The Crypto Market Rose Due to Dollar Weakness isn’t just a catchy headline—it’s a window into how modern markets actually behave. Crypto doesn’t move in isolation. Even though Bitcoin was designed as an alternative to traditional money, the prices of Bitcoin, Ethereum, and major altcoins often react to the same macro forces that drive stocks, bonds, commodities, and currencies. When the U.S. dollar loses strength, investors across the world recalibrate risk, shift capital, and reassess where value might hold up best. In many cases, that rebalancing pushes money toward assets that can benefit from a weaker greenback—sometimes gold, sometimes emerging markets, and increasingly, crypto.

So when people say the crypto market rose due to dollar weakness, they’re describing a relationship that has become more visible with every market cycle: a softer dollar can help lift crypto prices, especially when it coincides with lower real yields, easing financial conditions, or expectations of looser monetary policy. But it’s not automatic, and it’s not magic. Dollar weakness is usually a symptom of bigger macro narratives—like shifting interest rate expectations, inflation dynamics, economic slowdown fears, or global capital flows. Crypto tends to respond when those narratives change investor behavior.

In this article, we’ll unpack why the crypto market rose due to dollar weakness, how the dollar influences crypto demand, what indicators traders watch, and what this connection could mean for the next phase of the market. Along the way, you’ll see why Bitcoin as a hedge, risk-on sentiment, liquidity conditions, and macro-driven crypto rally aren’t just buzzwords—they’re the language of a market that’s growing up fast.

The Dollar’s Role in Global Markets

The U.S. dollar is more than a currency. It’s the world’s primary settlement unit for trade, debt, and commodities, and it’s the benchmark against which many countries measure financial stress. When the dollar strengthens, it can tighten global liquidity. Dollar-denominated debt becomes harder to service abroad, commodity prices often get pressured, and capital can flow toward U.S. assets seeking yield and safety. When the dollar weakens, the opposite can happen: global financial conditions can loosen, and investors can feel more comfortable taking risk.

This context matters because it helps explain why the crypto market rose due to dollar weakness. Crypto is frequently treated as a risk asset in the short term. Even long-term believers who view Bitcoin as “digital gold” still operate within a world where portfolios are priced in dollars, margin is funded in dollars, and global liquidity often hinges on dollar availability. A weaker dollar can make alternative assets look more attractive, especially if investors think real returns on cash are falling.

Why the U.S. Dollar Index (DXY) Matters for Crypto

When analysts talk about the dollar, they often reference the U.S. Dollar Index (DXY), which measures the dollar’s strength against a basket of major currencies. While it’s not a perfect indicator for every situation, it’s a widely watched gauge of broad dollar momentum. When DXY trends lower, markets often interpret that as looser conditions or reduced demand for dollar safety.

This is one of the key reasons the crypto market rose due to dollar weakness in many historical periods. A falling DXY can coincide with rising appetite for alternative stores of value and growth assets, including Bitcoin, Ethereum, and select altcoins. Traders don’t need a perfect correlation; they need a reliable narrative that influences flows. When enough money follows the same signals, the relationship becomes self-reinforcing—until it breaks.

Why the Crypto Market Rose Due to Dollar Weakness

At the core, the crypto market rose due to dollar weakness because a weaker dollar often signals shifting macro conditions that favor scarce or speculative assets. But the mechanism isn’t one single channel—it’s several channels that can stack together.

First, a weaker dollar can make investors feel less rewarded for holding cash. If the expected purchasing power of dollars is eroding—whether due to inflation, lower yields, or policy changes—capital may migrate to assets perceived as having better upside or better long-term value preservation.

Second, dollar weakness can be linked to expectations of lower interest rates. When markets start pricing in cuts, liquidity and risk-on sentiment often rise. Crypto, which is extremely sensitive to liquidity cycles, can benefit quickly. That’s a major reason the crypto market rose due to dollar weakness in episodes where rate expectations shifted from “tight for longer” to “easing ahead.”

Third, dollar weakness can boost global demand for crypto by improving affordability and access outside the U.S. Crypto is global by default. When the dollar declines, some international investors experience improved purchasing power in dollar-priced assets, potentially increasing demand for Bitcoin and large-cap tokens.

The Wealth Effect and Portfolio Rotation

When the dollar weakens, it often aligns with rising prices in other asset classes. Stocks may rally, commodities may recover, and credit spreads may stabilize. That can create a wealth effect: investors feel more confident, risk budgets expand, and portfolio managers rotate into higher-volatility assets for better returns.

