For years, Bitcoin mining has been portrayed almost exclusively as an energy-intensive activity that strains power grids and raises electricity costs. Headlines have often focused on mining’s electricity consumption without examining how modern energy markets actually function. However, a growing body of research is challenging this one-dimensional narrative. A recent study suggests that Bitcoin mining helps stabilize power grids, lowers user costs, and can even accelerate the transition toward renewable energy. Rather than being a burden, mining may serve as a flexible, responsive load that strengthens grid resilience.

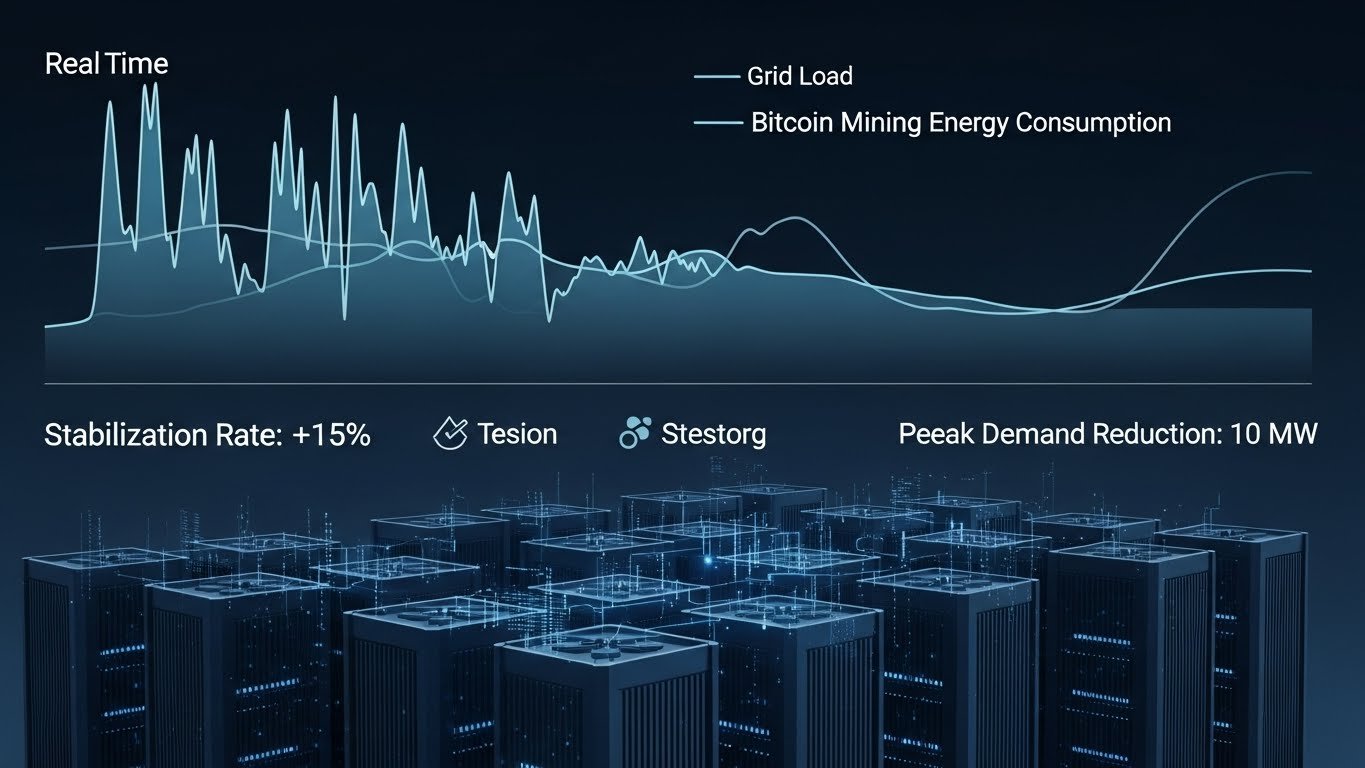

To this shift, it is essential to look at how power grids operate, where inefficiencies exist, and how large-scale flexible consumers like Bitcoin miners can interact with energy systems. Power grids must constantly balance supply and demand in real time. Any imbalance can cause price spikes, outages, or wasted energy. The study highlights that Bitcoin mining, when properly integrated, can absorb excess electricity during periods of oversupply and reduce demand during shortages, acting as a shock absorber for the grid.

This article explores how Bitcoin mining helps stabilize power grids, why this can lead to lower electricity costs for consumers, and what it means for the future of energy markets. By examining the economic, technical, and environmental dimensions, we can better understand why a growing number of energy experts are rethinking the role of mining in modern electricity systems.

