The Ethereum price locked below $2,150 has become one of the most closely watched developments in the cryptocurrency market. After months of volatility, optimism, and repeated attempts to regain higher ground, Ethereum has entered a phase of consolidation that leaves traders and long-term investors searching for clarity. Despite broader interest in blockchain technology, decentralized finance, and layer-two scaling solutions, the ETH market has struggled to generate the momentum needed for a decisive breakout.

This period of indecision reflects a broader tug-of-war between bullish expectations tied to network fundamentals and bearish pressure driven by macroeconomic uncertainty, regulatory concerns, and shifting liquidity conditions. While Bitcoin often sets the tone for the overall crypto market, Ethereum’s independent price action below $2,150 suggests that market participants are waiting for a clear catalyst before committing to a directional move.

In this article, we take an in-depth look at why the Ethereum price locked below $2,150 continues to frustrate traders, what technical indicators are signaling, how on-chain data and fundamentals fit into the picture, and what scenarios could define Ethereum’s next major move. By examining market structure, sentiment, and potential catalysts, this analysis aims to provide a balanced and actionable understanding of Ethereum’s current position.

Ethereum Price Locked Below $2,150: Current Market Snapshot

The ongoing consolidation highlights a market caught in equilibrium. The Ethereum price locked below $2,150 has established this zone as a critical resistance level, repeatedly rejecting upward attempts. Each rally toward this price area has met selling pressure, while downside moves have found buyers stepping in near lower support zones.

This behavior reflects reduced volatility compared to earlier cycles, indicating that speculative excess has cooled. Trading volumes have also remained relatively muted, reinforcing the idea that market participants are waiting rather than reacting. In technical terms, Ethereum is trading within a well-defined range, which often precedes a significant breakout or breakdown once a trigger emerges.

From a psychological perspective, $2,150 represents more than just a number. It is a level associated with previous support and resistance flips, making it a reference point for both short-term traders and institutional participants. As long as Ethereum remains capped below this threshold, confidence in sustained upside remains limited.

Technical Analysis: Why the Directional Break Is Still Missing

Key Resistance and Support Zones

The structure of the chart explains much of the current uncertainty. The Ethereum price locked below $2,150 is constrained by a resistance band formed by prior highs and heavy trading activity. Sellers consistently defend this region, suggesting that large holders may be distributing or hedging positions at these levels.

On the downside, support has emerged around the $1,900 to $2,000 range. Buyers appear willing to accumulate ETH near these prices, preventing deeper corrections. This narrowing range has compressed price action, often described as a coiling effect that increases the probability of a sharp move once the range breaks.

Moving Averages and Trend Signals

Ethereum’s interaction with key moving averages further illustrates the lack of direction. The price has hovered around the 50-day and 100-day moving averages, without establishing a clear trend above or below them. This sideways behavior confirms that the Ethereum price locked below $2,150 is not yet supported by strong trend confirmation.

Longer-term indicators such as the 200-day moving average remain closely watched. A sustained move above this level, accompanied by rising volume, would significantly improve the bullish outlook. Conversely, a decisive break below long-term support could shift sentiment toward a bearish continuation.

Momentum Indicators and Market Indecision

Momentum oscillators such as the Relative Strength Index often reflect the market’s indecision. With readings fluctuating around neutral levels, there is no strong overbought or oversold condition. This reinforces the narrative that the Ethereum price locked below $2,150 is stuck in a waiting phase, with neither bulls nor bears willing to take control without confirmation.

Broader Market Context and Its Impact on Ethereum

Ethereum does not trade in isolation, and its current price behavior is deeply influenced by the broader cryptocurrency and macroeconomic environment. While Bitcoin’s dominance remains a key factor, Ethereum’s sensitivity to risk appetite and liquidity conditions makes it particularly responsive to external developments.

Global interest rate policies, inflation expectations, and geopolitical uncertainty continue to shape investor behavior. Risk assets, including cryptocurrencies, tend to underperform when capital becomes more cautious. This environment partially explains why the Ethereum price locked below $2,150 has struggled to break higher despite strong long-term fundamentals.

At the same time, regulatory developments across major economies have created mixed signals. Clarity around Ethereum’s classification and its role within decentralized ecosystems could eventually act as a catalyst. Until then, uncertainty contributes to range-bound trading.