In that environment, the crypto market rose due to dollar weakness partly because crypto becomes a natural destination for investors seeking asymmetric upside. Bitcoin and Ethereum are often the first beneficiaries of that rotation, followed by selective altcoins as momentum builds. This is where phrases like capital inflows, institutional adoption, and crypto market rally become more than headlines—they describe a process of risk reallocation.

Understanding the Inverse Relationship Between DXY and Bitcoin

Many market participants talk about an inverse relationship: when the dollar goes down, Bitcoin tends to go up. While the relationship is not constant, it shows up often enough that it shapes expectations. In practical terms, traders may use DXY as a macro “wind indicator.” A softer dollar can be interpreted as a tailwind for crypto.

That helps explain again why the crypto market rose due to dollar weakness. Crypto traders love clean narratives because crypto is reflexive: if enough people believe a macro tailwind is present, they buy, prices rise, and the narrative gains credibility.

Correlation Isn’t Destiny

Even though the crypto market rose due to dollar weakness, it’s important to understand that correlation can fade. There are times when Bitcoin falls even as the dollar weakens, especially if crypto-specific risks dominate. Exchange failures, regulatory shocks, leverage unwinds, or major security incidents can overpower macro support. Similarly, Bitcoin can rise during a stronger dollar if demand is driven by adoption, ETF flows, halving narratives, or a surge in on-chain activity.Still, in many cycles, the macro environment is the stage on which crypto performs. When the stage lighting changes—like a weakening dollar—crypto can suddenly look much more attractive.

