Bitcoin and Ethereum can move fast. One day the market looks strong, and the next day it looks shaky. These sudden drops often create fear. Many people start searching for answers. Some investors even sell at the worst time. That is why Robert Kiyosaki’s calm attitude stands out.

Robert Kiyosaki is widely known for Rich Dad Poor Dad. He often talks about money, debt, and inflation. He also speaks about assets he trusts during uncertainty. In many public comments, he has shown confidence in Bitcoin. He has also discussed Ethereum in the same broader crypto context. His main point stays consistent. He is not focused on daily price swings.

This is why the headline matters: Robert Kiyosaki not worried by Bitcoin and Ethereum price fluctuations. He treats volatility as normal. He believes long-term forces matter more than short-term emotion. He also believes people should learn how money works. That knowledge helps them stay steady during chaos.

In this article, you will learn why he stays calm. You will also learn what Bitcoin and Ethereum price fluctuations really mean. We will explore his macro view and how it connects to crypto. You will also see practical ways to apply these ideas without blind trust. The goal is a human, clear, and useful guide that flows naturally.

Robert Kiyosaki’s View: Volatility Is Normal in Emerging Assets

Robert Kiyosaki not worried by Bitcoin and Ethereum price fluctuations is not a random stance. It matches how he views investing. He believes investors must expect turbulence. He also thinks emotional trading destroys wealth. That is why he talks about mindset as much as money.

Bitcoin is still a young asset class when compared to stocks and bonds. Ethereum is also still evolving. Both assets trade 24/7, which adds more movement. Liquidity changes can shift prices quickly. Leverage also makes moves sharper. These factors create intense Bitcoin and Ethereum price fluctuations.

Kiyosaki sees this volatility as a cost of entry. He often compares markets to real life. Business income can vary, too. Real estate can go up and down, as well. Yet people still buy those assets with a plan. He believes crypto should be treated the same way.

Why Short-Term Fear Can Be a Bigger Risk Than Volatility

Many investors fear price drops more than they fear losing purchasing power. That is a problem in Kiyosaki’s model. He warns that fiat currency can silently lose value over time. That loss can happen even when markets look stable. A calm investor notices this slow damage.

Bitcoin and Ethereum price fluctuations are loud. Inflation is often quiet. Yet inflation can hurt more over years. Kiyosaki’s mindset pushes people to focus on that long-term risk. That is one reason he does not panic during crypto dips. He expects them in advance.

Volatility Often Follows Opportunity

High volatility can be painful, but it can also signal growth. Many early-stage markets swing hard. Adoption is not smooth in any new technology. Crypto still reacts to news, regulation, and macro shifts. That creates waves of optimism and fear. Kiyosaki sees those waves as part of the journey.

Why Kiyosaki Focuses on Debt, Inflation, and Money Printing

Robert Kiyosaki not worried by Bitcoin and Ethereum price fluctuations makes more sense in a macro frame. He often talks about debt as a major threat. He also talks about inflation and currency debasement. His argument is simple. If money loses value, saving becomes harder.

He has repeatedly criticized systems that rely on heavy borrowing. He also warns that policy choices can push people into weaker positions. Whether you fully agree or not, his logic is consistent. He believes the larger system is fragile. He believes alternative assets can offer protection.

Bitcoin is often described as digital gold by supporters. Ethereum is often described as a platform for smart contracts and decentralized finance. Kiyosaki tends to like assets with real-world purpose or scarcity. That is why crypto fits his narrative. He views crypto as a hedge against monetary weakness.

Inflation and the Loss of Purchasing Power

Inflation is not just about prices rising. It is also about what your money can buy. When purchasing power drops, saving cash becomes less effective. Kiyosaki often encourages people to learn this early. He believes many people are not taught how money works.

That education gap can lead to bad decisions. People hold cash while it loses value. They also panic-sell assets during volatility. Kiyosaki argues that both choices can be harmful. That is why he focuses on long-term protection. He often points toward hard assets and alternative stores of value.

Why He Mentions Hard Assets Alongside Crypto

Kiyosaki has often discussed gold and silver. He groups them with Bitcoin in many conversations. The common theme is scarcity. Another theme is independence from traditional systems. These are key parts of the store of value idea.

Crypto is different from metals in many ways. Still, supporters argue it can play a similar role. Kiyosaki tends to accept that idea. This helps explain his calm response to Bitcoin and Ethereum price fluctuations. His focus stays on the long-term thesis.

