Bitcoin leverage is once again at the center of market attention as traders position themselves for what many believe could be the next major price rebound. Across derivatives platforms, rising open interest, increasing funding rates, and aggressive long positioning suggest that market participants are becoming more confident in a near-term recovery for Bitcoin. The resurgence of leveraged trading reflects renewed optimism after periods of consolidation and volatility that tested investor conviction.

The cryptocurrency market has always been cyclical, with periods of exuberant expansion followed by corrections and consolidation phases. When Bitcoin leverage increases significantly, it often signals heightened expectations of price movement. Traders are not merely buying spot Bitcoin; they are amplifying their exposure through margin trading, perpetual futures contracts, and options strategies. This dynamic introduces both opportunity and risk, as leveraged positions can accelerate gains but also intensify liquidations.

In recent weeks, Bitcoin leverage metrics across major exchanges such as Binance, Bybit, and CME Group have shown noticeable increases. This development has sparked debate among analysts: Is this the beginning of a sustainable rally, or are traders setting the stage for heightened volatility?

This article examines why Bitcoin leverage is heating up, how traders are betting on a price rebound, and what it means for the broader crypto market. We will explore derivatives data, macroeconomic drivers, institutional involvement, and the risks associated with excessive leverage. By the end, readers will have a comprehensive understanding of the forces shaping the current market environment.

The Mechanics of Bitcoin Leverage in Today’s Market

To understand why Bitcoin leverage is surging, it is essential to clarify how leveraged trading works in the cryptocurrency ecosystem. Leverage allows traders to control a larger position than their initial capital would normally permit. For example, using 10x leverage means a trader can control $10,000 worth of Bitcoin with just $1,000 in collateral.

Futures Contracts and Perpetual Swaps

Most Bitcoin leverage activity occurs in futures and perpetual swap markets. These instruments enable traders to speculate on price movements without directly holding Bitcoin. Perpetual contracts, in particular, have become dominant due to their flexibility and absence of expiration dates.

When funding rates turn positive and increase steadily, it indicates that long positions are paying short positions, reflecting bullish sentiment. A sustained rise in funding rates often accompanies growing leverage as traders collectively bet on higher prices.

Margin Trading and Liquidation Dynamics

Margin trading amplifies both upside and downside risk. If Bitcoin’s price moves against a leveraged position beyond a certain threshold, exchanges automatically liquidate the position to protect against losses exceeding collateral.

When Bitcoin leverage climbs across the market, the potential for cascading liquidations also increases. A sudden price drop can trigger forced selling, accelerating volatility. Conversely, a rapid upward movement can cause short squeezes, pushing prices higher as short sellers are liquidated.

Why Traders Are Betting on a Bitcoin Price Rebound

The current rise in Bitcoin leverage suggests that many market participants expect a price rebound. Several factors are contributing to this sentiment shift.

Technical Indicators Signaling Momentum

From a technical analysis perspective, Bitcoin has been forming higher lows on longer timeframes, suggesting underlying strength. Momentum oscillators, moving averages, and breakout patterns are encouraging traders to increase exposure.

As Bitcoin consolidates near key support levels, leveraged traders often interpret this as accumulation before a breakout. The expectation of a breakout above resistance levels fuels long positions, driving up Bitcoin leverage metrics.

Macro Environment and Risk Appetite

Global macroeconomic conditions also play a crucial role. As inflation pressures moderate and central banks adopt less aggressive tightening policies, risk assets tend to benefit. Bitcoin, often described as a high-beta asset, typically responds positively to improving liquidity conditions.

Institutional investors have increasingly incorporated Bitcoin into diversified portfolios. Platforms like BlackRock and Fidelity Investments have expanded digital asset offerings, reinforcing the perception that Bitcoin is maturing as an asset class. When macro uncertainty stabilizes, traders feel more comfortable using leverage to amplify exposure, anticipating capital inflows into digital assets.

The Role of Institutional Participation

Bitcoin leverage is no longer driven solely by retail traders. Institutional participation has grown substantially over the past several years, particularly through regulated futures markets.

CME Futures and Professional Traders

The involvement of CME Group has been instrumental in legitimizing Bitcoin futures trading. Institutional traders use CME contracts for hedging and speculative purposes, contributing to deeper liquidity.Rising open interest on CME often reflects growing institutional engagement. When professional traders increase leveraged positions, it can signal confidence in directional price movements.

