Understanding foreign exchange rates in Pakistan for today, February 02, 2026 has never been more crucial as businesses, exporters, importers, travelers, and remittance senders navigate fluctuating currency markets. The Pakistan forex market remains sensitive to both domestic economic indicators and global financial trends. As the Pakistani Rupee (PKR) trades against major world currencies like the US Dollar (USD), Euro (EUR), and British Pound (GBP), knowing accurate exchange rates helps in making informed financial decisions, whether for international trade, investment, or personal currency exchange needs.

Today’s data reflects the current open market foreign exchange rates in Pakistan, showing both buying and selling values for significant global currencies. These rates are subject to frequent adjustments influenced by market demand, State Bank of Pakistan (SBP) policies, inflation trends, foreign reserves, and international geopolitical developments. This comprehensive article offers an up-to-date view of the foreign exchange rates in Pakistan, an analysis of trends affecting the PKR, and expert insights into what these movements mean for the broader economy.

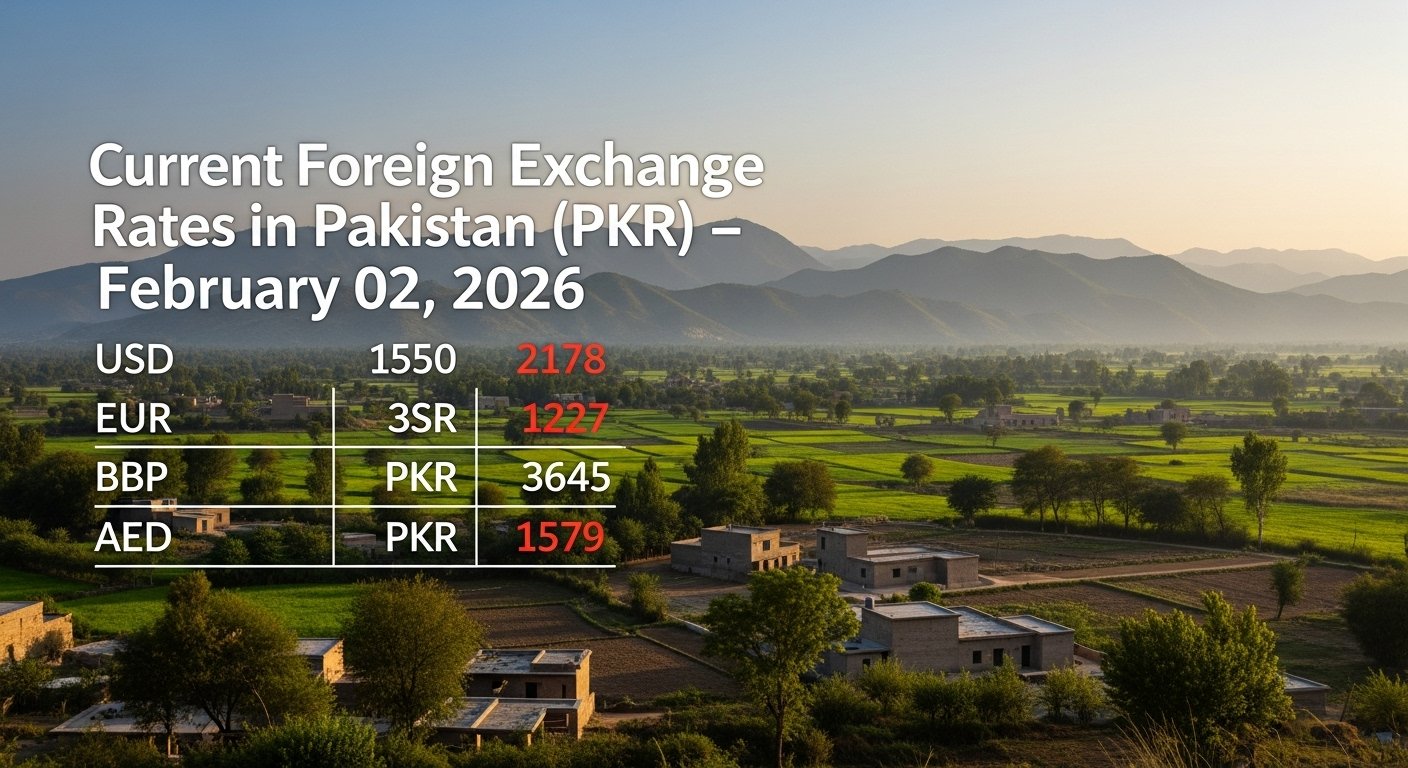

Current Foreign Exchange Rates in Pakistan (PKR) – February 02, 2026

On February 02, 2026, the Pakistani Rupee (PKR) continues to display stability against key global currencies in the open market. According to the latest market quotations, the USD/PKR rate and other major currency pairings have maintained relatively steady values compared to recent sessions. These exchange rates are compiled from local forex markets and reflect typical buying and selling prices available at exchange companies across major Pakistani cities, including Karachi, Lahore, Islamabad, and others.

In detail, the foreign exchange rates in Pakistan today are as follows:US Dollar (USD): The United States Dollar remains a pivotal benchmark in Pakistan’s forex landscape. Today, 1 USD trades at approximately PKR 280.50 (buying) and PKR 282.20 (selling). This rate underscores the continued influence of global demand for the USD and reflects market confidence in PKR stability.

Euro (EUR): The Euro is trading near PKR 333.83 (buying) and PKR 338.26 (selling), supported partly by broader economic dynamics within the European Union and demand from importers in Pakistan.British Pound (GBP): Another strong currency, the GBP, stands at around PKR 385.04 for buying and PKR 389.51 for selling, illustrating the premium associated with British currency in Pakistan’s forex market.

