Bitcoin’s surge beyond the $90,000 level marks one of the most significant milestones in its history, reigniting global debate about its long-term value, role in the financial system, and appeal to ultra-wealthy investors. This breakout is not merely another speculative spike fueled by retail enthusiasm. Instead, it reflects a deeper structural shift in how Bitcoin is perceived by billionaires, institutional investors, hedge funds, and even sovereign entities. A closer Bitcoin price analysis shows that the rally above $90,000 is underpinned by strong fundamentals, tightening supply dynamics, and growing confidence in Bitcoin as a strategic asset rather than a short-term trade.

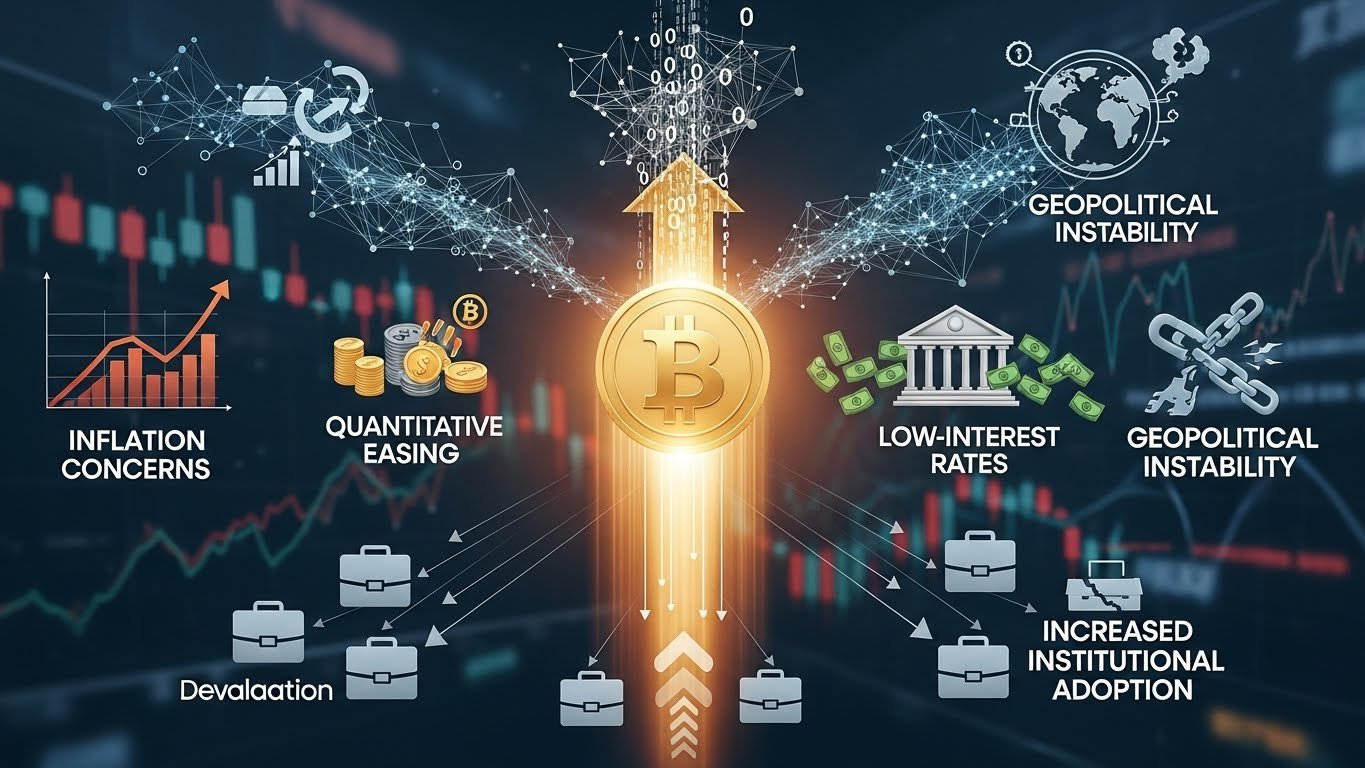

Over the past decade, Bitcoin has evolved from a fringe experiment into a globally recognized store of value. The latest rally comes amid persistent inflation concerns, geopolitical uncertainty, and a growing mistrust of fiat currencies. Billionaires who once dismissed Bitcoin as a speculative bubble are now allocating capital aggressively, seeing BTC digital gold with asymmetric upside. As Bitcoin surpasses $90,000, on-chain data, ETF inflows, and macroeconomic indicators collectively point to a market that is maturing rather than overheating.

