The convergence of mobile technology and blockchain infrastructure has accelerated rapidly over the past few years. As cryptocurrencies mature and decentralized applications expand, hardware manufacturers are experimenting with new ways to integrate mining capabilities into consumer devices. One of the most intriguing developments is the rise of Android phones with crypto mining chips—smartphones equipped with specialized hardware designed to mine digital assets directly from your pocket.

In 2026, the question is no longer whether such devices exist. The real debate is whether they are practical, profitable, or merely a marketing gimmick. With increased global interest in decentralized finance, rising energy concerns, and advancements in semiconductor engineering, the concept of mobile crypto mining has evolved far beyond its early experimental phase.

This article takes a comprehensive look at whether Android phones with crypto mining chips are worth buying in 2026. We will examine how the technology works, assess real-world profitability, analyze performance trade-offs, and evaluate long-term viability. If you’re considering investing in one of these devices—or simply curious about where mobile mining stands today—this guide will provide clarity grounded in technical and economic realities.

The Rise of Android Phones With Crypto Mining Chips

From Experimental Hardware to Commercial Products

The idea of mining cryptocurrency on a smartphone is not new. In the early days of Bitcoin and other proof-of-work networks, enthusiasts experimented with CPU-based mining on laptops and even mobile devices. However, standard smartphone processors were never optimized for sustained hash computations. Thermal throttling, battery degradation, and minimal profitability rendered early attempts largely impractical.

Fast forward to 2026, and the landscape has changed. Manufacturers are now integrating dedicated crypto mining chips, often based on low-power ASIC or optimized ARM architectures, into select Android devices. Unlike conventional SoCs, these chips are engineered specifically for hashing algorithms used by energy-efficient cryptocurrencies. This shift represents a move from general-purpose mining attempts to purpose-built mobile crypto mining hardware, a crucial distinction in assessing value.

Why 2026 Is Different

Several macro trends explain the renewed interest in Android phones with crypto mining chips: First, there has been a broader shift toward energy-efficient consensus mechanisms. While Bitcoin remains dominant, many altcoins now rely on modified proof-of-work or hybrid systems that are less power-intensive.Second, semiconductor innovation has significantly improved power-per-hash efficiency. Modern fabrication nodes allow mining chips to operate within acceptable thermal envelopes for mobile devices.

Third, the decentralization narrative has gained momentum. Consumers increasingly value sovereignty over digital assets, and mobile-based mining aligns with the ethos of decentralized participation.Together, these trends have made Android phones with crypto mining chips more technically feasible and commercially viable than ever before.

How Crypto Mining Chips Work in Android Phones

Dedicated Mining Silicon vs. Standard Processors

At the core of these devices lies a specialized mining chipset. Unlike the primary CPU or GPU in a typical Android device, this chip is optimized for hashing operations, enabling more efficient computation per watt.

The mining chip handles cryptographic algorithms—often for specific altcoins designed for mobile mining compatibility—without burdening the main processor. This separation minimizes performance degradation for daily tasks such as browsing, gaming, and streaming. In essence, these phones are hybrid devices: part smartphone, part micro-mining rig.