Exchange-Traded Products and Market Structure

The approval of spot Bitcoin exchange-traded products has enhanced accessibility for traditional investors. Increased exposure through regulated vehicles often correlates with heightened derivatives activity, as traders hedge ETF positions with futures contracts. This interplay between spot markets and derivatives markets intensifies Bitcoin leverage dynamics, particularly during periods of anticipated price expansion.

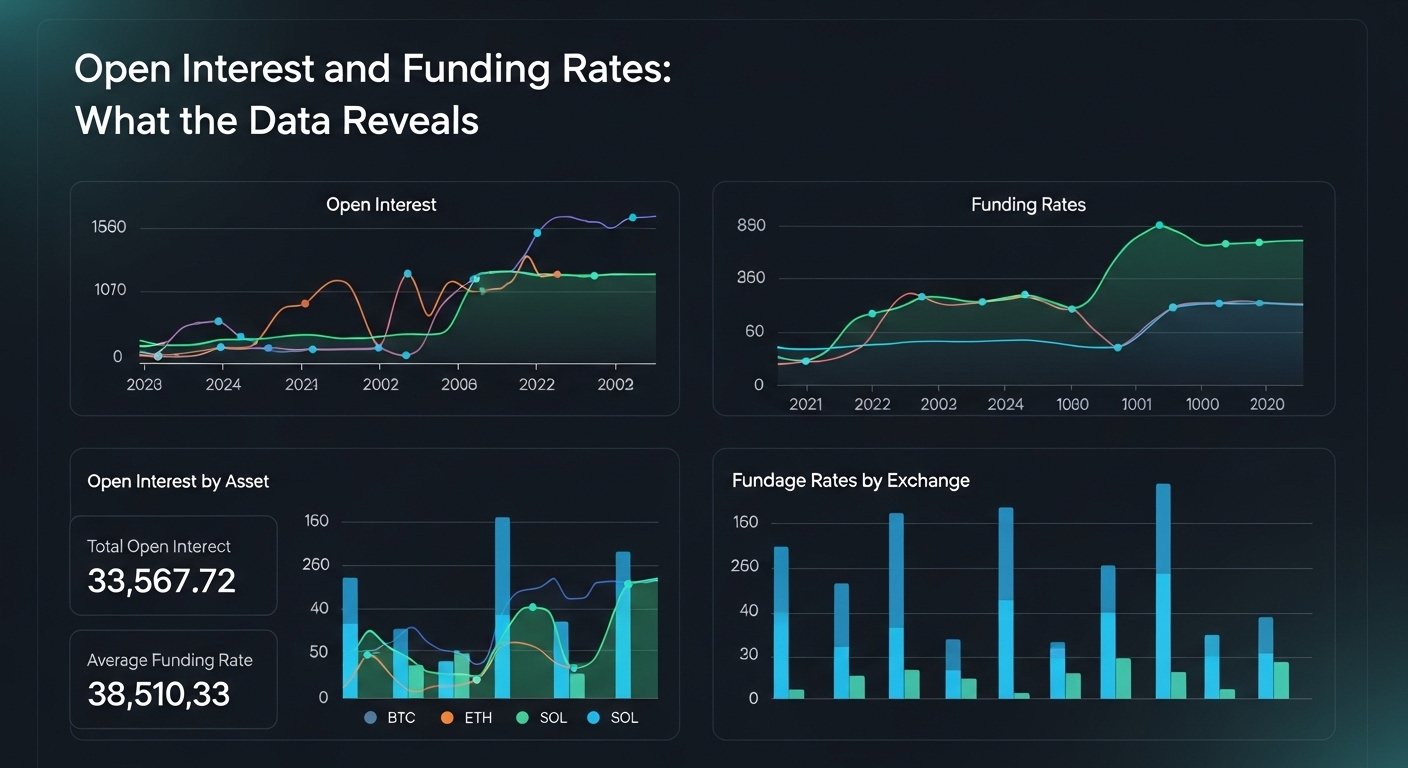

Open Interest and Funding Rates: What the Data Reveals

Open interest represents the total number of outstanding futures contracts. When open interest rises alongside price, it generally confirms bullish momentum. However, when open interest rises while price stagnates, it can signal overcrowded positioning.

Funding rates provide insight into trader sentiment. Sustained positive funding indicates aggressive long positioning. If funding becomes excessively positive, it may suggest over-leverage and increased risk of a correction.