Other Notable Currencies: The UAE Dirham (AED) trades at approximately PKR 76.55/77.35, the Saudi Riyal (SAR) at PKR 74.85/75.30, and the Swiss Franc (CHF) at PKR 362.64/367.78. Meanwhile, the Japanese Yen (JPY) remains lower in reflecting weaker performance against the PKR at approximately PKR 1.81/1.91.These values illustrate how global currencies are priced in terms of Pakistani Rupees (PKR) in the current foreign market in Pakistan today.

Factors Influencing Foreign Exchange Rates in Pakistan

The foreign exchange rates in Pakistan do not exist in isolation. They are shaped by a complex set of factors both within and beyond the country’s economic borders. Examining these influences helps clarify why the PKR values fluctuate and what this means for everyday users.

Monetary Policy and State Bank of Pakistan Actions

The State Bank of Pakistan (SBP) plays a significant role in shaping forex trends through monetary policy decisions, such as interest rate adjustments and reserve management. Although the SBP held its key policy rate recently at 10.5% — a move aimed at curbing excessive volatility — these policy settings directly influence market sentiment and currency demand.

Interest rate decisions affect investor confidence and capital flows, which in turn influence the demand for foreign currency. When the SBP signals stability in monetary policy or strengthens foreign reserve holdings, the PKR can maintain a more stable position against other currencies.

Foreign Exchange Reserves and Balance of Payments

The country’s foreign exchange reserves, accumulated through remittances, exports, and external financing, act as a buffer against drastic currency swings. In recent weeks, Pakistan’s reserves have shown incremental gains, although fluctuations are expected given shifts in global markets and domestic economic activity. Reports indicate that the SBP’s usable reserves are substantial, reflecting overall economic resilience.When reserves are robust, the PKR tends to exhibit greater resilience, allowing the industry and banking sectors to fulfill international currency requirements without forcing sharp changes in exchange rates.

Global Economic Trends and Commodity Prices

Global economic conditions — including oil prices, trade balances, and geopolitical tensions — influence currency valuation. For example, higher oil prices can raise import bills for oil-importing nations, weakening the PKR and affecting demand for hard currencies like the USD. Conversely, stable oil markets can ease pressure on foreign reserves and support PKR stability.Similarly, international interest rate trends, such as U.S. Federal Reserve decisions, often ripple through emerging markets like Pakistan. These external factors fuel daily fluctuations within the forex market in Pakistan.

