The cryptocurrency market began the week under heavy pressure as the Bitcoin price bleeds below $89,000 following a grim and volatile weekend. Investors who had hoped for stability after recent consolidation instead faced renewed selling pressure, underscoring how fragile sentiment remains across digital asset markets. This latest downturn reflects a complex mix of macroeconomic uncertainty, weakening liquidity, and fading risk appetite that continues to challenge even the most resilient cryptocurrencies.

Bitcoin’s decline below the psychologically important $89,000 level has reignited debates about whether the market is entering a deeper corrective phase or simply experiencing a temporary pullback within a broader long-term uptrend. As the flagship cryptocurrency, Bitcoin often sets the tone for the entire digital asset ecosystem, and its recent performance has once again sent ripples through altcoins, crypto-linked equities, and investor confidence.

In this in-depth analysis, we explore why the Bitcoin price bleeds below $89,000, what the grim weekend revealed about market structure, and what traders and long-term holders should watch next. By examining technical indicators, macroeconomic forces, and on-chain data, this article provides a comprehensive perspective designed to help readers navigate the current market landscape.

Bitcoin Price Bleeds Below $89,000: What Happened Over the Weekend

The weekend sell-off that pushed Bitcoin below $89,000 did not occur in isolation. Thin weekend liquidity often amplifies price movements, and this time was no exception. As trading volumes declined, even moderate sell orders were enough to trigger sharp price swings, exposing how sensitive the market remains to sudden shifts in sentiment.

Another factor contributing to the decline was the absence of strong bullish catalysts. Without fresh institutional inflows or positive regulatory developments, buyers lacked the conviction needed to defend key support levels. As a result, Bitcoin drifted lower, eventually breaching the $89,000 threshold that many traders viewed as a short-term floor.

The fact that the Bitcoin price bleeds below $89,000 during a weekend also highlights the ongoing structural differences between crypto markets and traditional financial systems. Unlike stock markets, which close on weekends, cryptocurrencies trade continuously, making them vulnerable to sudden moves when participation is limited.

Weak Liquidity and Its Role in the Decline

Liquidity has been a recurring theme throughout recent market discussions, and the latest downturn reinforces its importance. With fewer active participants, order books become thinner, allowing price movements to accelerate in either direction. During the grim weekend, this lack of depth worked against Bitcoin, magnifying bearish momentum.

This environment also discourages risk-taking behavior. Traders are less willing to step in and “buy the dip” when price action feels unstable, further exacerbating declines. The result is a feedback loop where falling prices reduce confidence, leading to even lower liquidity and additional selling pressure.

Market Sentiment Turns Cautious as Bitcoin Slips

When the Bitcoin price bleeds below $89,000, sentiment inevitably takes a hit. Market psychology plays a crucial role in cryptocurrency valuations, and the loss of a key price level can quickly shift narratives from optimism to caution.

Social media discussions, trading forums, and market commentary over the weekend reflected growing unease. While long-term believers remain confident in Bitcoin’s fundamentals, short-term traders appeared increasingly defensive, opting to reduce exposure rather than risk further downside.

Fear, Uncertainty, and the Return of Volatility

Volatility has long been a defining characteristic of cryptocurrency markets, and the latest price action is a reminder that sharp swings remain the norm. As the Bitcoin price bleeds below $89,000, volatility indicators have ticked higher, signaling increased uncertainty.

While volatility can present opportunities for experienced traders, it often deters new entrants and institutional investors who prioritize stability. This dynamic can slow capital inflows, prolonging periods of consolidation or decline.

