The landscape of Bitcoin has changed dramatically, and the phrase Bitcoin News Today no longer refers only to market movement or speculative excitement. For years, Bitcoin dominated conversations as a revolutionary store of value often compared to digital gold. Investors celebrated its scarcity, praised its decentralised architecture, and adopted it as a long-term hedge against inflation. Although this early narrative still plays a significant role in the perception of Bitcoin, it is now only one part of a much larger story. As we enter 2025, Bitcoin has transformed far beyond its original identity and has evolved into a dynamic foundation for decentralised finance and artificial intelligence-driven applications. This evolution is not merely theoretical; it is reflected in real adoption, expanding technological capabilities, and an expanding demand for Bitcoin-native innovation.

Innovations in Layer-2 technology, cross-chain interoperability, programmable smart-contract frameworks, and payment rails such as the Lightning Network have accelerated Bitcoin’s development. These advancements are pushing Bitcoin into new areas previously dominated by platforms like Ethereum and Solana. The result is a version of Bitcoin that is not passive or static but active, programmable, and capable of powering complex economic systems. Meanwhile, artificial intelligence systems—especially autonomous AI agents—are beginning to interact with Bitcoin seamlessly, using it to settle microtransactions, purchase services, and exchange data. As a result, Bitcoin is steadily becoming an essential component of the next generation of digital finance and intelligent automation.

In this comprehensive analysis, we explore how Bitcoin has transitioned from digital gold to a multifaceted financial engine. This transformation is being driven by Bitcoin DeFi, often referred to as BTCFi, and by the growing integration of AI and Bitcoin-enabled payment networks. Understanding this shift is critical not only for investors and developers but for anyone following Bitcoin News Today, as the implications reach far beyond price movements into the very structure of the global digital economy.

From Digital Gold to a Programmable Financial Layer

The Limitations of the Early Narrative

When Bitcoin emerged in 2009, its architecture intentionally avoided expansive programmable features. Its creator prioritised decentralisation, security, and censorship resistance over adaptable smart-contract capabilities. This design had significant consequences for how Bitcoin was used and perceived. While Ethereum cultivated a vibrant environment for decentralised applications, Bitcoin remained primarily a store of value and a medium of exchange. Its functionality was limited, but this limitation was also its advantage because it allowed Bitcoin to remain the most secure and decentralised blockchain in existence.

Yet as the broader cryptocurrency ecosystem evolved, the idea that Bitcoin must remain isolated from innovation gradually faded. Developers began to explore how Bitcoin could preserve its security while gaining programmability at higher layers. Instead of altering the base chain, which would compromise its integrity, they focused on building smarter and more expressive systems around it. These external layers, or Layer-2 networks, opened the door to a new phase of Bitcoin’s history.

The Emergence of BTCFi

BTCFi, short for Bitcoin-based decentralised finance, represents the maturation of Bitcoin into a vibrant financial ecosystem. This transformation has been gradual but powerful. Layer-2 solutions like Stacks and Rootstock introduced environments where developers could deploy smart contracts and decentralised applications that settle transactions back onto Bitcoin. This made it possible for Bitcoin holders to participate in lending, borrowing, and yield-generating strategies without abandoning BTC’s underlying security model.

One of the most profound shifts in Bitcoin News Today is the recognition of BTCFi as a legitimate financial sector. In early 2024, Bitcoin DeFi represented a relatively small portion of the crypto market, with a total value locked hovering near three hundred million dollars. By 2025, that figure has surged to more than seven billion dollars. This exponential increase illustrates not only growing interest but also newfound confidence in Bitcoin’s expanded capabilities.

The digital gold narrative has therefore evolved into something more nuanced. Bitcoin continues to serve as a robust store of value, but it is increasingly viewed as a productive asset rather than an idle one. BTCFi allows Bitcoin to be used as collateral, deployed into smart contracts, and integrated into far more advanced financial mechanisms. This new, more dynamic form of Bitcoin is central to its future role in global finance.

