The cryptocurrency mining landscape has evolved dramatically, and finding the right ASIC bitcoin miner for sale has become crucial for both newcomers and seasoned miners. With Bitcoin’s continued growth and increasing network difficulty, selecting the most efficient and profitable mining hardware can make the difference between success and failure in your mining venture.

Whether you’re looking to purchase your first ASIC miner or expand your existing mining operation, understanding the current market offerings is essential. This comprehensive guide will walk you through everything you need to know about finding the perfect ASIC bitcoin miner for sale, helping you make an informed decision that aligns with your budget, electricity costs, and mining goals.

Understanding ASIC Bitcoin Miners: What Makes Them Special

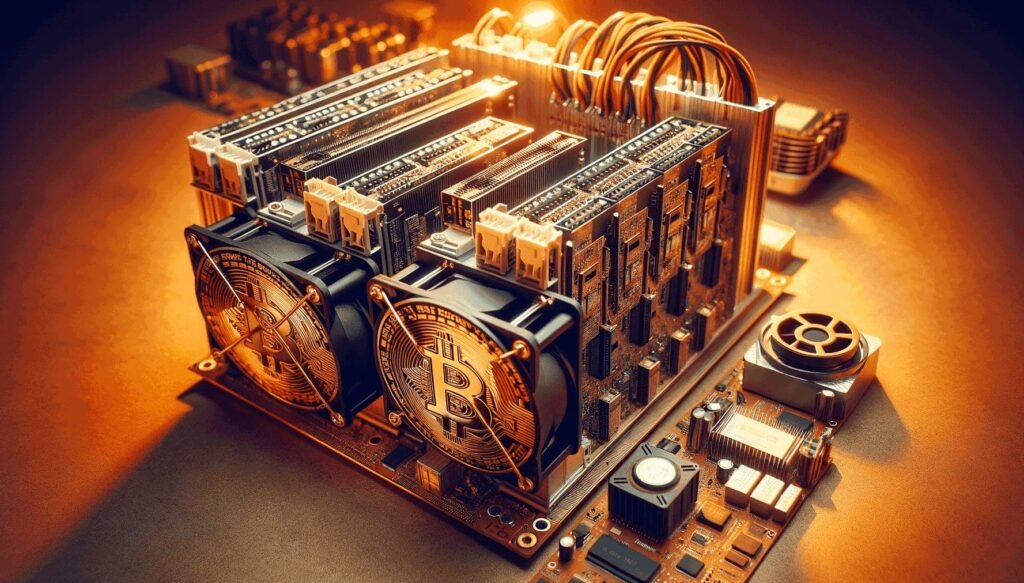

Application-Specific Integrated Circuits (ASICs) represent the pinnacle of bitcoin mining technology. Unlike general-purpose computers or graphics cards, these specialized devices are designed exclusively for mining cryptocurrencies, particularly Bitcoin. When searching for an ASIC bitcoin miner for sale, you’re looking at machines that can deliver hash rates measured in terahashes per second (TH/s), far exceeding what traditional mining equipment can achieve.

The evolution of ASIC technology has been remarkable. Early Bitcoin miners used CPUs, then GPUs, but today’s mining landscape is dominated by ASIC devices that offer unparalleled efficiency. These machines consume significantly less electricity per hash compared to their predecessors, making them the only viable option for profitable Bitcoin mining in today’s competitive environment.

Modern ASIC miners incorporate advanced cooling systems, optimized chip designs, and sophisticated firmware that maximizes performance while minimizing energy consumption. The continuous innovation in ASIC technology means that newer models consistently outperform older ones, making it crucial to stay informed about the latest releases when considering a purchase.

Top ASIC Bitcoin Miner Models Currently for Sale

Bitmain Antminer Series

Bitmain’s Antminer series dominates the ASIC bitcoin miner market, and for good reason. The Antminer S21 represents their latest flagship model, delivering impressive hash rates of up to 200 TH/s while maintaining reasonable power consumption. When evaluating an ASIC bitcoin miner for sale from this series, consider factors like delivery timeframes, warranty coverage, and authorized dealer networks.

The Antminer S19 series continues to be popular among miners seeking proven performance. These models offer excellent price-to-performance ratios and have established track records for reliability. The S19 Pro delivers around 110 TH/s, making it suitable for medium-scale mining operations.

For budget-conscious miners, older Antminer models like the S17 or S19j Pro still offer competitive performance at lower price points. However, factor in their higher power consumption when calculating long-term profitability.

MicroBT Whatsminer Series

The Whatsminer M50 series has gained significant traction in the mining community. These units offer competitive hash rates ranging from 114 TH/s to 126 TH/s, depending on the specific model. The M50S, in particular, stands out for its excellent power efficiency and robust build quality.

MicroBT’s reputation for producing reliable, long-lasting miners makes their products attractive options when searching for an ASIC bitcoin miner for sale. Their miners typically feature better cooling solutions and tend to operate more quietly than some competitors.

Canaan AvalonMiner Series

Canaan’s AvalonMiner series provides another viable option for miners. The AvalonMiner 1246 delivers competitive performance with hash rates around 90 TH/s. While not the most powerful options available, these miners often come at more affordable price points, making them suitable for smaller operations or beginners.

Key Factors to Consider When Buying ASIC Bitcoin Miners

Hash Rate and Performance Metrics

Hash rate represents the processing power of your miner, directly impacting your potential earnings. When evaluating any ASIC bitcoin miner for sale, compare hash rates across different models and consider how they align with current network difficulty levels. Higher hash rates generally translate to better earning potential, but they often come with increased power consumption and higher purchase prices.

Remember that hash rate specifications provided by manufacturers represent optimal conditions. Real-world performance may vary based on factors like ambient temperature, power quality, and firmware versions.