What Bitcoin and Ethereum Price Fluctuations Really Mean

Bitcoin and Ethereum price fluctuations can look random, but there are drivers. Crypto markets react to liquidity, leverage, and sentiment. They also react to interest rates and global risk appetite. When investors feel confident, risk assets rise. When fear grows, risk assets fall.

Crypto is also driven by narrative cycles. One month the market focuses on ETFs or regulation. Another month it focuses on protocol upgrades or adoption news. These shifts move capital quickly. They also create sharp pumps and drops.Kiyosaki’s approach is not to predict every move. Instead, he focuses on the broader trend. He believes the bigger economic story supports alternative assets. That belief helps him stay calm during chaos.

Bitcoin: Scarcity, Cycles, and Speculation

Bitcoin is known for scarcity, but it is still traded heavily. Speculation creates big swings. Leverage can make drops faster. Liquidations can also accelerate moves. These forces produce major Bitcoin and Ethereum price fluctuations.

Long-term holders often see these cycles before. Many of them still view Bitcoin as a long-term asset. That does not remove risk. Yet it changes how they respond to short-term moves. Kiyosaki’s public stance fits this long-term attitude.

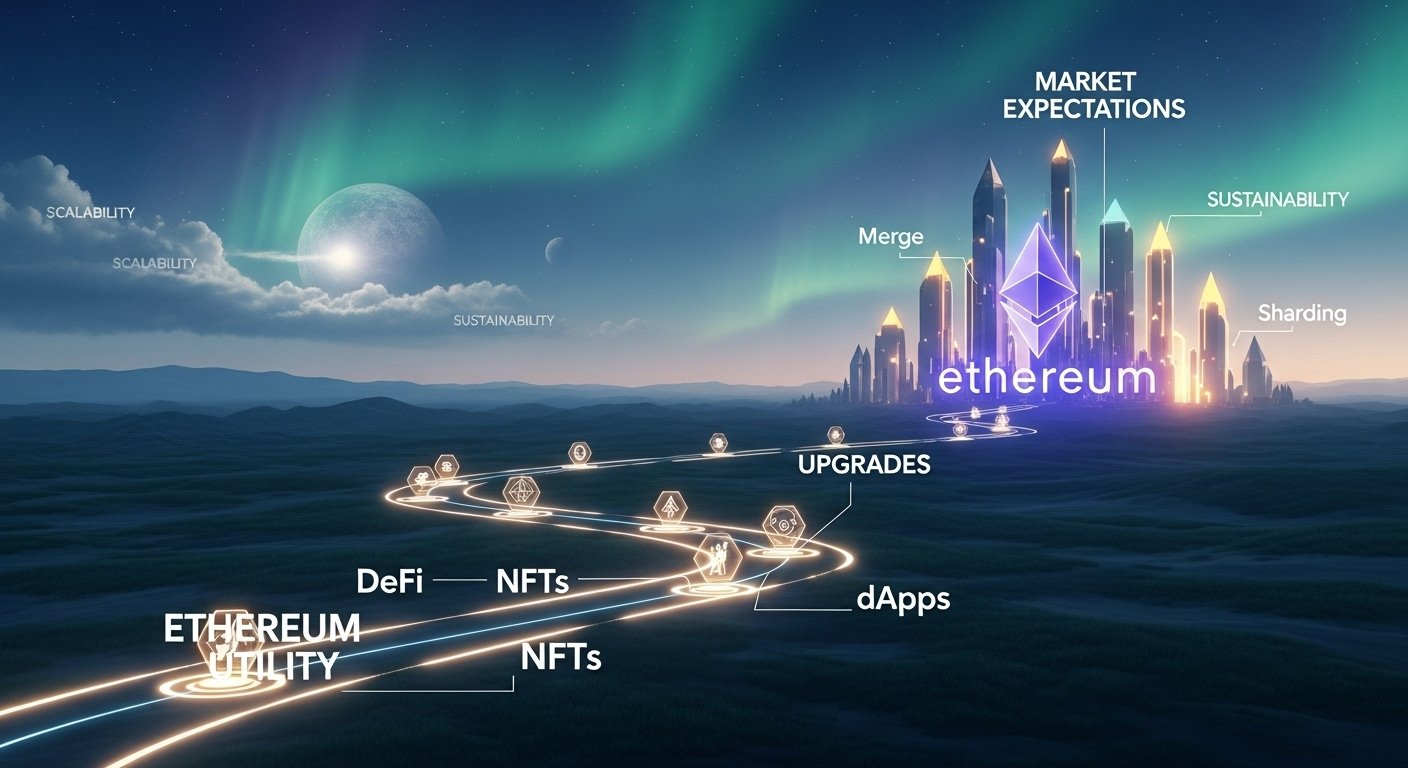

Ethereum: Utility, Upgrades, and Market Expectations

Ethereum is tied to usage and innovation. Its ecosystem includes DeFi, NFTs, and tokenized assets. It also includes apps that depend on network security. Ethereum upgrades can influence sentiment. Fee trends can also shift confidence.