This article provides an in-depth Bitcoin price analysis explaining why billionaires are buying at these levels, what is driving BTC’s strength, and how this rally differs from previous bull cycles. By examining institutional behavior, supply-demand mechanics, macro trends, and long-term price outlooks, we can better understand why $90,000 may not be the peak but a new foundation for Bitcoin’s next phase.

Bitcoin Price Analysis: What Makes the $90,000 Level So Important?

The $90,000 mark is not just a psychological milestone; it represents a major structural breakout in Bitcoin’s long-term price chart. Historically, Bitcoin has moved in cycles defined by accumulation, breakout, parabolic expansion, and correction. Breaking above $90,000 confirms a transition from consolidation into a new price discovery phase, where historical resistance levels no longer cap upside momentum.

From a technical perspective, Bitcoin’s move above $90,000 coincides with sustained strength above key moving averages and long-term trendlines. This suggests that buyers are not merely chasing momentum but are confident in Bitcoin’s valuation at higher levels. For billionaires and institutional investors, such confirmation reduces downside risk and validates long-term allocation strategies.

From a valuation standpoint, Bitcoin at $90,000 still compares favorably to gold and global monetary aggregates. When measured against the total market value of gold or global sovereign debt, Bitcoin’s market capitalization remains relatively small. This disparity reinforces the argument that BTC has significant room to grow as adoption expands. A detailed Bitcoin price analysis therefore shows that the $90,000 level acts more as a gateway than a ceiling.

Why Billionaires Are Buying Bitcoin Now

Bitcoin as Digital Gold in a Fragile Global Economy

One of the primary reasons billionaires are buying Bitcoin above $90,000 is its growing reputation as digital gold. In an era of ballooning government debt, currency debasement, and persistent inflation, wealthy investors are seeking assets that cannot be manipulated by central banks. Bitcoin’s fixed supply of 21 million coins offers a level of monetary certainty unmatched by fiat currencies.

Unlike gold, Bitcoin is easily transferable, divisible, and verifiable. These properties make it particularly attractive to global investors who need mobility and liquidity. Billionaires who manage wealth across borders see Bitcoin as a hedge not only against inflation but also against capital controls and geopolitical instability. This narrative has gained strength as traditional safe havens struggle to preserve purchasing power in real terms.

Institutional Validation Reduces Perceived Risk

Another key factor driving billionaire interest is the rapid institutionalization of Bitcoin. The approval and growth of spot Bitcoin ETFs have opened the door for large pools of capital that were previously unable or unwilling to hold BTC directly. Pension funds, endowments, and family offices now have regulated pathways to gain exposure, significantly reducing custody and compliance concerns.

This institutional validation has a powerful signaling effect. Billionaires tend to follow structural trends rather than short-term price movements. As major asset managers and Wall Street firms publicly endorse Bitcoin, the perceived risk of holding BTC decreases. A thorough Bitcoin price analysis reveals that these ETF inflows are not speculative bursts but steady allocations, suggesting long-term confidence rather than opportunistic trading.

Scarcity After the Bitcoin Halving

Bitcoin’s most recent halving event has further tightened supply dynamics, cutting the issuance of new BTC in half. Historically, halvings have preceded major bull markets as reduced supply collides with growing demand. For billionaires accustomed to investing in scarce assets, this predictable scarcity is a compelling feature.

At prices above $90,000, many retail investors assume Bitcoin is “too expensive,” but billionaires view it differently. They focus on future supply constraints and long-term adoption curves rather than nominal price levels. With fewer new coins entering circulation and a growing percentage of existing supply held by long-term holders, upward price pressure becomes more likely over time.

On-Chain Data Confirms Smart Money Accumulation

On-chain metrics provide valuable insight into who is buying Bitcoin at current levels. Data shows a steady increase in accumulation by large wallet addresses, often associated with institutions, funds, and high-net-worth individuals. These wallets tend to buy during periods of consolidation and hold through volatility, reinforcing long-term price stability.

Exchange balances have also declined, indicating that investors are moving Bitcoin into cold storage rather than preparing to sell. This behavior aligns with a bullish Bitcoin price analysis, suggesting that supply available for trading is shrinking. When combined with rising demand from ETFs and institutional buyers, this creates a supply squeeze that supports higher prices.

Another important signal is the behavior of long-term holders, who are selling less despite rising prices. In previous cycles, sharp rallies were often accompanied by significant profit-taking. The current environment shows a more disciplined approach, implying that experienced investors expect further upside beyond $90,000.

