The cryptocurrency market continues to captivate investors worldwide, with bitcoin price prediction 2025 news today dominating financial headlines and social media discussions. As we navigate through 2025, Bitcoin remains the flagship digital asset that sets the tone for the entire cryptocurrency ecosystem. Current market dynamics, institutional adoption trends, and regulatory developments are creating a perfect storm of factors that could significantly impact Bitcoin’s trajectory over the coming months.

Today’s bitcoin price prediction 2025 news today reveals compelling insights from leading analysts who are closely monitoring key technical indicators, macroeconomic factors, and on-chain metrics. Whether you’re a seasoned cryptocurrency investor or someone considering their first Bitcoin purchase, understanding these expert predictions and market analysis is crucial for making informed investment decisions in this volatile yet potentially rewarding market.

Current Bitcoin Market Overview

Market Sentiment and Recent Performance

Bitcoin’s performance in 2025 has been nothing short of remarkable, with the digital currency demonstrating resilience despite global economic uncertainties. The cryptocurrency has experienced significant price movements driven by various factors including institutional adoption, regulatory clarity, and technological improvements.

Recent market data shows that Bitcoin has maintained strong support levels while breaking through key resistance points that analysts have been monitoring closely. The current trading patterns suggest a mature market that’s beginning to stabilize around certain price ranges, providing more predictable movement patterns for technical analysis.

Institutional investors continue to show growing confidence in Bitcoin as a store of value and hedge against inflation. Major corporations and financial institutions have been steadily increasing their Bitcoin holdings, creating substantial buying pressure that supports higher price levels.

Key Technical Indicators

Technical analysis reveals several important patterns that are shaping current price predictions. The Relative Strength Index (RSI) indicates that Bitcoin is currently in a healthy trading range, neither overbought nor oversold, which suggests room for continued upward movement.

Moving average convergence divergence (MACD) signals are showing bullish crossovers on multiple timeframes, indicating strengthening momentum. These technical indicators are particularly significant because they often precede major price movements in the cryptocurrency market.

Volume analysis demonstrates increasing participation from both retail and institutional investors, with daily trading volumes consistently exceeding historical averages. This increased activity typically correlates with sustained price movements and reduced volatility over time.

Bitcoin Price Prediction 2025: Expert Analysis and Forecasts

Short-Term Price Predictions (Q4 2025)

Leading cryptocurrency analysts are presenting increasingly optimistic scenarios for Bitcoin’s price performance through the remainder of 2025. Several prominent figures in the industry have revised their predictions upward based on recent market developments and improving fundamentals.

Technical analysts are pointing to several key price levels that could serve as targets for Bitcoin’s continued rally. The consensus among experts suggests that Bitcoin could test previous all-time highs while potentially establishing new resistance levels that would set the stage for future growth.

Market strategists emphasize that short-term predictions should be viewed within the context of broader market cycles. The cryptocurrency market’s inherent volatility means that significant price swings remain possible, but the overall trend appears to favor continued appreciation.

Long-Term Bitcoin Outlook Through 2025

The long-term outlook for Bitcoin through 2025 remains overwhelmingly positive according to most industry experts. Fundamental analysis reveals strengthening adoption metrics, improving infrastructure, and growing institutional acceptance that collectively support higher valuation targets.

Cryptocurrency research firms are highlighting several key factors that could drive Bitcoin’s price higher over the coming months. These include potential regulatory approvals, technological improvements, and macroeconomic conditions that favor alternative assets like Bitcoin.

Supply and demand dynamics continue to favor Bitcoin’s price appreciation. The fixed supply schedule combined with growing demand from various market participants creates a fundamental imbalance that typically results in upward price pressure over time.

Factors Influencing Bitcoin’s 2025 Price Trajectory

Institutional Adoption and Investment Flows

Institutional adoption remains one of the most significant drivers of Bitcoin’s price performance. Major financial institutions, hedge funds, and corporations continue to allocate increasing portions of their portfolios to Bitcoin, creating sustained buying pressure.

Recent announcements from several Fortune 500 companies regarding Bitcoin adoption have reinforced the narrative that cryptocurrency is becoming mainstream. These developments provide credibility and stability to the Bitcoin market while attracting additional institutional interest.

Investment flows from traditional finance into Bitcoin-related products continue to accelerate. Exchange-traded funds (ETFs), futures contracts, and other Bitcoin investment vehicles are making it easier for institutional investors to gain exposure to cryptocurrency returns.

Regulatory Environment and Government Policies

The regulatory landscape for Bitcoin continues to evolve favorably in many jurisdictions. Clear regulatory frameworks provide the certainty that institutional investors require before making significant allocations to cryptocurrency assets.

Government policies regarding cryptocurrency taxation and legal status are becoming more accommodative in several major economies. These developments reduce regulatory risk and encourage broader adoption among both individual and institutional investors.

International cooperation on cryptocurrency regulation is improving, creating more consistent standards across different markets. This harmonization reduces compliance costs and operational complexity for businesses operating in the Bitcoin ecosystem.