The Basics of Bitcoin Mining and Energy Use

What Bitcoin Mining Really Is

At its core, Bitcoin mining is the process of securing the Bitcoin network by validating transactions and adding them to the blockchain. Miners use specialized hardware to perform cryptographic calculations, competing to solve mathematical puzzles. The first miner to solve a puzzle earns the right to add a new block and receives a reward in Bitcoin.

This process requires electricity, which is why mining has become closely linked with energy discussions. However, electricity consumption alone does not determine whether an activity is beneficial or harmful to a power grid. What matters is when, where, and how that electricity is used.

The Difference Between Constant and Flexible Energy Demand

Most industrial electricity users have relatively fixed demand. Factories, data centers, and commercial buildings often need power continuously and cannot easily shut down when supply tightens. Bitcoin mining, by contrast, is uniquely flexible. Mining rigs can be powered on or off within minutes without damaging equipment or disrupting operations.

The study emphasizes that this flexibility is central to understanding why Bitcoin mining helps stabilize power grids. When electricity supply exceeds demand, miners can ramp up operations. When supply is tight, they can power down, freeing electricity for homes and businesses.

How Power Grids Struggle With Supply and Demand

The Challenge of Real-Time Balancing

Electricity grids operate on a delicate balance. Power must be generated at the exact moment it is consumed. Unlike many other commodities, electricity is difficult and expensive to store at scale. This creates a constant challenge for grid operators, especially as renewable energy sources like wind and solar become more prevalent.

Renewables are inherently variable. Solar generation peaks during sunny midday hours, while wind output depends on weather conditions. These fluctuations can lead to periods of excess generation followed by sudden shortages. Without flexible demand, grid operators may be forced to curtail renewable energy or rely on expensive peaker plants.

Why Excess Energy Often Goes to Waste

One surprising finding highlighted in the study is how much energy is routinely wasted. When supply exceeds demand, power plants may be forced to shut down or reduce output, even if they are producing clean energy. This curtailment represents lost economic value and undermines investments in renewables.

Here, the study argues, Bitcoin mining helps stabilize power grids by acting as a buyer of last resort. Miners can consume excess electricity that would otherwise be wasted, improving overall grid efficiency.

Bitcoin Mining as a Grid Stabilization Tool

Absorbing Excess Power During Oversupply

During periods of low demand or high renewable output, electricity prices can fall dramatically, sometimes even turning negative. In such scenarios, Bitcoin mining can quickly scale up operations to absorb surplus power. This helps maintain grid balance and provides revenue to energy producers who might otherwise face losses.

The study notes that this dynamic can encourage further investment in renewable energy. Knowing that there is a flexible demand source ready to purchase excess electricity makes renewable projects more financially viable.

Reducing Demand During Peak Stress Events

Just as miners can ramp up during oversupply, they can also shut down during periods of high demand. Extreme weather events, such as heatwaves or cold snaps, often strain power grids as households increase heating or cooling usage. In these moments, miners can voluntarily or contractually reduce consumption.

By doing so, Bitcoin mining helps stabilize power grids and reduces the risk of blackouts. This responsiveness is particularly valuable in regions with aging infrastructure or rapidly growing electricity demand.

Lowering Electricity Costs for Consumers

How Flexible Demand Impacts Pricing

Electricity prices are influenced by the balance between supply and demand. When demand spikes unexpectedly, grid operators may rely on expensive backup generation, driving up prices for everyone. Conversely, when supply exceeds demand, prices can collapse, harming producers.

The study suggests that Bitcoin mining helps stabilize power grids by smoothing out these extremes. By absorbing excess supply and reducing demand during peaks, miners contribute to more stable pricing. Over time, this stability can translate into lower average electricity costs for consumers.

Passing Savings on to End Users

When grids operate more efficiently, costs associated with emergency measures, grid congestion, and infrastructure stress decline. Utilities can pass these savings on to residential and commercial customers through lower rates or reduced price volatility.

In regions where mining participates in demand response programs, consumers may benefit directly. The study highlights examples where mining operations receive incentives to curtail usage during peak periods, effectively acting as a grid service provider.

Bitcoin Mining and Renewable Energy Integration

Supporting Wind and Solar Expansion

Renewable energy developers often struggle with revenue uncertainty due to intermittent generation. Bitcoin mining can provide a steady, flexible demand source that improves project economics. By purchasing electricity during periods of high output, miners help stabilize revenues for renewable producers.

The study underscores that Bitcoin mining helps stabilize power grids by making renewable integration smoother and less risky. This symbiotic relationship challenges the idea that mining and sustainability are inherently at odds.

