Crypto markets today are experiencing a renewed wave of optimism as Bitcoin rallies on Japan rate hike as futures traders pile in, signaling a powerful shift in global risk sentiment. The unexpected monetary policy move by the Bank of Japan, long known for its ultra-loose stance, has sent ripples across traditional financial markets and spilled decisively into the cryptocurrency ecosystem. For years, Japan’s accommodative policy suppressed yields and encouraged carry trades, but the recent rate hike has altered currency dynamics, capital flows, and investor psychology in ways that directly benefit digital assets.

Bitcoin’s surge is not merely a price reaction; it reflects a deeper structural change in how macroeconomic signals are interpreted by crypto investors. As the yen strengthens and global markets recalibrate expectations for liquidity and inflation, futures traders have aggressively increased exposure, driving open interest and volumes to levels not seen in months. This rally underscores Bitcoin’s evolving role as both a speculative instrument and a macro-sensitive asset increasingly intertwined with central bank decisions.

In this in-depth analysis of crypto markets today, we explore why Bitcoin rallied following Japan’s rate hike, how futures traders are shaping short-term momentum, and what this means for the broader digital asset landscape. From institutional participation and derivatives data to altcoin performance and global monetary implications, this article provides a comprehensive view designed to inform, engage, and add lasting value for readers seeking clarity in a fast-moving market.

Japan’s Rate Hike and Its Global Market Impact

Japan’s decision to raise interest rates marks a historic pivot after years of negative or near-zero rates. This shift has profound implications not only for domestic markets but also for global capital flows that influence crypto markets today.

Why the Bank of Japan’s Policy Shift Matters

For decades, Japan’s low-rate environment fueled global carry trades, where investors borrowed cheaply in yen to invest in higher-yielding assets elsewhere. The rate hike disrupts this strategy, strengthening the yen and prompting investors to reassess risk exposure. As traditional markets adjust, Bitcoin has emerged as an attractive alternative for capital seeking protection against currency volatility and policy uncertainty.

The significance of this move lies in its timing. With other major central banks maintaining restrictive stances or signaling caution, Japan’s rate hike introduces a new variable into global liquidity conditions. This has led investors to seek assets that can perform independently of traditional yield curves, reinforcing Bitcoin’s appeal.

Currency Markets, Yen Strength, and Bitcoin

A stronger yen typically pressures risk assets, yet Bitcoin rallies on Japan rate hike as futures traders pile in because crypto markets interpret the move differently. Bitcoin benefits from currency dislocations as traders hedge against fiat volatility. The yen’s appreciation has also encouraged Japanese investors to diversify into digital assets, adding regional demand to global momentum.

