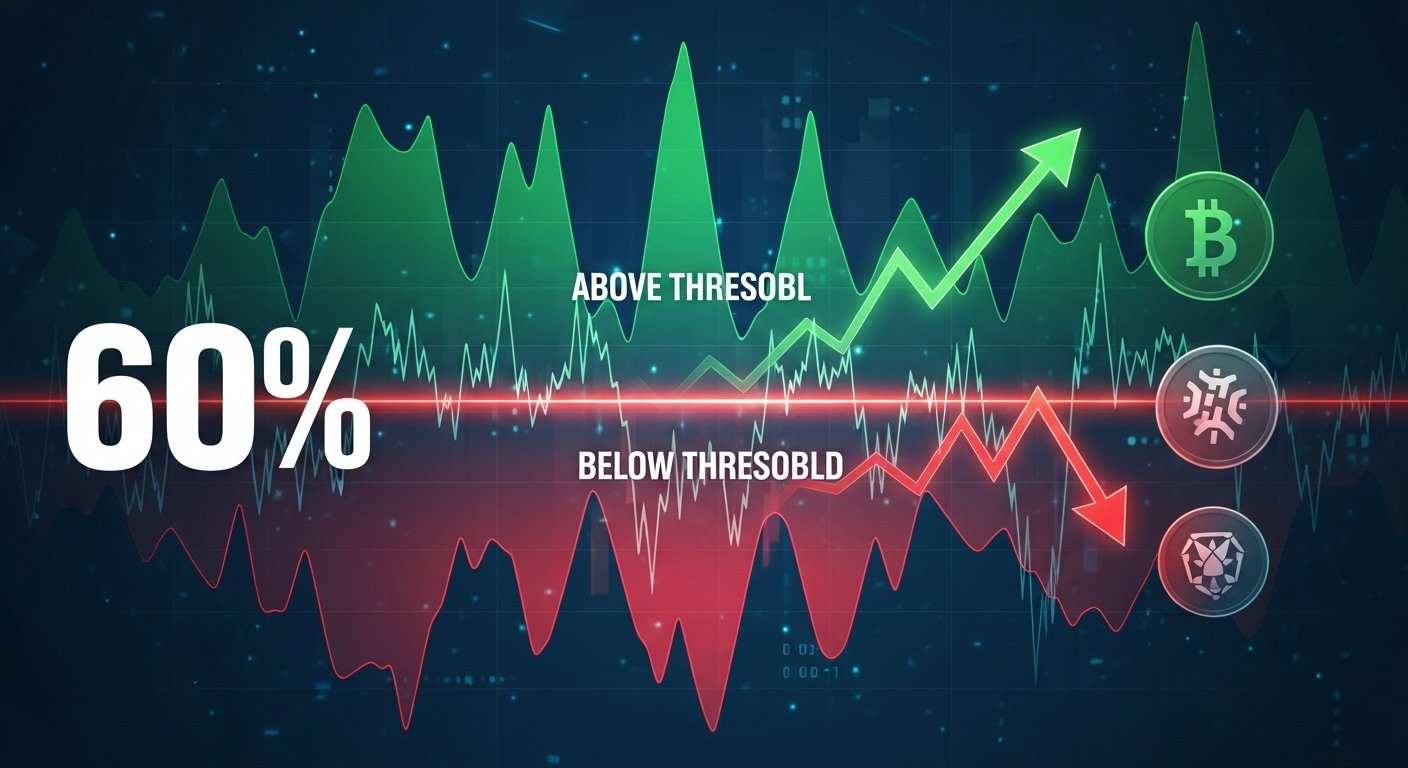

The cryptocurrency market has entered an electrifying phase as Bitcoin dominance plunges below the pivotal 60% threshold. This decline marks a crucial moment for the digital asset ecosystem, sparking renewed speculation that a powerful altcoin season may be emerging. For traders and long-term investors alike, Bitcoin dominance serves as a compass that helps interpret capital flows, investor sentiment, and overall market structure. When it drops sharply, analysts often begin to anticipate an environment in which altcoins outperform Bitcoin, sometimes dramatically.

This shift is not merely statistical. It signals a potential turning point in how market participants perceive opportunity within the crypto space. For years, Bitcoin has been the undisputed leader, commanding the lion’s share of the crypto market’s total value. But as blockchain technology evolves and new sectors such as DeFi, AI-driven crypto solutions, layer-two scaling, and metaverse ecosystems gain traction, capital increasingly diversifies. A fall below 60% Bitcoin dominance suggests that many traders are either reallocating into altcoins or entering the market through alternative entry points. This dynamic creates the perfect environment for speculation, innovation, and accelerated momentum across non-Bitcoin assets.