In the current environment, both open interest and funding rates have been trending upward. This combination implies that traders are positioning for a rebound but also raises the probability of sharp volatility if expectations are not met.

Risks of Elevated Bitcoin Leverage

While increased Bitcoin leverage can accelerate gains during a rally, it also magnifies systemic risk within the crypto market.

Liquidation Cascades

High leverage creates fragile market conditions. A sudden negative catalyst can trigger widespread liquidations, pushing prices down rapidly. Liquidation cascades have historically led to dramatic intraday swings in Bitcoin’s price.

Overcrowded Long Positions

When too many traders align on one side of the market, even minor price fluctuations can trigger mass unwinding. Overcrowded long positions can amplify downside risk if sentiment shifts unexpectedly.

Psychological Factors and Market Sentiment

Leverage often reflects emotional conviction rather than disciplined risk management. During bullish phases, traders may underestimate downside risk. This behavioral bias contributes to heightened volatility.

Historical Context: Lessons from Previous Leverage Cycles

Bitcoin leverage cycles have historically preceded major price movements. During previous bull runs, rising leverage amplified gains. However, excessive leverage has also contributed to sharp corrections. In 2021, Bitcoin reached all-time highs before experiencing significant liquidations during periods of market stress. Exchanges tightened margin requirements to stabilize conditions, underscoring the systemic implications of excessive leverage. Learning from these cycles, traders and institutions now monitor derivatives metrics more closely, using them as leading indicators for potential inflection points.

The Interplay Between Spot Demand and Derivatives Activity

A sustainable rebound requires more than leveraged speculation. Spot market demand must support upward price momentum. When spot buying aligns with rising Bitcoin leverage, rallies tend to be more durable.

If leverage increases without corresponding spot accumulation, price movements may be short-lived and prone to reversals. Analysts therefore track exchange inflows, long-term holder behavior, and on-chain metrics to assess underlying demand.

Market Sentiment and On-Chain Indicators

On-chain data provides additional context for understanding Bitcoin leverage trends. Metrics such as realized profit and loss, exchange balances, and miner activity reveal underlying market health.

When long-term holders accumulate while leveraged traders increase exposure, it strengthens the case for a rebound. Conversely, if long-term holders distribute holdings during leverage spikes, caution may be warranted.

Can Bitcoin Sustain the Rebound?

The sustainability of the current momentum depends on several interrelated factors. Liquidity conditions, regulatory clarity, institutional flows, and macro stability all influence Bitcoin’s trajectory.

If economic conditions remain supportive and spot demand strengthens, elevated Bitcoin leverage could accelerate a breakout above key resistance levels. However, traders must remain vigilant, as leverage-driven rallies can reverse quickly in the absence of fundamental support.

Conclusion

Bitcoin leverage is heating up as traders position for a potential price rebound. Rising open interest, increasing funding rates, and renewed institutional engagement signal growing optimism across the derivatives market. Platforms like Binance, Bybit, and CME Group are witnessing heightened activity, reflecting broader market anticipation.

However, leverage is a double-edged sword. While it can magnify gains during a rally, it also amplifies volatility and liquidation risk. Sustainable upward momentum requires alignment between leveraged speculation and genuine spot demand.

As Bitcoin navigates this pivotal phase, market participants must balance opportunity with disciplined risk management. The coming weeks will reveal whether current leverage levels mark the beginning of a sustained rally or set the stage for another volatility-driven shakeout.

FAQs

Q: What does rising Bitcoin leverage indicate?

Rising Bitcoin leverage typically indicates that traders expect significant price movement, often anticipating a rebound or breakout. It reflects increased use of margin and futures contracts.

Q: How do funding rates relate to Bitcoin leverage?

Funding rates measure the cost of holding leveraged positions. Positive funding rates suggest more long positions, indicating bullish sentiment and elevated leverage.

Q: Is high Bitcoin leverage bullish or bearish?

High Bitcoin leverage can be bullish if supported by spot demand, but excessive leverage increases the risk of sharp corrections through liquidation cascades.

Q: Why do institutional investors use Bitcoin futures?

Institutions use futures for hedging, portfolio diversification, and speculative positioning. Regulated platforms like CME Group provide compliant access to leveraged exposure.

Q: How can traders manage leverage risk?

Traders can manage risk by using lower leverage ratios, setting stop-loss orders, diversifying positions, and monitoring funding rates and open interest closely.

Also More: Crypto Market Heals Bitcoin & Altcoins Rebound