Macroeconomic Forces Supporting Bitcoin’s Rally

Inflation, Interest Rates, and Monetary Policy

Global macroeconomic conditions play a crucial role in Bitcoin’s performance. While central banks have attempted to control inflation through tighter monetary policy, real interest rates remain historically low in many regions. This environment reduces the appeal of traditional fixed-income assets and pushes capital toward alternative stores of value like Bitcoin.

Billionaires closely monitor these trends. They understand that even modest inflation can erode wealth over time, especially when compounded. Bitcoin’s decentralized nature and predictable supply make it an attractive hedge against these risks. A forward-looking Bitcoin price analysis suggests that as long as monetary uncertainty persists, demand for BTC will remain strong.

Geopolitical Uncertainty and Capital Preservation

Geopolitical tensions, trade disputes, and regional conflicts have also contributed to Bitcoin’s appeal. Wealthy individuals often seek assets that are independent of any single government or political system. Bitcoin’s borderless design allows it to function as a neutral reserve asset, accessible anywhere with an internet connection.

This attribute is particularly valuable in times of crisis, when capital mobility can be restricted. As Bitcoin surpasses $90,000, billionaires are not just speculating on price appreciation but also securing a form of financial insurance against systemic shocks.

How This Bitcoin Bull Market Differs From Previous Cycles

The current rally stands apart from earlier Bitcoin bull markets in several important ways. In the past, price surges were largely driven by retail speculation, leverage, and hype. While retail interest still plays a role, the dominant force behind the move above $90,000 is institutional capital.

This shift has important implications for volatility and sustainability. Institutional investors tend to deploy capital gradually and hold positions longer, reducing the likelihood of sharp boom-and-bust cycles. As a result, Bitcoin’s price behavior increasingly resembles that of a maturing asset class rather than a speculative experiment.

Moreover, regulatory clarity in key markets has improved, reducing uncertainty that previously scared off large investors. A comprehensive Bitcoin price analysis shows that these structural improvements create a more stable foundation for long-term growth, even if short-term corrections occur.

Long-Term Bitcoin Price Outlook Beyond $90,000

Looking ahead, many analysts believe that Bitcoin’s rally is still in its early stages. Price targets above $100,000 are increasingly common, with some projections extending much higher over the next several years. These forecasts are based not on hype but on adoption curves, supply constraints, and macroeconomic trends.

As Bitcoin continues to integrate into traditional finance, its total addressable market expands. If BTC captures even a fraction of the value stored in gold, bonds, or offshore wealth, prices well above $90,000 become plausible. Billionaires buying at current levels appear to be positioning for this long-term scenario rather than attempting to time short-term peaks.

At the same time, it is important to acknowledge risks. Regulatory shifts, technological challenges, and macroeconomic shocks can introduce volatility. However, a balanced Bitcoin price analysis suggests that these risks are increasingly outweighed by Bitcoin’s growing resilience and institutional support.

Conclusion

Bitcoin’s rise above $90,000 represents far more than a headline-grabbing price point. It signals a profound shift in market structure, investor composition, and long-term expectations. Billionaires are buying not because they expect a quick flip, but because they see Bitcoin as a scarce, resilient, and strategically important asset in an uncertain world.

This Bitcoin price analysis highlights how institutional adoption, supply constraints, and macroeconomic forces have converged to support higher valuations. While volatility remains part of Bitcoin’s DNA, the quality of demand behind this rally suggests a more sustainable trajectory than in previous cycles. For investors watching from the sidelines, the actions of billionaires provide a clear message: Bitcoin above $90,000 is not the end of the story, but a new chapter in its ongoing evolution.

FAQs

Q: Why are billionaires buying Bitcoin at such high prices?

Billionaires focus on long-term value rather than short-term price levels. They view Bitcoin as digital gold, a hedge against inflation, and a scarce asset with significant upside as global adoption grows.

Q: Is Bitcoin overpriced after surpassing $90,000?

A detailed Bitcoin price analysis suggests that BTC is not necessarily overpriced when compared to its potential market size. Relative to gold and global financial assets, Bitcoin still has room to grow.

Q: How do Bitcoin ETFs influence billionaire interest?

Spot Bitcoin ETFs provide regulated and secure access to BTC, making it easier for large investors to allocate capital. This institutional access reduces risk and increases confidence.

Q: Could Bitcoin fall below $90,000 again?

Short-term corrections are always possible due to market volatility. However, strong institutional demand and reduced supply may limit the depth and duration of any pullbacks.

Q: What is the long-term outlook for Bitcoin?

Many analysts believe Bitcoin could exceed $100,000 and beyond over the coming years, driven by scarcity, adoption, and macroeconomic trends that favor decentralized assets.