Bitcoin Dominance and Its Market Impact

Bitcoin dominance reflects the percentage of the overall cryptocurrency market that belongs to Bitcoin alone. Its calculation is simple: the market cap of Bitcoin is divided by the total market cap of all cryptocurrencies combined. But the implications of this number extend far beyond a mathematical ratio. Bitcoin dominance is widely regarded as a sentiment gauge that reveals whether investors prefer the relative stability of Bitcoin or are willing to take on greater risk by entering the altcoin arena.

When Bitcoin dominance is high, investors typically favor the perceived safety and maturity of Bitcoin. During uncertain macroeconomic conditions or market-wide corrections, capital often consolidates into Bitcoin because it is viewed as the most established and resilient asset in the digital economy. On the other hand, falling dominance can indicate a shift in confidence. If traders believe the market is ripe for growth, they may channel investments into altcoins that promise higher returns, innovative features, or emerging narratives.

This delicate relationship between Bitcoin and altcoins shows why dominance is more than just a technical measure. It mirrors changing attitudes toward risk and reward. When the metric begins to decline consistently, especially from a high base, it often reflects an increased appetite for experimentation and growth across the broader crypto ecosystem. This environment frequently precedes periods where altcoins achieve remarkable performance relative to Bitcoin.

Why the 60% Threshold Matters in Crypto Market Cycles

The 60% dominance level holds special significance within the cryptocurrency market. Throughout past cycles, this region has acted as a boundary between Bitcoin-led markets and altcoin-oriented environments. When dominance remains above 60%, Bitcoin typically commands most of the liquidity and the majority of investor attention. Its movements set the tone for the rest of the market, and altcoins generally follow Bitcoin’s trend rather than striking out on independent rallies.

When the figure dips below 60%, however, the dynamic tends to shift. Capital begins to rotate more aggressively into altcoins, which often signals the early stages of an altcoin rally. During past cycles, extended periods in which Bitcoin dominance stayed below this threshold coincided with explosive growth in altcoins, ranging from established networks such as Ethereum to emerging ecosystems across DeFi, gaming, and artificial intelligence.

The psychological impact of crossing this level cannot be overstated. Investors and analysts closely monitor dominance because they understand that the 60% line often separates periods of market consolidation from chapters of high speculation. When Bitcoin loses ground in terms of dominance, the narrative naturally shifts toward altcoins gaining strength. This creates a self-reinforcing loop as traders anticipate altcoin season and begin allocating capital accordingly, further reducing Bitcoin’s share of the market.

What Altcoin Season Really Means for the Market

The term “altcoin season,” often shortened to “altseason,” describes a period in which a broad range of altcoins outperform Bitcoin significantly over a sustained timeframe. This phenomenon is not limited to a few isolated tokens. Instead, it involves a widespread surge in value across multiple sectors, from smart contract platforms and layer-two solutions to decentralized finance, gaming ecosystems, metaverse initiatives, and emerging AI-powered crypto projects.

An altcoin season rarely appears out of nowhere. It typically unfolds in stages. Bitcoin often rallies first, drawing attention from outside the crypto space and injecting fresh liquidity into the market. As Bitcoin begins to consolidate after its initial surge, early investors look for higher-return opportunities in larger altcoins such as Ethereum or Solana. Once these coins begin outperforming, momentum spreads toward mid-cap and eventually small-cap tokens, creating a cascading effect.

The defining characteristic of altseason is that altcoins outperform Bitcoin not just against the dollar but also against BTC pairs. This means that altcoins are gaining value more rapidly than Bitcoin itself. When this shift coincides with falling Bitcoin dominance, and particularly when dominance remains below 60% for several weeks, market participants typically gain more confidence that a true altcoin season is underway.