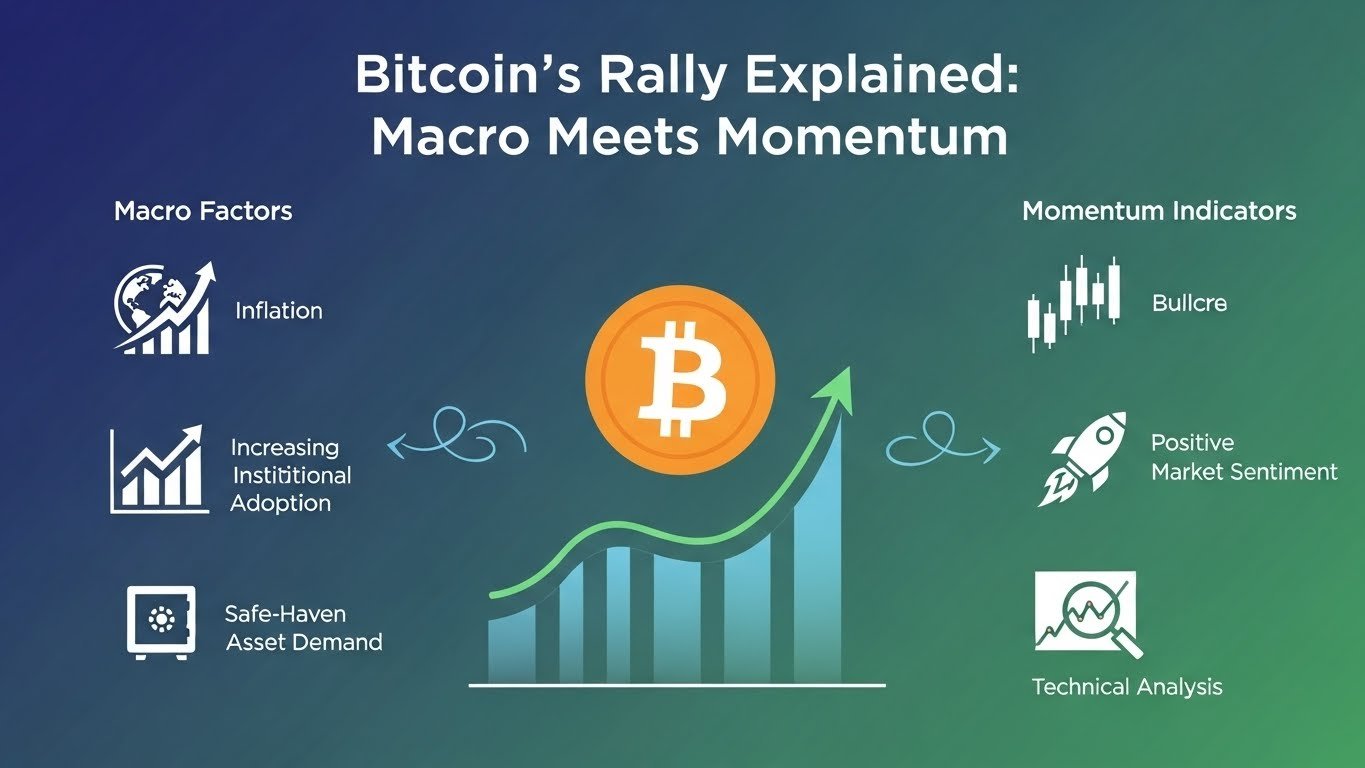

Bitcoin’s Rally Explained: Macro Meets Momentum

Bitcoin’s price action following Japan’s rate hike reflects a convergence of macroeconomic signals and technical momentum. This is not an isolated pump but a structurally supported rally.

Macroeconomic Tailwinds Supporting Bitcoin

The rate hike has intensified debates around global monetary policy divergence. Bitcoin, often described as digital gold, thrives in environments where policy uncertainty rises. As investors question the sustainability of fiat systems, Bitcoin’s fixed supply narrative gains renewed traction.

Additionally, inflation expectations remain elevated in many economies. Even as Japan tightens policy, global inflation risks persist, reinforcing Bitcoin’s role as a hedge. These factors collectively explain why crypto markets today are responding so strongly to a single central bank decision.

Technical Breakouts and Market Structure

From a technical perspective, Bitcoin’s rally coincided with a breakout above key resistance levels. This triggered algorithmic buying and short liquidations, accelerating upward momentum. Futures traders capitalized on this move, amplifying price action through leveraged positions.

Futures Traders Pile In: Derivatives Drive Momentum

One of the most striking features of this rally is the surge in derivatives activity. Bitcoin futures trading has become the primary engine of short-term price discovery.

Rising Open Interest and Leverage

Following Japan’s rate hike, open interest across major futures exchanges spiked sharply. This indicates fresh capital entering the market rather than mere position rotation. Futures traders, anticipating sustained volatility, increased leverage to maximize returns, reinforcing upward momentum.

While leverage can amplify gains, it also introduces risk. However, the current structure suggests a healthier market compared to previous speculative excesses. Funding rates remain relatively balanced, signaling confidence rather than euphoria.

Institutional Participation in Bitcoin Futures

Institutional investors are increasingly active in Bitcoin futures markets. The clarity provided by regulated derivatives platforms has attracted hedge funds and asset managers seeking macro exposure. Their participation adds depth and stability, making the rally more resilient to sudden reversals. This institutional engagement is a key reason why crypto markets today feel fundamentally stronger than in previous cycles driven purely by retail speculation.

Broader Crypto Market Reaction

Bitcoin’s rally has set the tone for the wider digital asset market, influencing altcoins, stablecoins, and overall sentiment.