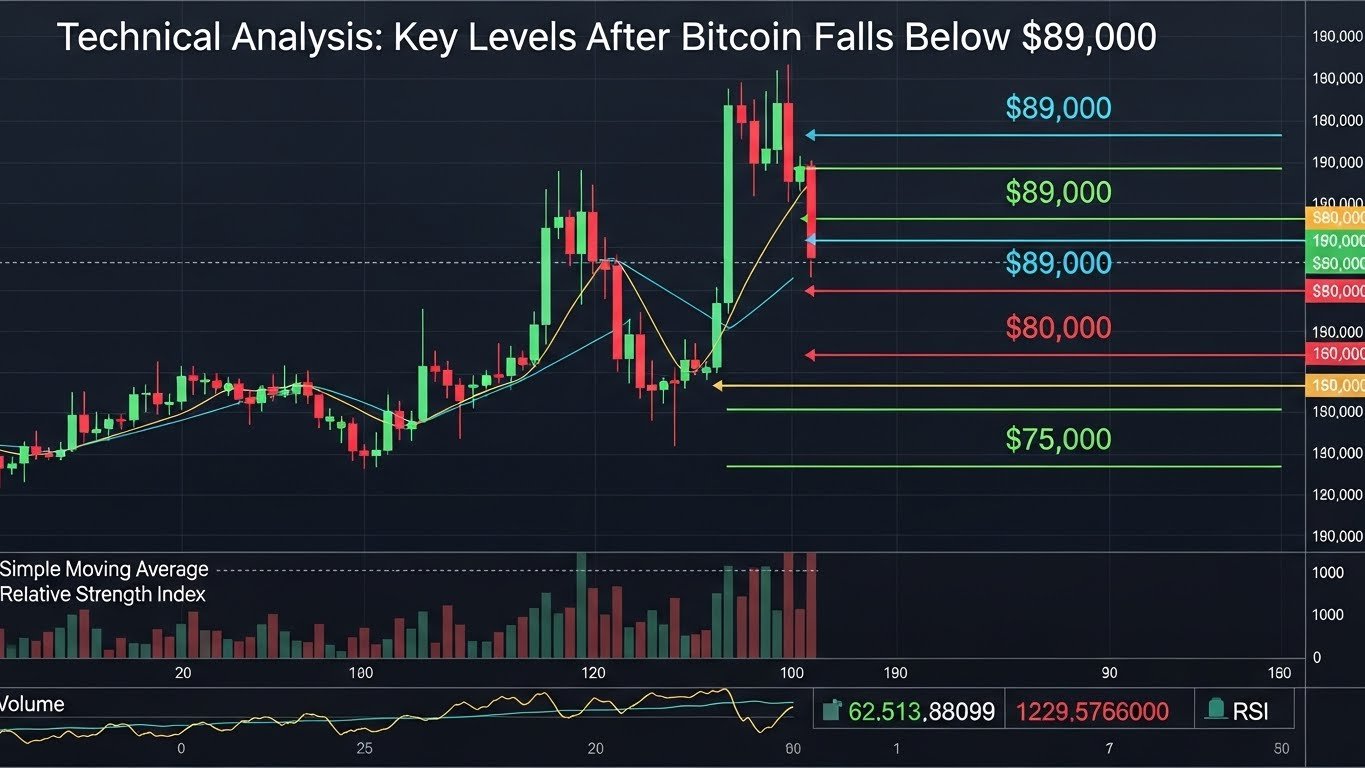

Technical Analysis: Key Levels After Bitcoin Falls Below $89,000

From a technical perspective, the breakdown below $89,000 carries significant implications. This level had acted as a consolidation zone in recent sessions, providing temporary support during previous pullbacks. Its failure suggests that sellers currently hold the upper hand. Chart analysts are now closely watching the next potential support areas. While some view the decline as a healthy correction within a larger uptrend, others warn that further downside could materialize if buying interest does not return quickly.

Resistance and Support Zones to Watch

As the Bitcoin price bleeds below $89,000, former support levels may now turn into resistance. Any attempt at a rebound will likely face selling pressure near this zone, making it a critical area to monitor. On the downside, traders are assessing whether buyers will step in at lower levels to stabilize the market. The speed and strength of any bounce will offer valuable clues about overall market confidence and whether the current move is merely a short-term shakeout.

Macroeconomic Pressures Weigh on Bitcoin Price

Beyond crypto-specific factors, broader macroeconomic conditions continue to influence Bitcoin’s trajectory. Global markets remain sensitive to inflation data, interest rate expectations, and central bank policies, all of which shape investor behavior across asset classes. Rising yields and a stronger dollar often reduce the appeal of risk assets, including cryptocurrencies. As these pressures persist, Bitcoin faces headwinds that make sustained rallies more difficult to achieve.