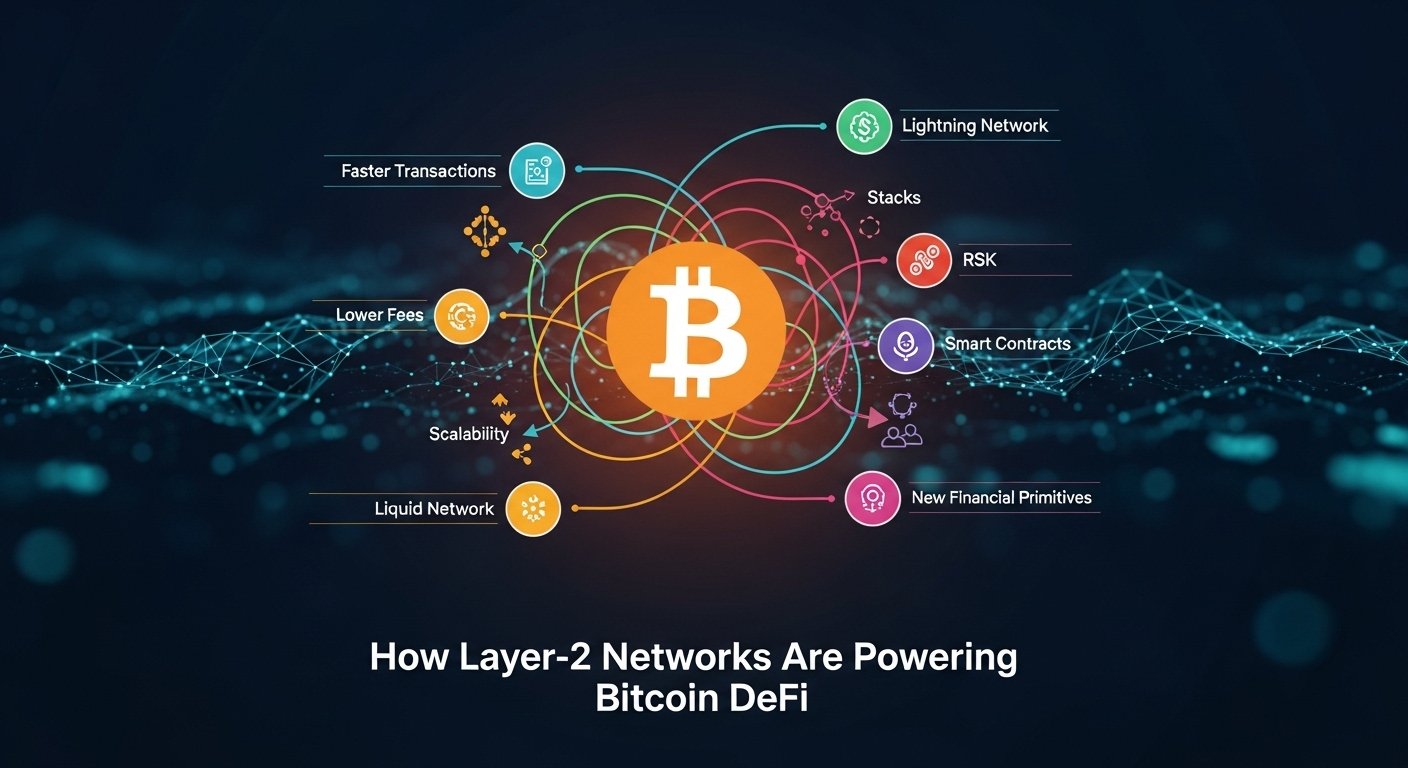

How Layer-2 Networks Are Powering Bitcoin DeFi

The Foundation of a New Bitcoin Economy

Layer-2 systems serve as the technological backbone of BTCFi. They enable functionality that the base chain cannot provide while still maintaining a connection to Bitcoin’s unmatched security. Stacks is one of the most influential players in this space. Its innovative proof-of-transfer mechanism anchors Stacks blocks directly to Bitcoin, ensuring that all activity ultimately settles onto the Bitcoin chain. Within this environment, developers can create decentralised applications, digital identities, non-fungible assets, and financial instruments that behave similarly to those found on Ethereum but with Bitcoin’s security as the final arbiter.