Altcoins Follow Bitcoin’s Lead

Major altcoins such as Ethereum, Solana, and Avalanche have posted gains in response to Bitcoin’s surge. However, the rally remains Bitcoin-led, with capital rotating selectively into high-liquidity assets. This suggests a risk-on environment tempered by caution, rather than indiscriminate speculation.

Stablecoin Flows and Liquidity

On-chain data shows increased inflows into stablecoins ahead of the rally, followed by deployment into Bitcoin futures. This pattern indicates strategic positioning rather than impulsive buying, reinforcing the narrative that crypto markets today are maturing.

Japan’s Crypto Landscape and Regional Influence

Japan has long been a significant player in the crypto ecosystem, with progressive regulations and active retail participation.

Japanese Investors and Regulatory Clarity

Japan’s clear regulatory framework has fostered trust in digital assets. The rate hike has prompted domestic investors to reassess portfolios, with Bitcoin emerging as a compelling option amid currency fluctuations.

Asia’s Growing Role in Crypto Markets

The rally highlights Asia’s influence on global crypto markets. As Japanese policy shifts intersect with regional trading activity, Asia-based exchanges and liquidity providers are playing a growing role in shaping price trends.

Bitcoin as a Macro Asset in 2025

The current rally underscores Bitcoin’s transformation into a macro-sensitive asset closely tied to global economic signals.

Central Bank Policies and Digital Assets

Bitcoin’s reaction to Japan’s rate hike illustrates how central bank decisions now directly impact crypto valuations. This evolution positions Bitcoin alongside commodities and currencies in global portfolios.

Correlation With Traditional Markets

While Bitcoin’s correlation with equities fluctuates, its response to monetary policy highlights a unique positioning. It can act as both a risk asset and a hedge, depending on market context, making crypto markets today more complex and nuanced.

Risks and Volatility Ahead

Despite the optimism, risks remain. Futures-driven rallies can reverse quickly if sentiment shifts or leverage unwinds High leverage increases the risk of cascading liquidations during pullbacks. Traders must monitor funding rates and open interest closely to gauge market health.

Regulatory and Macro Uncertainties

Future central bank decisions, regulatory developments, and geopolitical tensions could impact momentum. While the Japan rate hike has fueled the current rally, sustainability depends on broader macro alignment.

Long-Term Implications for Crypto Markets

The rally offers insights into the future trajectory of digital assets and their integration into global finance. Bitcoin’s ability to respond positively to macro shifts strengthens its case as a strategic asset. Institutional adoption, derivatives growth, and regulatory clarity all contribute to a more robust market structure.

Evolution of Crypto Market Dynamics

As futures traders play a larger role, volatility patterns may change. This could lead to more frequent but less extreme cycles, benefiting long-term investors seeking stability.

Conclusion

Crypto markets today are witnessing a pivotal moment as Bitcoin rallies on Japan rate hike as futures traders pile in, highlighting the asset’s growing sensitivity to global monetary policy. Japan’s historic shift has reshaped currency dynamics, encouraged capital reallocation, and reinforced Bitcoin’s role as both a hedge and a high-conviction macro asset. The surge in futures trading underscores increasing institutional participation and market maturity, while broader crypto assets follow cautiously.

While risks remain, the current rally reflects deeper structural changes rather than fleeting speculation. As central banks continue to influence global liquidity, Bitcoin’s integration into macro portfolios is likely to deepen. For investors and observers alike, this moment offers valuable insights into how digital assets are evolving within the global financial system.

FAQs

Q: Why did Bitcoin rally after Japan’s rate hike?

Bitcoin rallied because the rate hike altered global currency dynamics, increased policy uncertainty, and drove investors toward alternative assets like Bitcoin.

Q: How are futures traders influencing crypto markets today?

Futures traders amplify price movements through leveraged positions, increasing volume and open interest, which accelerates momentum during rallies.

Q: Is this Bitcoin rally sustainable?

Sustainability depends on macro conditions, leverage levels, and institutional participation. Current indicators suggest a healthier structure than past speculative surges.

Q: What role does Japan play in global crypto markets?

Japan’s regulatory clarity and active investor base make it a significant contributor to global crypto liquidity and sentiment.

Q: Should investors be cautious during futures-driven rallies?

Yes, futures-driven rallies can be volatile. Monitoring leverage, funding rates, and macro signals is essential for managing risk effectively.