On-Chain Data and Network Fundamentals

Ethereum Network Activity and Usage

Despite price stagnation, Ethereum’s underlying network activity remains robust. Transactions related to decentralized finance, non-fungible tokens, and layer-two solutions continue to generate consistent demand for block space. This fundamental strength contrasts with the Ethereum price locked below $2,150, highlighting a disconnect between usage and valuation.

Gas fees, while lower than previous peaks, still reflect steady activity. The ongoing adoption of scaling solutions has improved efficiency, making Ethereum more accessible to users and developers. These factors support the long-term bullish case, even if short-term price action remains subdued.

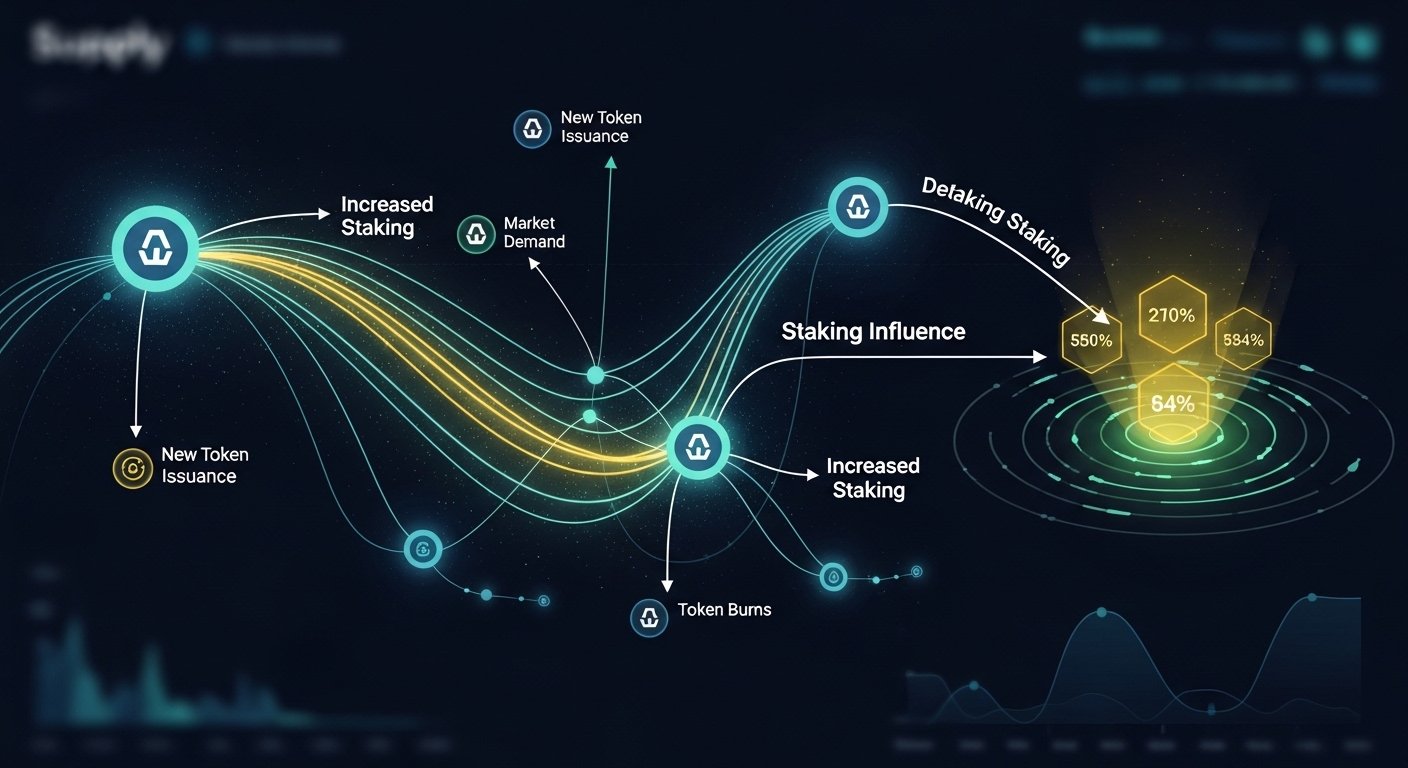

Supply Dynamics and Staking Influence

Ethereum’s transition to proof-of-stake introduced new supply dynamics that continue to influence price behavior. Staking has removed a significant portion of ETH from liquid supply, reducing immediate selling pressure. However, this effect alone has not been sufficient to push the Ethereum price locked below $entiment and Market Psychology

Market psychology often determines whether consolidation resolves upward or downward. The Ethereum price locked below $2,150 has created frustration among bullish investors who expected stronger performance following network upgrades and ecosystem growth. At the same time, bears have been unable to push prices significantly lower, indicating underlying demand.