Reducing the Need for Fossil Fuel Peaker Plants

Peaker plants, typically fueled by natural gas or oil, are activated during periods of high demand. They are expensive to operate and emit significant greenhouse gases. By reducing peak demand through flexible load shedding, mining can lessen reliance on these plants. This indirect emissions reduction is an important, often overlooked benefit highlighted in the study. When miners power down during peak periods, cleaner energy can be prioritized for essential uses.

Economic Benefits Beyond Energy Markets

Job Creation and Infrastructure Investment

Large-scale Bitcoin mining operations often bring investment to regions with underutilized energy infrastructure. This can lead to job creation, improved grid assets, and increased tax revenues. Rural or industrial areas with surplus power capacity may particularly benefit.

The study points out that these economic spillovers can strengthen local communities while enhancing grid resilience. When energy infrastructure is better utilized, the overall system becomes more robust.

Strengthening Energy Market Competition

By acting as a new class of energy consumer, bitcoin miners introduce additional competition into electricity markets. This can encourage innovation, efficiency, and better pricing mechanisms. Over time, such competition may benefit all market participants. Again, the core finding remains that Bitcoin mining helps stabilize power grids not just technically, but economically as well.

Addressing Common Criticisms of Bitcoin Mining

The Carbon Emissions Debate

Critics often argue that mining exacerbates climate change. While energy consumption is real, the study emphasizes that context matters. Mining tends to gravitate toward regions with cheap electricity, which increasingly comes from renewables or surplus generation.

Moreover, by improving grid efficiency and reducing waste, Bitcoin mining helps stabilize power grids in ways that can lower overall emissions intensity.

Concerns About Grid Strain

Another common concern is that mining overloads local grids. The study counters this by noting that properly regulated mining operations coordinate closely with grid operators. Flexible demand and participation in demand response programs mitigate strain rather than exacerbate it. The key takeaway is that outcomes depend on policy, market design, and integration—not on mining itself.

Policy Implications and Regulatory Considerations

Designing Smart Energy Policies

The study suggests that policymakers should recognize the grid-stabilizing potential of Bitcoin mining. Rather than imposing blanket bans or punitive measures, regulators could incentivize miners to locate near renewable sources and participate in grid services.

Such policies would align economic incentives with grid stability goals, reinforcing the finding that Bitcoin mining helps stabilize power grids when properly managed.

Encouraging Transparency and Collaboration

Transparency in energy sourcing and collaboration between miners, utilities, and regulators are crucial. The study calls for data-driven approaches to assess impacts rather than relying on assumptions. By fostering cooperation, governments can harness the benefits of mining while addressing legitimate concerns.

The Future of Bitcoin Mining and Energy Systems

Mining as a Strategic Energy Partner

Looking ahead, the role of mining may evolve from a passive consumer to an active grid participant. Advanced software, real-time pricing, and automated load management could further enhance mining’s ability to balance supply and demand.

The study envisions a future where Bitcoin mining helps stabilize power grids as part of a broader ecosystem of flexible energy users.

Implications for Global Energy Transition

As countries pursue decarbonization, managing variability will become increasingly important. Flexible demand sources like mining could play a critical role in integrating renewables at scale.

Rather than being an obstacle, mining could become an enabler of the clean energy transition.

Conclusion

The narrative surrounding Bitcoin mining is changing. According to the study, Bitcoin mining helps stabilize power grids, lowers user costs, and supports renewable energy integration when properly integrated into energy markets. Its unique flexibility allows it to absorb excess power, reduce demand during peak periods, and improve overall grid efficiency.

While challenges remain, particularly around regulation and transparency, the evidence suggests that mining’s role in energy systems is more nuanced than commonly portrayed. By recognizing and leveraging its grid-stabilizing potential, policymakers, utilities, and communities can turn a controversial technology into a valuable asset for modern power grids.

FAQs

Q: How does Bitcoin mining help stabilize power grids?

Bitcoin mining provides flexible electricity demand, allowing miners to consume excess power during oversupply and reduce usage during peak demand, helping balance the grid.

Q: Can Bitcoin mining really lower electricity costs for consumers?

Yes, by smoothing demand fluctuations and reducing reliance on expensive backup generation, mining can contribute to more stable and potentially lower electricity prices.

Q: Is Bitcoin mining compatible with renewable energy?

The study shows that Bitcoin mining can support renewable energy by absorbing surplus generation and improving project economics for wind and solar producers.

Q: Does Bitcoin mining increase carbon emissions?

While mining uses energy, its tendency to utilize surplus and renewable power, along with its grid-stabilizing effects, can reduce overall emissions intensity.

Q: What role should governments play in regulating Bitcoin mining?

Governments should focus on smart regulation that encourages miners to support grid stability and renewable integration rather than imposing blanket restrictions.