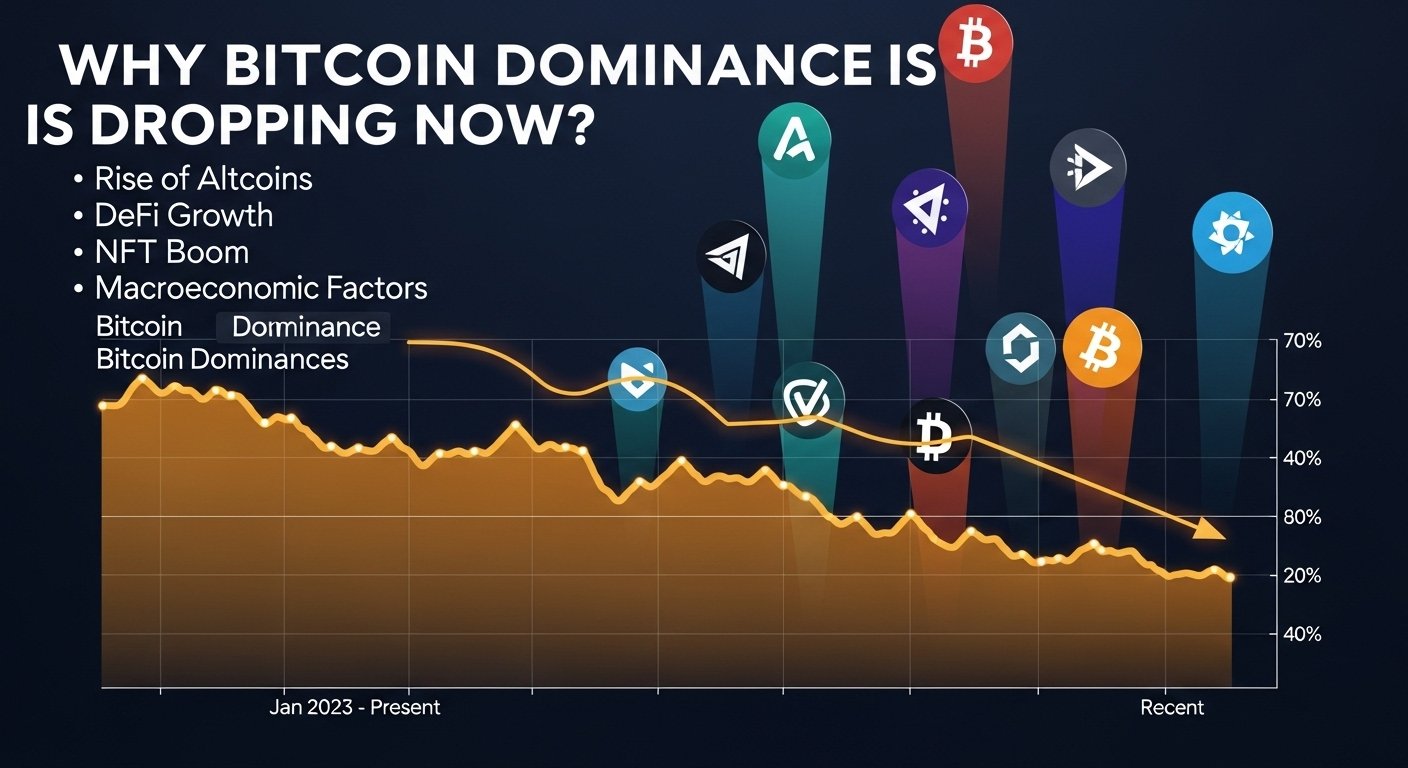

Why Bitcoin Dominance Is Dropping Now

Several important forces contribute to the decline in Bitcoin dominance below 60%, each playing a unique role in reshaping investor strategy and market structure. One of the most influential is the increasing demand for Ethereum and major altcoins that provide functionality beyond digital money. As the crypto industry matures, assets that offer smart contracts, decentralized applications, scaling innovations, and interoperable networks are attracting significant capital inflows. These altcoins allow developers to build real-world solutions and decentralized platforms, giving them intrinsic utility that differentiates them from Bitcoin’s primary role as a store of value.

Another key factor influencing dominance is the remarkable growth of stablecoins. These assets, which are pegged to fiat currencies, now account for a substantial share of the crypto market. As stablecoins grow, they dilute Bitcoin’s proportional share of total market capitalization. Investors often use stablecoins as both a safety mechanism and a liquidity tool, enabling fast transitions into altcoins when new opportunities arise. The continual expansion of stablecoins naturally places downward pressure on Bitcoin dominance even in periods when Bitcoin remains stable or rises modestly.

The broader macroeconomic environment also contributes to shifts in dominance. Periods of uncertainty in traditional markets often push traders toward Bitcoin. However, once conditions stabilize and risk appetite increases, altcoins frequently attract speculative capital. As new narratives emerge surrounding blockchain gaming, decentralized finance, tokenized assets, and artificial intelligence, traders increasingly view altcoins as vehicles for higher growth potential. This diversification of interest leads to a sustained reduction in Bitcoin’s market share.

The Drop Below 60%: Signal or False Alarm?

While a decline in Bitcoin dominance below 60% is a compelling indicator, it does not guarantee an immediate or sustained altcoin season. The crypto market is known for sudden reversals, meaning that dominance can spike upward again if Bitcoin undergoes a strong rally or if external events trigger a shift toward lower-risk assets. Regulatory announcements, macroeconomic shocks, or unexpected sell-offs can also cause altcoins to lose ground more quickly than Bitcoin, interrupting the momentum that typically drives altseason.

Successful identification of a genuine altcoin season requires consideration of additional factors. Traders often look for sustained strength in altcoin performance against both USD and BTC, rising trading volume across multiple altcoin sectors, and consistent investor interest reflected through search trends, exchange activity, and on-chain metrics. When these elements converge alongside a prolonged period of reduced Bitcoin dominance, the probability of a full altcoin season increases significantly.