Rootstock has taken a different approach by replicating the Ethereum Virtual Machine within the Bitcoin ecosystem. This compatibility allows developers familiar with Ethereum’s programming languages and tools to build Bitcoin-native decentralised applications without learning a new technical stack. As a result, Rootstock bridges the gap between the two ecosystems, making Bitcoin more accessible to developers while expanding its DeFi capabilities.

Lightning Network and Real-Time Bitcoin Utility

While Layer-2 smart-contract networks are revolutionising programmable finance, the Lightning Network is transforming Bitcoin into a real-time global payments system. Lightning functions as an overlay network that allows Bitcoin transactions to be settled instantly and at negligible cost. Initially celebrated for enabling fast peer-to-peer payments, Lightning has since evolved into a foundational technology for machine-to-machine transactions and AI-driven microeconomies.

The emergence of AI agents capable of executing transactions autonomously has created an enormous need for fast, permissionless, low-cost payments. Traditional payment systems are too slow and restrictive to support autonomous digital services. Lightning, with its ability to route microtransactions across borders in milliseconds, has filled this gap. AI systems are now able to pay for APIs, purchase compute power, request data, and exchange services using Bitcoin without any human intervention. This development is a key theme in modern Bitcoin News Today, as it marks the convergence of two of the most important technological revolutions of our time: cryptocurrency and artificial intelligence.

Bitcoin DeFi’s Rapid Expansion and Why It Matters

The Meaning Behind Bitcoin’s TVL Growth

The tremendous surge in total value locked within Bitcoin DeFi ecosystems is not an accident or a speculative bubble. It reflects a meaningful expansion in Bitcoin’s utility, driven by real financial demand from both retail participants and institutional investors. The dramatic increase from a few hundred million dollars to billions in locked Bitcoin assets signals widespread confidence in Bitcoin’s ability to facilitate decentralised financial services beyond the scope of simple currency transfers.

Institutional interest in Bitcoin DeFi has also played a significant role in this upward trend. Regulated custody providers, institutional-grade wallets, and secure staking-like systems for Bitcoin-related assets have paved the way for larger entities to interact with BTCFi safely. These institutions recognise that Bitcoin’s stability and liquidity make it an ideal form of collateral. By combining Bitcoin with Layer-2 programmability, they gain access to new opportunities for yield, diversification, and advanced financial strategies that previously required exposure to more volatile altcoins.

The broader implication of this shift is that Bitcoin is moving deeper into the global financial system. It is evolving from a speculative asset to an integral part of decentralised finance and emerging AI-driven economic interactions. This accelerated adoption reinforces Bitcoin’s position at the centre of the digital asset industry.

The Growing Intersection of Bitcoin and Artificial Intelligence

Why AI Needs Bitcoin

Artificial intelligence is becoming increasingly autonomous and capable of performing complex tasks without constant human oversight. However, AI systems still rely on external resources such as data, compute power, APIs, and digital services that require payment. Traditional financial rails cannot support the scale or speed required for seamless AI transactions. They are geographically restricted, centralised, and built for human use rather than machine efficiency.

Bitcoin and the Lightning Network fill this void perfectly. Lightning’s micropayment capability allows AI agents to request and pay for resources in real time. This opens the possibility for a global machine economy where AI systems communicate, transact, and collaborate without friction. Payment protocols designed for Lightning, such as L402 and Nostr Wallet Connect, make it easy for developers to integrate Bitcoin payments directly into AI applications. As a result, Bitcoin is becoming the monetary backbone of an emerging autonomous services economy.

The Dawn of AI-Driven Bitcoin Ecosystems

As this integration deepens, a new type of digital economy is beginning to form. AI agents can hold Bitcoin, spend it, earn it, and autonomously engage in economic activity. An AI agent may purchase training data in Bitcoin, use Lightning to pay for compute cycles, or even sell services and accumulate BTC through automated workflows. This dynamic interaction marks a groundbreaking moment in digital finance, where Bitcoin is not only the currency of humans but of intelligent machines.