How Interest Rates and Monetary Policy Connect the Dots

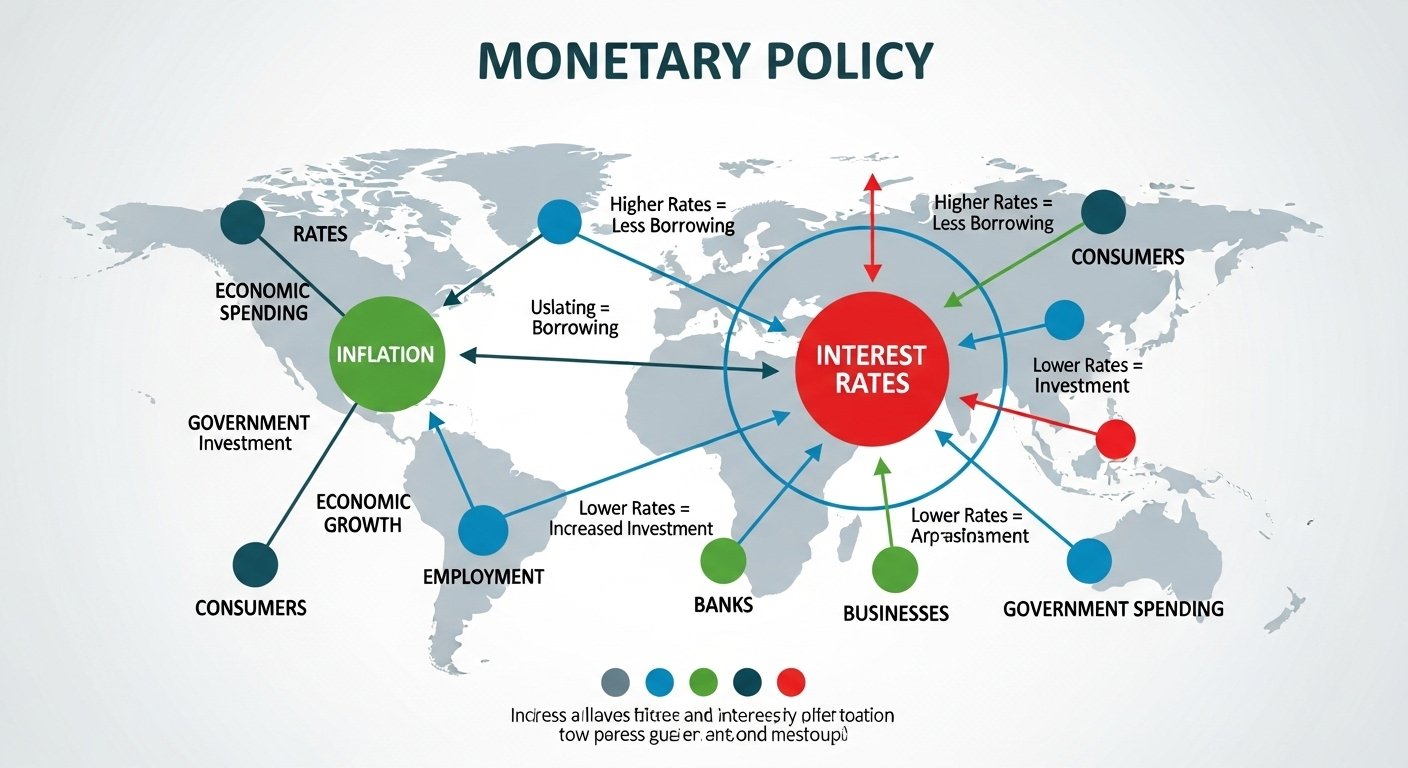

To really grasp why the crypto market rose due to dollar weakness, you have to talk about interest rates. The dollar is heavily influenced by relative yields. When U.S. rates are high compared to other regions, the dollar can strengthen because global capital chases those yields. When markets anticipate lower U.S. rates, the dollar can weaken as that yield advantage shrinks.

Crypto is highly sensitive to this because lower rates tend to support risk assets and reduce the opportunity cost of holding non-yielding or volatile assets like Bitcoin. That’s why a narrative shift from tightening to easing can act like fuel.

Liquidity Conditions and the Crypto Engine

Crypto runs on liquidity. When dollars are plentiful and risk appetite improves, leverage returns, trading volume increases, and speculative capital flows into smaller tokens. When dollars are scarce, the opposite happens: volatility spikes, liquidations accelerate, and capital retreats to safety.

So when the crypto market rose due to dollar weakness, it often reflected improved liquidity expectations. A weaker dollar can signal that financial conditions are loosening, even subtly. Traders watch this closely because crypto typically moves early and aggressively when liquidity turns.

Inflation, Purchasing Power, and the “Store of Value” Narrative

Another reason the crypto market rose due to dollar weakness is psychological as much as mechanical. When people perceive the dollar losing purchasing power, they look for alternatives. That doesn’t automatically mean crypto wins—gold, real estate, and inflation-linked assets compete too—but Bitcoin has a powerful narrative advantage: provable scarcity.

Bitcoin’s fixed supply schedule feeds the digital gold idea, and Ethereum’s ecosystem adds a different value proposition: programmable finance, tokenized assets, and decentralized applications. In periods of dollar softness, these stories can feel more compelling, especially to investors seeking diversification.

Bitcoin as a Hedge—With Caveats

You’ll often hear Bitcoin as a hedge against currency debasement. The concept is simple: if fiat weakens over time, a scarce asset might preserve value. But in the short term, Bitcoin can still trade like a risk asset. That’s why it’s still accurate to say the crypto market rose due to dollar weakness—because in practice, macro perception can trigger buying, even if the long-term “hedge” thesis isn’t what drives every trade.

Altcoins, Ethereum, and Why the Rally Spreads

When Bitcoin rises, the rest of the market often follows—but not all at once. The typical pattern is that Bitcoin leads, Ethereum confirms, and then momentum spills into large-cap and mid-cap altcoins. If the macro backdrop stays supportive, the rally broadens.

This spillover is another dimension of why the crypto market rose due to dollar weakness. A softer dollar can set off a chain reaction: investors buy Bitcoin as the most recognized macro proxy, then rotate into Ethereum for ecosystem exposure, and then selectively into altcoins as confidence grows.

Risk Appetite and Narrative Coins

During risk-on phases, narratives can become engines: DeFi, Layer 2 scaling, AI tokens, gaming, real-world assets, and meme coins can all surge when liquidity is improving. A weakening dollar can create the macro permission slip for those trades to exist.

This doesn’t mean every altcoin move is rational. It means the environment changes what’s possible. In many cases, the crypto market rose due to dollar weakness because that weakness signaled conditions where speculation could thrive.

Key Indicators Traders Watch When the Dollar Weakens

To understand and potentially anticipate moments when the crypto market rose due to dollar weakness, traders monitor a set of macro and crypto-native indicators.They watch DXY trends for momentum and breakouts. They track U.S. Treasury yields for rate expectations. They pay attention to inflation data and central bank messaging because these shape the market’s view of future policy. They also look at liquidity metrics and stablecoin market dynamics because crypto has its own internal money supply signals.