This stalemate suggests a classic accumulation or distribution phase, depending on perspective. Long-term investors may view current prices as an opportunity to build positions, while short-term traders focus on range-bound strategies. Sentiment indicators show cautious optimism rather than outright fear or euphoria.

Potential Catalysts for a Breakout or Breakdown

Bullish Scenarios for Ethereum

A decisive move above $2,150 would likely require a combination of technical and fundamental catalysts. Increased institutional participation, favorable regulatory clarity, or a broader risk-on environment could all contribute to a breakout. In such a scenario, the Ethereum price locked below $2,150 narrative would shift toward renewed bullish momentum.

Network upgrades, improvements in scalability, and growing adoption of Ethereum-based applications could also reinforce confidence. If these developments align with improving market conditions, Ethereum could establish higher support levels and resume a long-term uptrend.

Bearish Risks and Downside Considerations

On the other hand, failure to hold key support levels could expose Ethereum to deeper corrections. Macroeconomic shocks, unfavorable regulations, or a sharp decline in Bitcoin could drag ETH lower. In this case, the Ethereum price locked below $2,150 would be followed by a breakdown that tests investor conviction.

Understanding these risks is essential for managing exposure. While long-term fundamentals remain strong, short-term volatility cannot be ruled out in a rapidly evolving market.

Comparative Performance: Ethereum Versus Other Assets

Ethereum’s relative performance compared to Bitcoin and other major altcoins provides additional context. While Bitcoin often benefits from its status as a digital store of value, Ethereum’s utility-driven narrative introduces different valuation dynamics. The Ethereum price locked below $2,150 reflects this distinction, as investors weigh growth potential against execution risks.

Compared to emerging layer-one competitors, Ethereum continues to dominate in terms of developer activity and ecosystem depth. However, competition has intensified, and market participants are increasingly selective. This competitive landscape underscores the importance of innovation and adoption in determining future price direction.

What Traders and Investors Should Watch Next

The coming weeks and months will be critical in determining whether the Ethereum price locked below $2,150 resolves into a breakout or breakdown. Key factors to monitor include volume trends, reactions to resistance levels, and broader market sentiment.

On-chain metrics such as active addresses, staking participation, and fee generation can provide early signals of shifting dynamics. Additionally, macroeconomic indicators and regulatory news should not be overlooked, as they can quickly alter risk appetite.

For investors, patience and disciplined risk management remain essential. Understanding the broader context behind Ethereum’s consolidation can help avoid emotional decision-making during periods of uncertainty.

Conclusion

The Ethereum price locked below $2,150 represents a pivotal moment for the second-largest cryptocurrency. While the lack of a clear directional break has tested investor patience, it also reflects a market in balance, waiting for a catalyst strong enough to define the next trend. Technical indicators, on-chain data, and fundamental developments all point to a period of consolidation rather than weakness.

Ethereum’s long-term outlook remains supported by its dominant ecosystem, ongoing innovation, and evolving supply dynamics. Whether the next move is upward or downward will depend on a convergence of market conditions, sentiment, and external factors. For now, understanding the forces behind this price lock is key to navigating the opportunities and risks ahead.

FAQs

Q: Why is the Ethereum price locked below $2,150?

The Ethereum price is locked below $2,150 due to strong resistance at this level, reduced trading volume, and broader market uncertainty that has limited directional momentum.

Q: Is the current consolidation phase bullish or bearish for Ethereum?

The consolidation is neutral in the short term but can be seen as constructive for the long term, as it allows the market to build a base before a potential breakout.

Q: What technical indicators matter most right now?

Key indicators include resistance at $2,150, support near $2,000, moving averages, and momentum oscillators that currently signal indecision.

Q: Could Ethereum break above $2,150 soon?

A breakout is possible if volume increases and favorable catalysts emerge, such as positive macro conditions, regulatory clarity, or stronger network activity.

Q: Should long-term investors be concerned about Ethereum’s current price action?

Long-term investors may view the Ethereum price locked below $2,150 as a temporary phase, given the network’s strong fundamentals and ongoing development.