This convergence profoundly transforms the meaning of Bitcoin News Today. It signals a future where Bitcoin becomes the settlement layer for both human and artificial intelligence-driven commerce. The implications are immense, ranging from automated financial markets to hyper-efficient supply chains and globally connected digital services.

Institutional Transformation: From Storage to Active Deployment

For years, institutions held Bitcoin passively in cold storage, viewing it primarily as a long-term investment. That behaviour is changing rapidly as institutions discover Bitcoin’s expanding utility through BTCFi. Regulated custody providers now offer structured access to Bitcoin-based financial products that include lending, liquidity provisioning, and smart-contract-driven applications hosted on Layer-2 networks.

This transition represents a major turning point in Bitcoin’s maturity. When institutions begin to actively deploy Bitcoin within decentralised financial systems, they not only add liquidity but also legitimise the technology in mainstream finance. Institutional participation also accelerates innovation by pushing developers to create more secure, transparent, and sophisticated infrastructure capable of meeting professional standards.

In addition, staking-like mechanisms anchored to the Bitcoin blockchain are gaining traction. These systems allow both retail and institutional participants to lock assets and receive Bitcoin-denominated rewards. As the ecosystem grows, Bitcoin becomes more than a dataset on a balance sheet. It becomes a productive financial instrument capable of generating yield within a secure and decentralised framework.

See More: Bitcoin News Today Price Prediction Latest Updates & Expert Analysis 2025

Opportunities and Challenges for Bitcoin’s New Era

Bitcoin’s evolution into a programmable and AI-integrated financial engine brings extraordinary opportunities. The asset now offers a more compelling narrative than the original digital gold concept. It is increasingly recognised as a foundational layer for global decentralised finance and machine-driven commerce. Its unmatched security makes it uniquely suited to serve as the settlement layer for AI-enabled economic systems. Moreover, its expanding utility positions it as one of the most important technological infrastructures of the twenty-first century.

Nevertheless, this transformation comes with challenges. Layer-2 smart contracts, cross-chain bridges, and tokenised systems introduce new technical and operational risks. Although Bitcoin’s base chain remains exceptionally secure, auxiliary networks must maintain equally high standards to ensure safety. Regulatory scrutiny is also intensifying, especially as Bitcoin becomes more involved in yield-generating financial products. Furthermore, competition from other blockchains remains strong. Platforms such as Ethereum and Solana continue to innovate and maintain large developer communities. Bitcoin must continue improving user experience, scalability, and cross-chain interoperability to preserve its competitive edge.

However, the opportunities significantly outweigh the risks. Bitcoin’s transition into BTCFi and AI-powered payments represents a paradigm shift that is already reshaping the global digital economy. The changes unfolding in Bitcoin News Today reflect the early stages of a powerful transformation that will continue for years to come.

Conclusion

Bitcoin’s evolution from digital gold to a powerhouse for decentralised finance and artificial intelligence marks one of the most important developments in digital technology. The Bitcoin we see in Bitcoin News Today is not the same Bitcoin that dominated headlines a decade ago. It remains a secure store of value, but it has grown into a programmable, interoperable, and intelligent financial layer capable of supporting the next era of digital commerce.

Layer-2 networks have unlocked advanced functionality, enabling lending, trading, automated strategies, and asset issuance directly within the Bitcoin ecosystem. The Lightning Network has revolutionised real-time payments, supporting both human transactions and automated AI-driven microtransactions. Institutional adoption has expanded beyond passive storage and now embraces active participation in BTCFi. Developers, builders, and AI innovators increasingly rely on Bitcoin as a trusted settlement currency for intelligent agents and decentralised systems.

Bitcoin is no longer merely a tool for investment. It is becoming a central component of the emerging digital financial world, the intelligent economy, and the future of global value exchange. As Bitcoin continues to evolve, Bitcoin News Today will play an essential role in documenting its journey toward becoming the foundational monetary layer for both human civilisation and its rapidly advancing AI counterparts.