtail their consumption during times of stress.

During heatwaves or winter storms, this flexibility can make the difference between stability and large-scale blackouts. Miners have reduced their load by gigawatts in emergency events, freeing capacity for residential and commercial customers when it matters most. In return, miners sometimes receive reduced rates or demand response credits for supporting the system.

Some analyses estimate that these actions have saved billions in avoided peak pricing, though the exact figures remain debated among economists. What is clear, however, is that miners have proven they can operate as reliable partners to the grid, and ERCOT has become a model for how energy systems can benefit from flexible loads in a world dominated by renewable energy.

Can Bitcoin miners truly lower your electricity bill?

The idea that Bitcoin miners can lower your power bill is both true and incomplete. The reality depends on how mining operations are integrated into the grid. Miners can indeed reduce costs by lowering peak demand, limiting price spikes, and absorbing excess renewable energy that would otherwise be wasted. Over time, this can reduce the need for expensive grid upgrades or peaker plants, lowering system-wide energy costs.

However, miners also introduce a large new demand to the grid. If this growth occurs without infrastructure planning or regulatory oversight, it can drive wholesale prices higher, increase congestion, and necessitate new investments that ultimately show up on consumer bills. This is why thoughtful regulation is essential. Miners must be incentivized to operate primarily during periods of low demand or energy surplus.

When integrated with care, Bitcoin miners function like controllable loads that enhance rather than burden the grid. When allowed to expand without coordination, they can strain the system. The difference lies entirely in the rules governing their participation.

See More: Bitcoin Miners Market Cap Hits Record High in September

The importance of market design and regulatory oversight

Market design determines whether Bitcoin miners benefit or harm the power grid. Regulators hold the responsibility of ensuring that miners provide value rather than extract it. This can involve requiring miners to register as interruptible load, participate in demand response programs, or agree to curtailment during predetermined conditions.

Time-of-use rates and dynamic pricing models can naturally encourage miners to operate when electricity is cheap and stand down when it is scarce. Clear interconnection guidelines can also prevent the uncontrolled growth of high-demand facilities in areas not equipped for additional load.

Transparency plays an essential role as well. Public reporting on how often miners curtail, how much they earn from grid programs, and how they affect total demand helps communities and policymakers determine whether mining operations are delivering real value.

Environmental and community considerations

No discussion about Bitcoin mining would be complete without acknowledging environmental concerns. Critics argue that mining encourages fossil fuel consumption and increases carbon emissions. The reality, however, varies widely by region. In grids dominated by renewable energy, mining can actually reduce emissions by absorbing energy that would otherwise be curtailed and by reducing reliance on fossil-fueled peaker plants.

Community impacts such as noise, infrastructure strain, or local environmental effects must also be managed carefully. Responsible policy can require miners to co-locate with renewable projects, invest in noise mitigation, or provide grid services as a condition of operating within a region.

Ultimately, mining’s environmental footprint is shaped not by its inherent technology but by the energy sources powering it and the regulations governing it.

How consumers can actually feel the savings

Even when Bitcoin miners are actively supporting the grid, the benefits may not be immediately obvious on your bill. Retail electricity pricing structures often mask the connection between grid-level savings and residential rates. But over time, the effect becomes noticeable in the form of a slower rate of increase and fewer extreme spikes during periods of elevated demand.

If miners help reduce the frequency of emergencies, lower wholesale prices during scarcity events, and delay costly grid expansions, the savings eventually flow to customers. Instead of dramatic monthly discounts, the benefit appears as long-term price stability.

A global perspective: Will more grids embrace Bitcoin miners?

Around the world, energy systems are grappling with the same pressures seen in Texas. Volatile renewable generation, rising demand, and the need for flexible resources. Countries with strong renewable growth may increasingly view Bitcoin mining as an opportunity rather than a burden. Provided miners operate under strict rules that align with grid needs.

Other regions, however, may choose to restrict mining due to political concerns, environmental priorities, or competing demands for electricity. Ultimately, the global expansion of mining as a grid asset will depend on whether. Policymakers recognize the strategic value of programmable, flexible demand.

Conclusion

So, can Bitcoin miners lower your power bill? The honest answer is that they can, but only under the right conditions. Bitcoin miners are uniquely positioned to act as flexible load resources. Capable of stabilizing grids, supporting renewable integration, and reducing peak demand. When guided by smart regulations and market rules, they become part of the solution, not part of the problem.

But if miners are allowed to expand without oversight, the opposite can occur. Large uncontrolled demand can strain the grid, increase congestion, and ultimately raise consumer costs.

The future, therefore, hinges on thoughtful policy. When energy grids allow miners to plug in responsibly, aligning their flexibility with the needs of the system. The result is a cleaner, more resilient grid with lower long-term costs. In that scenario, Bitcoin miners genuinely can help lower your electricity bill—not by magic. But by contributing to a more efficient and stable energy marketplace.