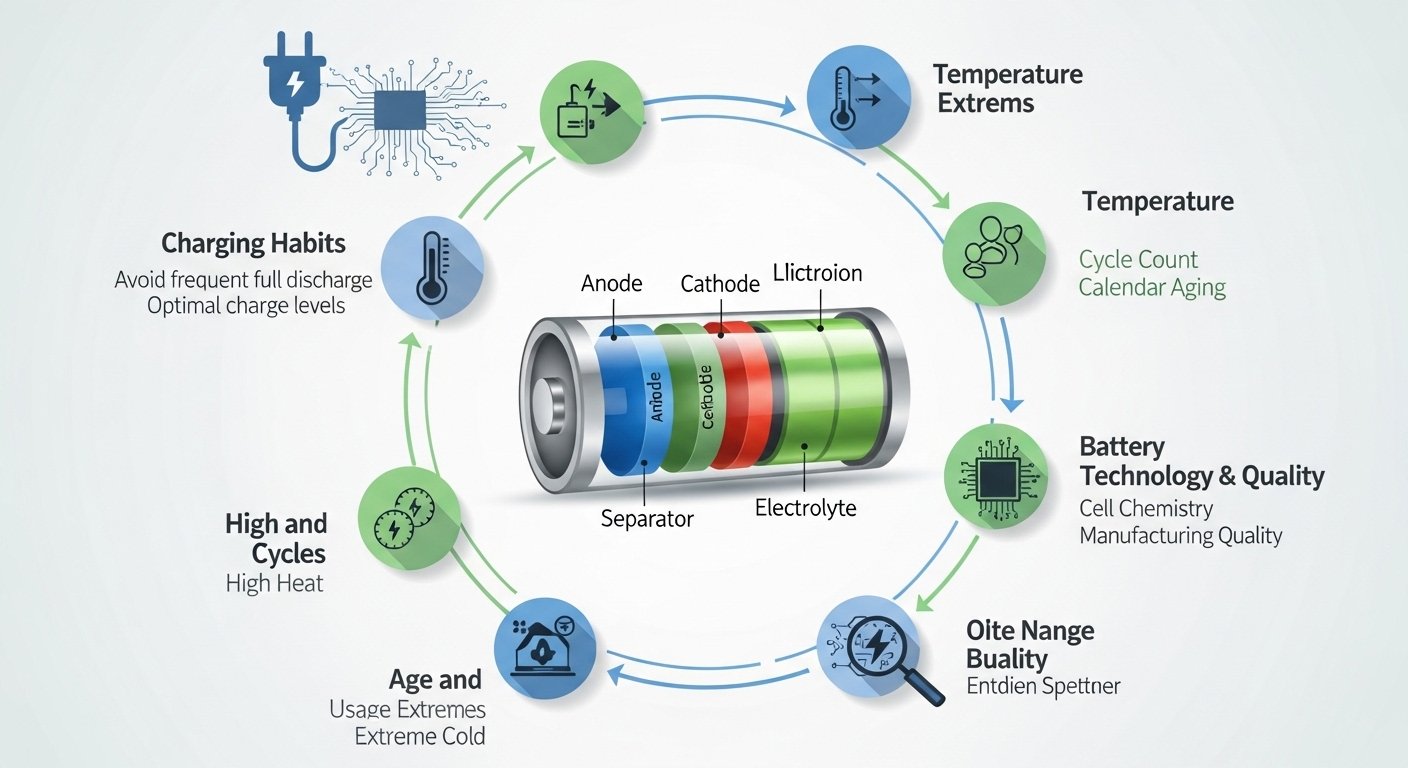

Thermal and Power Management

Thermal constraints are the primary engineering challenge in any Android phone with crypto mining chips. Sustained hashing generates heat, and excessive temperatures can degrade internal components. Manufacturers address this issue through improved heat dissipation systems, dynamic clock scaling, and optimized battery management software. Some models restrict mining to idle states or when connected to power, reducing stress on the battery. Nevertheless, even with these innovations, long-term wear remains a critical consideration for buyers evaluating real profitability.

Profitability: Can You Actually Make Money?

Mining Rewards vs. Electricity Costs

The first question consumers ask is simple: can an Android phone with crypto mining chips generate meaningful profit? In 2026, the answer depends heavily on network difficulty, token price volatility, and electricity costs. While mobile mining chips are more efficient than standard processors, they still cannot compete with industrial-scale ASIC rigs operating in low-cost energy regions.

However, these devices are not designed to replace mining farms. Instead, they target micro-earnings, passive accumulation, and participation in emerging ecosystems. For users in regions with moderate electricity costs, profitability margins tend to be slim but positive if mining occurs primarily while charging. In high-cost energy environments, net gains may be negligible.

Token Incentives and Ecosystem Rewards

Some blockchain projects now incentivize mobile mining participation beyond pure block rewards. Users may receive staking bonuses, governance tokens, or ecosystem perks. This additional utility can enhance the value proposition of Android phones with crypto mining chips. Instead of focusing solely on raw mining income, buyers may consider indirect benefits such as early token allocations or network influence.

Performance Trade-Offs and User Experience

Does Mining Slow Down Your Phone?

A common concern surrounding Android phones with crypto mining chips is performance degradation. In well-designed models, the mining chip operates independently of the primary processing unit, minimizing interference.

Still, sustained background operations can impact system responsiveness if poorly optimized. High-quality devices mitigate this through resource scheduling and intelligent workload balancing. Users should evaluate independent benchmarks before purchasing. Real-world performance often varies by manufacturer implementation.