Because of that, Ethereum can swing hard. It can behave like a tech asset in some periods. In other periods, it behaves like a monetary asset. This mixed identity can amplify volatility. Kiyosaki’s calm approach suggests he cares more about long-term utility.

“People’s Money” and the Idea of Financial Independence

Kiyosaki often frames crypto as a choice people can make outside old systems. Some reports describe him calling crypto “people’s money.” That phrase fits his wider brand message. He often encourages financial education and independence.

This narrative becomes stronger during uncertainty. When trust in institutions drops, alternatives look attractive. Bitcoin and Ethereum price fluctuations can still scare people. Yet the independence story can keep believers committed. That is why the “not worried” headline spreads fast.

Why This Message Connects With Everyday Investors

Many people feel squeezed by rising costs. Many also feel savings do not grow fast enough. Crypto offers a different promise. It offers a new kind of financial system. It also offers upside potential.That promise does not guarantee success. It does explain why the narrative is powerful. Kiyosaki’s confidence gives people emotional support. It also pushes them to think bigger than daily charts.

How to Use Kiyosaki’s Mindset Without Becoming Reckless

Robert Kiyosaki not worried by Bitcoin and Ethereum price fluctuations can be inspiring. Still, calm must be paired with discipline. Crypto is risky and volatile. The lesson is not to ignore danger. The lesson is to build a plan that can survive volatility.A good plan includes position sizing and time horizon. It also includes a clear reason for owning the asset. Without a reason, every dip feels personal. With a reason, dips feel expected. That is a key shift.

Risk Management Is What Makes Calm Real

Many people claim they are long-term investors. They still panic when price drops. That panic usually comes from overexposure. If you invest more than you can tolerate, volatility becomes unbearable. A smarter approach is to size your position responsibly.That is how calm becomes practical. It also helps you avoid emotional selling. This matters because Bitcoin and Ethereum price fluctuations can be severe. If you plan well, you can avoid being forced to act.

Know What Would Change Your Thesis

Long-term investing needs reflection. You should know what would make you exit. That prevents blind loyalty. For Bitcoin, it could be major security failure or adoption collapse. For Ethereum, it could be persistent technical failure or loss of developer strength.This approach keeps you rational. It also keeps you grounded during hype. Kiyosaki’s message works best when paired with critical thinking.

Conclusion

Robert Kiyosaki not worried by Bitcoin and Ethereum price fluctuations is a mindset built on macro thinking. He focuses on debt, inflation, and the long-term value of alternative assets. He treats short-term swings as normal. He believes emotional reactions lead to bad outcomes.

For readers, the main takeaway is clear. Decide why you own crypto. Choose a time horizon that matches your belief. Use strong risk management so volatility cannot break your plan. When you do that, Bitcoin and Ethereum price fluctuations become easier to handle. Calm becomes a strategy, not a mood.

FAQs

Q: Why is Robert Kiyosaki not worried by Bitcoin and Ethereum price fluctuations?

He focuses on long-term macro risks like debt and inflation. He sees volatility as normal in emerging assets. He also believes mindset is crucial for investors.

Q: Does Kiyosaki think Bitcoin is better than Ethereum?

He often speaks positively about Bitcoin. He also discusses crypto broadly, which can include Ethereum. His core idea is the value of alternative assets.

Q: Are Bitcoin and Ethereum price fluctuations a sign crypto is dying?

Not necessarily. Volatility can reflect liquidity shifts, leverage, and sentiment. Emerging markets often swing more than mature ones.

Q: How can beginners handle crypto volatility better?

They can focus on long-term learning and avoid emotional trading. A clear plan and proper position sizing can also help a lot.

Q: Is it safe to follow Kiyosaki’s advice directly?

No single person should be followed blindly. Use his ideas as a framework. Combine them with your own research and risk management.

Also More: Ethereum Price News $500M ETF Inflows Fuel ETH Bounce