Bitcoin’s Evolving Role as a Risk Asset

Once touted as a hedge against traditional finance, Bitcoin increasingly trades in line with other risk assets during periods of stress. This correlation means that negative developments in equities or bonds can spill over into crypto markets, amplifying losses. Understanding this evolving relationship is essential for investors seeking to manage risk and set realistic expectations about Bitcoin’s short-term behavior.

On-Chain Data Signals Mixed Outlook

On-chain metrics offer additional insight into the current market environment. While some indicators suggest reduced selling pressure from long-term holders, others point to cautious behavior among newer participants. Wallet activity over the grim weekend showed an uptick in transfers to exchanges, often interpreted as a sign of potential selling.

However, long-term holders largely remained inactive, suggesting continued confidence in Bitcoin’s long-term value proposition. These mixed signals reflect a market at a crossroads. As the Bitcoin price bleeds below $89,000, the balance between conviction and caution will determine the next major move.

Long-Term Holders vs. Short-Term Traders

The divergence between long-term holders and short-term traders is particularly noteworthy. While traders react quickly to price movements, long-term investors tend to focus on fundamentals, viewing dips as potential accumulation opportunities rather than reasons to panic. This dynamic often shapes market recoveries, as strong hands can absorb selling pressure once prices stabilize.

Broader Crypto Market Impact

Bitcoin’s decline rarely occurs in isolation, and the latest drop has once again influenced the broader crypto ecosystem. Major altcoins followed Bitcoin lower, while smaller tokens experienced heightened volatility.

Crypto-related stocks and funds also felt the impact, reflecting the growing integration between digital assets and traditional financial markets. As the Bitcoin price bleeds below $89,000, these ripple effects highlight Bitcoin’s continued dominance as the market’s primary bellwether.

Investor Strategy During Market Downturns

Periods of weakness often force investors to reassess their strategies. Some choose to reduce exposure and wait on the sidelines, while others view downturns as opportunities to accumulate assets at lower prices.

The key lies in aligning investment decisions with individual risk tolerance and time horizon, particularly in a market as volatile as cryptocurrency.

Outlook: What Comes Next for Bitcoin Price

Looking ahead, the path forward for Bitcoin will depend on a combination of technical recovery, renewed liquidity, and supportive macro conditions. A swift reclaim of $89,000 could restore confidence and pave the way for stabilization.

However, failure to regain this level may leave Bitcoin vulnerable to further downside, especially if external pressures intensify. As the Bitcoin price bleeds below $89,000, patience and discipline become essential virtues for market participants. Ultimately, Bitcoin’s long-term narrative remains intact, but short-term challenges underscore the importance of managing expectations and staying informed.

Conclusion

The latest downturn serves as a stark reminder of cryptocurrency’s inherent volatility. As the Bitcoin price bleeds below $89,000 after a grim weekend, investors are confronted with a market shaped by weak liquidity, cautious sentiment, and broader economic uncertainty. While the decline has unsettled short-term traders, long-term holders appear largely unfazed, reflecting confidence in Bitcoin’s enduring value.

Whether this move marks a deeper correction or a temporary setback will become clearer in the coming weeks. For now, understanding the forces at play and maintaining a balanced perspective is crucial for navigating the evolving crypto landscape.

FAQs

Q. Why did the Bitcoin price bleed below $89,000?

The decline was driven by weak weekend liquidity, cautious market sentiment, and a lack of bullish catalysts, which amplified selling pressure.

Q. Is this a sign of a long-term bear market for Bitcoin?

Not necessarily. While the drop is significant, long-term fundamentals remain strong, and the move could represent a short-term correction.

Q. How does macroeconomic uncertainty affect Bitcoin price?

Factors like interest rates, inflation, and dollar strength influence investor risk appetite, often impacting Bitcoin alongside other risk assets.

Q. Should investors be worried about further downside?

Short-term volatility remains possible, but long-term investors often view such pullbacks as part of Bitcoin’s natural market cycles.

Q. What key levels should traders watch next?

Traders are closely monitoring whether Bitcoin can reclaim $89,000 and where strong buying interest emerges below current levels.