Battery Health and Longevity

Battery degradation remains one of the most critical factors. Even with advanced battery management systems, prolonged charging cycles combined with mining heat can accelerate wear. Manufacturers claim improved thermal insulation and adaptive charging algorithms reduce this risk. However, long-term empirical data suggests moderate battery lifespan reduction compared to standard Android devices. Buyers must factor replacement costs into profitability calculations when considering an Android phone with crypto mining chips.

Security and Privacy Considerations

Integrated Wallet Security

Most Android phones with crypto mining chips ship with built-in secure wallets. Hardware-level encryption, biometric authentication, and secure enclaves aim to protect mined assets. However, mobile devices remain susceptible to phishing, malware, and OS-level vulnerabilities. Users must maintain robust cybersecurity hygiene.

Regulatory Landscape in 2026

Cryptocurrency regulations vary globally. Some jurisdictions impose reporting obligations on mined digital assets. Prospective buyers should understand local compliance requirements before investing. Regulatory clarity can influence the long-term sustainability of mobile crypto mining markets.

Environmental Impact and Sustainability

Energy Efficiency Improvements

Compared to traditional mining rigs, Android phones with crypto mining chips consume significantly less power per device. However, scale matters. If millions of devices mine simultaneously, aggregate consumption increases. The sustainability argument hinges on whether these phones replace more energy-intensive alternatives or simply add new load to the grid.

Carbon Footprint Considerations

Environmentally conscious consumers may question whether mobile mining aligns with climate goals. Devices powered by renewable energy sources can mitigate environmental impact, improving the ethical profile of this technology.

Market Outlook for Android Phones With Crypto Mining Chips

Consumer Demand Trends

In 2026, demand for Android phones with crypto mining chips remains niche but growing. Tech-savvy users, crypto enthusiasts, and early adopters drive sales. Mainstream adoption depends on clearer profitability and seamless integration into everyday use.

Competition and Innovation

Major smartphone brands are cautiously experimenting, while specialized crypto-tech firms lead innovation. Advancements in low-power ASIC design could significantly enhance efficiency over the next few years.

Are Android Phones With Crypto Mining Chips Worth It in 2026?

The answer depends on user expectations. If you expect substantial passive income comparable to a dedicated mining farm, these devices will likely disappoint. Hash rates remain modest, and market volatility introduces uncertainty.

However, if you value decentralized participation, modest token accumulation, and integration of blockchain functionality into everyday devices, Android phones with crypto mining chips can offer meaningful utility. The devices represent a hybrid between smartphone and blockchain node—a conceptual shift rather than a pure profit machine.

Conclusion

In 2026, Android phones with crypto mining chips occupy a fascinating intersection between consumer electronics and decentralized infrastructure. They are not revolutionary wealth generators, nor are they purely gimmicks. Instead, they serve as incremental steps toward deeper integration of blockchain technology into mainstream devices.Profitability remains modest and highly dependent on external factors such as token value and electricity costs.

Performance trade-offs are manageable in well-designed models, though battery longevity is a valid concern.Ultimately, these devices are worth it for users who prioritize participation, experimentation, and early adoption over guaranteed financial returns. As semiconductor efficiency improves and blockchain incentives evolve, their value proposition may strengthen further.

FAQs

Q: Are Android phones with crypto mining chips profitable in 2026?

Profitability is generally modest and depends on electricity costs, token prices, and network difficulty. They are unlikely to generate significant income but may produce small passive rewards.

Q: Do crypto mining chips damage smartphone batteries?

Prolonged mining can contribute to battery wear due to heat and charging cycles. Modern devices include mitigation technologies, but some lifespan reduction is possible.

Q: What cryptocurrencies can be mined on Android phones with crypto mining chips?

Most devices support specific energy-efficient altcoins optimized for low-power hardware rather than Bitcoin or other high-difficulty networks.

Q: Is mobile crypto mining legal?

Legality varies by country. Users should verify local regulations regarding cryptocurrency mining and taxation before purchasing.

Q: Should beginners buy Android phones with crypto mining chips?

Beginners interested in learning about blockchain participation may find value in these devices. However, those seeking high financial returns should consider alternative investment strategies.

Also More: Crypto Market Volatility Triggers $2.5B Bitcoin Liquidations