In some cases, dominance may dip temporarily without igniting a true altcoin rally. These instances highlight the importance of viewing dominance as one piece of a larger analytical framework rather than relying on it as a singular indicator. Trend confirmation, price structure, and overall market conditions must also be evaluated to determine whether altseason is truly underway or remains a possibility in the near future.

See More: Bitcoin Fall Phase Morgan Stanley’s 4-Year Cycle Warning

How Traders Use Bitcoin Dominance as a Strategic Tool

Bitcoin dominance has become an indispensable tool for traders seeking to optimize portfolio allocation across different market phases. When dominance rises, many traders interpret it as a signal to prioritize Bitcoin or large-cap assets, expecting that altcoins may stagnate or underperform. This approach aligns with the idea that Bitcoin often leads during early-stage bull markets or periods of heightened uncertainty, serving as an anchor of stability.

When dominance begins to drop, particularly below historically important levels like 60%, traders frequently adjust their strategies to capitalize on the potential outperformance of altcoins. They may increase exposure to major altcoins that demonstrate strong technical structure, expanding liquidity, or rising network activity. As confidence builds and broader participation emerges across altcoin sectors, traders may gradually allocate additional capital to mid-cap or emerging tokens with compelling narratives or innovative technology.

Risk management plays a crucial role, especially during periods of heightened volatility. Altcoins, while capable of delivering substantial gains, also experience sharper corrections. Monitoring Bitcoin dominance helps traders understand when the market environment favors aggressive positioning and when caution may be warranted. A comprehensive view of dominance trends and market cycles helps investors decide when to enter, hold, or exit altcoin positions more strategically.

Sectors Poised to Benefit if Altcoin Season Intensifies

If Bitcoin dominance remains below 60% and the market continues to move toward a full altcoin season, several sectors are likely to attract substantial capital inflows. Layer-one and layer-two networks are among the primary beneficiaries. These platforms support smart contracts, decentralized applications, and scalable infrastructure, making them powerful engines for innovation. Their importance grows as more developers build high-performance decentralized systems capable of handling millions of transactions and hosting diverse applications.

The decentralized finance sector also stands to gain significantly. As liquidity returns and investor interest intensifies, DeFi platforms that facilitate lending, borrowing, trading, staking, and asset management can experience accelerated growth. The resurgence of DeFi would reinforce the broader altseason narrative, especially if new advancements in real-world asset tokenization and on-chain financial solutions generate mainstream attention.

Narrative-driven sectors, such as blockchain gaming, artificial intelligence, and metaverse ecosystems, may experience renewed surges. These sectors thrive on storytelling, community engagement, and rapid technological advancement. They tend to attract speculative capital during altseasons due to their potential for exponential expansion. The ability to merge blockchain functionality with entertainment, digital identity, or AI-powered applications creates a compelling proposition for investors seeking high-growth opportunities.

Should Investors Shift Strategy Now That Dominance Is Below 60%?

Deciding whether to adjust investment strategy in response to falling Bitcoin dominance depends largely on individual goals and risk tolerance. Long-term investors who view Bitcoin as a store of value may prefer to maintain a strong foundational position, using dominance trends as contextual insight rather than direct trading signals. For these investors, the long-term potential of Bitcoin remains unchanged despite fluctuations in dominance, and short-term movements may not require immediate portfolio changes.

Active traders, however, often view the decline as an opportunity. A sustained drop below 60% encourages a more aggressive approach toward altcoins, especially if price trends, momentum indicators, and network activity support the shift. For traders who thrive in dynamic environments, the possibility of an emerging altcoin season presents opportunities for strategic rotation, profit-taking, and diversifying into innovative sectors that often surge during these periods.

Regardless of investment style, staying informed is critical. The cryptocurrency market evolves constantly, and the broader context surrounding Bitcoin dominance allows investors to make well-reasoned decisions. The key is maintaining a balance between capturing upside potential and managing the inherent risks associated with volatile altcoin markets.

Conclusion

The drop in Bitcoin dominance below 60% represents a pivotal moment for the cryptocurrency market. While the decline does not guarantee an immediate altcoin season, it creates the conditions that often precede one. Altcoins are already gaining ground, new narratives are forming, and investor confidence appears to be strengthening across multiple sectors.

If dominance remains suppressed and altcoins continue outperforming Bitcoin across both dollar and BTC pairs, the market could soon enter a more robust and sustained altcoin season. The coming months will reveal whether this shift marks the start of a major rotation or simply another temporary fluctuation in Bitcoin’s long-standing leadership.

For now, the atmosphere is charged with anticipation. The crypto market stands on the edge of a potentially transformative moment. Whether you are a long-term believer in Bitcoin or a passionate supporter of altcoin innovation, the next phase of the market promises excitement, volatility, and opportunity in equal measure.