Remittances and Trade Flows

Pakistan benefits significantly from remittances sent by overseas workers. Consistent inflows support PKR liquidity and help regulate foreign exchange trends. Large remittance volumes increase the supply of foreign currency, which can ease upward pressure on exchange rates and lead to tighter spreads between buying and selling prices.Trade flows, especially exports of textiles and agricultural products, also shape currency dynamics. A stronger export performance typically increases forex inflows, enhancing PKR strength.

How Exchange Rates Affect Everyday Pakistanis

Understanding the practical impact of foreign exchange rates in Pakistan for today goes beyond numbers; it directly affects financial decisions, business operations, and individual lifestyles.For the general public, exchange rates influence travel costs, tuition fees paid abroad, and the value of remittances received by families from overseas. A stronger PKR means cheaper foreign travel and lower costs for imported goods, while a weaker PKR might raise expenses for students and travelers.

Businesses engaged in imports and exports are highly sensitive to exchange rate movements. Importers must manage costs when the PKR weakens, as paying for goods in USD or EUR becomes more expensive. Conversely, exporters can benefit because international buyers get more competitive pricing when exporting goods priced in PKR.

Investors and financial professionals track these rates to hedge currency risk and plan investment strategies. Forecasting future rate movements is part of broader portfolio management, particularly for those with exposure to international assets.

Tips for Getting the Best Exchange Rate in Pakistan

When dealing with foreign exchange services, a few strategic approaches can help individuals and businesses secure better PKR conversions:First, it’s essential to monitor exchange rates throughout the day because values can shift with market demand and global currency fluctuations. Large differences between buying and selling rates can exist among banks and exchange houses, so comparing rates before transacting can make a noticeable difference.

Using trusted exchange companies — often located in major urban centers like Karachi, Lahore, and Islamabad — helps ensure that you get competitive forex quotes. These companies typically update rates in real time and provide transparent pricing.Lastly, consider timing your exchanges around favorable market trends when possible. For example, remittance senders might choose to transfer funds when the PKR is stronger, maximizing return value for recipients.

Conclusion

Today’s foreign exchange rates in Pakistan for February 02, 2026 reflect a stable yet dynamic currency environment, with the PKR trading against major global currencies at values influenced by both domestic policy and international market trends. The USD/PKR rate of approximately 280.50/282.20, coupled with rates for the Euro, British Pound, UAE Dirham, and others, highlights ongoing market activity that affects everyday economic decisions.

Understanding the drivers behind these exchange rates — from SBP policy and foreign reserves to global economic developments — enables individuals and businesses to make informed choices. Whether you are transferring funds from abroad, planning travel, or managing import-export operations, staying updated with daily PKR values and reviewing trends will help navigate Pakistan’s foreign exchange landscape more effectively.

FAQs

Q: What are the current USD to PKR exchange rates in Pakistan today?

As of February 02, 2026, the USD to PKR exchange rate is approximately PKR 280.50 for buying and PKR 282.20 for selling in the open market.

Q: Why do foreign exchange rates vary between banks and exchange companies?

Rates differ due to supply and demand dynamics, transaction volumes, service fees, and how individual institutions manage their currency holdings. These factors contribute to slight variations in buying and selling prices.

Q: How often do forex rates update in Pakistan?

Foreign exchange rates are typically updated multiple times daily, depending on market activity and international currency movements. Many exchange companies refresh rates throughout the business day.

Q: Can individuals get better rates than banks?

Often, licensed exchange companies offer more competitive rates than traditional banks due to lower overhead costs and high transaction volumes, but this varies by location and market conditions.

Q: How do global events affect Pakistan’s exchange rates?

Global events — including economic policies, oil prices, geopolitical tensions, and international interest rate changes — influence currency demand and supply, which in turn impacts the PKR value against foreign currencies.

Also More: US Dollar Exchange Rate Slightly Increases in Iraq Today