Power Consumption and Efficiency

Electricity costs represent the largest ongoing expense in Bitcoin mining. When examining an ASIC bitcoin miner for sale, carefully review the power consumption specifications, typically measured in watts (W). More importantly, consider the efficiency rating, expressed as J/TH (joules per terahash).

Miners with better efficiency ratings will consume less electricity per unit of hash rate, improving your profit margins. This becomes particularly important in regions with higher electricity costs or during periods of lower Bitcoin prices.

Initial Investment and ROI Calculations

The upfront cost of purchasing an ASIC miner represents a significant investment. Prices for new ASIC bitcoin miners can range from $2,000 to $15,000 or more, depending on the model and current market conditions. Calculate your expected return on investment (ROI) by considering factors like current Bitcoin prices, mining difficulty, electricity costs, and pool fees.

Use online mining calculators to estimate potential earnings, but remember that Bitcoin prices and network difficulty fluctuate constantly. Conservative estimates typically assume gradual increases in difficulty and stable electricity costs.

Where to Find Reliable ASIC Bitcoin Miners for Sale

Authorized Manufacturers and Distributors

Purchasing directly from manufacturers like Bitmain, MicroBT, or Canaan ensures authenticity and warranty coverage. However, direct purchases often involve longer waiting periods and minimum order quantities. Authorized distributors provide similar guarantees while offering more flexible purchasing options.

Always verify the legitimacy of sellers before making significant purchases. Check for official certifications, customer reviews, and established business histories.

Reputable Online Marketplaces

Several specialized cryptocurrency mining equipment retailers have established strong reputations in the industry. These platforms often provide detailed product comparisons, customer support, and competitive pricing. Look for sellers with extensive product knowledge, clear return policies, and responsive customer service.

Suggested outbound link: Link to a reputable mining hardware retailer like Compass Mining or similar established platform

Secondary Markets and Used Equipment

The secondary market offers opportunities to purchase ASIC bitcoin miners at reduced prices. However, buying used equipment requires additional caution. Verify the condition of the hardware, remaining warranty coverage, and the seller’s reputation. Consider factors like the age of the equipment, its mining history, and potential component wear.

Setting Up Your ASIC Bitcoin Mining Operation

Infrastructure Requirements

Successfully operating an ASIC bitcoin miner requires proper infrastructure. Ensure adequate electrical capacity, as most modern miners require 220V connections and draw substantial power. Proper ventilation and cooling systems are essential, as these devices generate significant heat during operation.

Consider noise levels, particularly for residential installations. ASIC miners can be quite loud, potentially requiring soundproofing or dedicated mining spaces.

Network Configuration and Pool Selection

Configure your miner to connect to a reliable mining pool. Popular options include F2Pool, Antpool, and Slush Pool. Each pool has different fee structures, payout methods, and minimum payout thresholds. Research pool statistics, including their hash rate distribution and historical performance.

Suggested internal link anchor text: “bitcoin mining pool comparison guide”

Monitoring and Maintenance

Implement monitoring systems to track your miner’s performance, temperature, and earnings. Regular maintenance, including cleaning dust from cooling fans and checking connections, helps ensure optimal performance and longevity.

Maximizing Profitability with Your ASIC Miner

Optimizing Operating Conditions

Maintain optimal operating temperatures to ensure maximum performance and hardware longevity. Most ASIC miners perform best in temperatures between 5°C and 35°C (41°F to 95°F). Implement proper cooling systems and consider seasonal adjustments to your setup.

Regular firmware updates from manufacturers can improve performance and efficiency. Stay informed about available updates and implement them during maintenance windows.

Strategic Timing and Market Awareness

Bitcoin mining profitability fluctuates with market conditions, network difficulty adjustments, and electricity costs. Develop strategies for managing these variables, including potentially adjusting your mining schedule based on electricity rate structures or market conditions.

Consider the upcoming Bitcoin halving events, which historically impact mining economics. Plan your equipment purchases and upgrades around these significant market events.

Understanding Warranty and Support Options

When purchasing an ASIC bitcoin miner for sale, carefully review warranty terms and available support options. Most manufacturers provide warranties ranging from 180 days to one year, covering defects in materials and workmanship.

Understand what actions might void your warranty, such as overclocking, physical modifications, or using unauthorized firmware. Keep detailed records of your purchase and any maintenance activities.

Future Trends in ASIC Mining Technology

The ASIC mining industry continues evolving rapidly, with manufacturers constantly developing more efficient and powerful devices. Emerging trends include improved chip architectures, better cooling solutions, and enhanced remote management capabilities.

Consider these technological advances when making purchasing decisions. While newer models offer better performance, they often come with premium pricing and limited availability.

Environmental Considerations and Sustainable Mining

Environmental concerns surrounding Bitcoin mining have led to increased focus on sustainable practices. When selecting an ASIC bitcoin miner for sale, consider the environmental impact of your operation. Look for miners with better energy efficiency and consider renewable energy sources for your mining facility.

Some regions offer incentives for using renewable energy in industrial applications, potentially improving your mining operation’s economics while reducing environmental impact.

Conclusion

Selecting the right ASIC bitcoin miner for sale requires careful consideration of multiple factors including performance, efficiency, cost, and your specific mining goals. The cryptocurrency mining landscape continues evolving rapidly, making it essential to stay informed about the latest developments and market conditions.

Success in Bitcoin mining depends not just on choosing the right hardware, but also on proper setup, ongoing maintenance, and strategic operation management. Take time to research thoroughly, calculate potential returns conservatively, and consider long-term market trends when making your investment decision.

SEE MORE:Best Bitcoin Mining ASIC 2025 Top 10 Miners for Maximum Profitability