On the crypto side, traders study on-chain activity, exchange inflows and outflows, funding rates, open interest, and spot ETF flows where applicable. When these align with a weaker dollar backdrop, rallies can gain durability.

Sentiment Can Turn Faster Than Fundamentals

One reason crypto is so dramatic is that sentiment flips quickly. A small change in the dollar’s trajectory can change the story. That’s why the crypto market rose due to dollar weakness can appear suddenly—seemingly overnight—because positioning adjusts rapidly in a market that trades 24/7.

Risks and Limitations of the Dollar-Driven Thesis

Even if the crypto market rose due to dollar weakness, it’s risky to assume the relationship will hold perfectly in the future. There are several reasons.Crypto has idiosyncratic risks. Regulation can change sentiment instantly. A major protocol exploit can drain confidence. A big exchange disruption can freeze liquidity. Even if the dollar is weak, crypto can still fall if trust is damaged or leverage collapses.

Additionally, macro is multi-factor. The dollar can weaken for “good” reasons—like easing inflation and stable growth—or for “bad” reasons—like economic stress that triggers a flight to safety in other assets. If fear rises enough, investors might sell crypto even with a softer dollar, because they want cash and certainty.So while it’s true the crypto market rose due to dollar weakness in many scenarios, it’s best viewed as a probability shift, not a guarantee.

What This Could Mean Next for Crypto Investors

When the crypto market rose due to dollar weakness, it highlighted that crypto remains deeply connected to global money dynamics. If the dollar continues to soften, crypto could benefit from improved financial conditions, stronger risk appetite, and broader global participation. But if the dollar weakness reverses—especially alongside higher yields—crypto could face headwinds.

For long-term investors, the key is not predicting every tick of DXY. It’s understanding the regime. In a regime of easing policy, falling real yields, and loosening conditions, crypto tends to do better. In a regime of tightening and dollar strength, crypto often struggles.This perspective helps investors avoid emotional decision-making. Instead of chasing candles, they can focus on the environment that makes sustained trends more likely.

Conclusion

“The headline The Crypto Market Rose Due to Dollar Weakness” captures a powerful truth about today’s financial landscape: crypto is increasingly macro-aware. A weaker dollar often signals changing conditions—lower yield advantages, shifting rate expectations, looser liquidity, and stronger appetite for risk—that can lift Bitcoin, Ethereum, and the broader digital asset market. But the relationship is not a law of nature. Crypto has its own catalysts and its own vulnerabilities, and the dollar is only one piece of the puzzle.

Still, understanding why the crypto market rose due to dollar weakness gives you an edge. It helps you read the market’s mood, interpret macro headlines more clearly, and place crypto moves in context. In a world where money flows react faster than ever, context is the difference between guessing and navigating.

FAQs

Q: Why does a weaker dollar often boost Bitcoin?

A weaker dollar can signal easier financial conditions and reduced demand for cash, encouraging investors to rotate into alternative assets. That’s a common reason the crypto market rose due to dollar weakness, especially when liquidity expectations improve.

Q: Is the DXY-to-crypto relationship always reliable?

No. While there are periods where Bitcoin moves inversely to DXY, crypto-specific events and risk shocks can break the pattern. The idea that the crypto market rose due to dollar weakness describes a frequent tendency, not a guaranteed rule.

Q: Does dollar weakness help altcoins as much as Bitcoin?

Often it starts with Bitcoin and Ethereum, then spreads as risk appetite grows. When conditions remain supportive, traders rotate into higher-volatility tokens, reinforcing the idea that the crypto market rose due to dollar weakness across the board.

Q: What macro signals should I watch alongside the dollar?

Pay attention to interest rate expectations, real yields, inflation trends, and central bank guidance. These often drive dollar moves and liquidity, which can explain why the crypto market rose due to dollar weakness during certain phases.

Q: Can crypto rise even if the dollar strengthens?

Yes. Strong adoption, major product launches, network upgrades, and institutional inflows can push crypto higher even during periods of dollar strength. Macro matters, but it doesn’t control everything—even if the crypto market rose due to dollar weakness in the latest move.

Also More: Crypto Market Dips Trade War & FOMC Shock Watch