Technological Developments and Network Improvements

Bitcoin’s underlying technology continues to evolve through various improvement proposals and layer-two solutions. The Lightning Network and other scaling solutions are making Bitcoin more practical for everyday transactions while maintaining security and decentralization.

Network hash rate and security metrics continue to reach new all-time highs, demonstrating the robust and growing infrastructure supporting Bitcoin. These improvements enhance Bitcoin’s value proposition as a secure store of value and medium of exchange.

Development activity within the Bitcoin ecosystem remains high, with continuous improvements being made to wallets, exchanges, and other infrastructure components. These technological advances make Bitcoin more accessible and user-friendly for mainstream adoption.

Market Analysis: Bulls vs Bears on Bitcoin 2025

Bullish Arguments and Price Targets

Bitcoin bulls present compelling arguments for continued price appreciation based on fundamental and technical analysis. The fixed supply of 21 million Bitcoin combined with growing demand creates a mathematical certainty of price increases if adoption continues at current rates.

Prominent analysts are setting ambitious price targets for Bitcoin based on various valuation models. Stock-to-flow models, network value calculations, and adoption curve analysis all suggest significantly higher prices are justified by Bitcoin’s fundamentals.

Historical price patterns and market cycles provide additional support for bullish predictions. Previous Bitcoin market cycles have demonstrated the potential for explosive price growth during favorable market conditions, and current indicators suggest similar dynamics may be developing.

Bearish Concerns and Risk Factors

Despite overwhelming optimism, some analysts maintain cautious or bearish perspectives on Bitcoin’s 2025 price prospects. Regulatory risks, technological challenges, and macroeconomic uncertainties could potentially impact Bitcoin’s performance negatively.

Market concentration among large holders (whales) remains a concern for some analysts who worry about potential selling pressure from these significant stakeholders. Large-scale liquidations could temporarily suppress Bitcoin’s price despite positive fundamentals.

Competition from other cryptocurrencies and central bank digital currencies (CBDCs) could potentially reduce Bitcoin’s market dominance. While Bitcoin maintains its position as the leading cryptocurrency, evolving competitive dynamics warrant careful monitoring.

Investment Strategies for Bitcoin in 2025

Dollar-Cost Averaging and Long-Term Holding

Dollar-cost averaging remains one of the most effective strategies for Bitcoin investment, particularly given the cryptocurrency’s volatility. This approach allows investors to benefit from price fluctuations while building positions over time.

Long-term holding strategies (HODLing) have historically proven successful for Bitcoin investors who can weather short-term volatility. The cryptocurrency’s long-term trend remains strongly positive despite periodic corrections and bear markets.

Portfolio allocation strategies vary among financial advisors, but most recommend limiting cryptocurrency exposure to a percentage that investors can afford to lose completely. This risk management approach allows participation in Bitcoin’s upside potential while protecting overall portfolio stability.

Risk Management and Portfolio Diversification

Effective risk management is essential when investing in Bitcoin given its inherent volatility and regulatory uncertainties. Diversification across different asset classes helps reduce overall portfolio risk while maintaining exposure to Bitcoin’s growth potential.

Position sizing becomes crucial when dealing with volatile assets like Bitcoin. Financial advisors typically recommend limiting cryptocurrency investments to 5-10% of total portfolio value, though some aggressive investors choose higher allocations.

Stop-loss orders and profit-taking strategies can help manage downside risk while capturing gains during favorable market conditions. However, Bitcoin’s volatility can trigger these orders prematurely, so careful consideration of appropriate levels is important.

Global Economic Impact on Bitcoin Prices

Inflation and Monetary Policy Effects

Global inflation trends continue to influence Bitcoin’s appeal as a hedge against currency debasement. Central bank monetary policies that increase money supply typically benefit Bitcoin and other scarce assets.

Interest rate policies from major central banks affect Bitcoin’s relative attractiveness compared to traditional investments. Lower interest rates generally favor Bitcoin and other alternative assets by reducing the opportunity cost of holding non-yielding investments.

Currency devaluation in various countries drives local demand for Bitcoin as a store of value. This trend is particularly pronounced in countries experiencing high inflation or currency instability.

Geopolitical Events and Market Volatility

Geopolitical tensions and international conflicts often drive flight-to-safety behaviors that can benefit Bitcoin. The cryptocurrency’s decentralized nature and independence from any single government make it attractive during periods of international uncertainty.

Trade disputes and economic sanctions can increase Bitcoin’s utility as an alternative means of international value transfer. These use cases demonstrate Bitcoin’s practical applications beyond speculative investment.

Global economic recessions and financial crises have historically coincided with increased interest in Bitcoin and other alternative assets. The cryptocurrency’s performance during such periods continues to be closely monitored by analysts and investors.

Bitcoin Mining and Network Fundamentals

Hash Rate and Network Security

Bitcoin’s network hash rate continues to reach new all-time highs, indicating growing miner participation and network security. Higher hash rates make the Bitcoin network more secure and resistant to attacks, supporting higher valuations.

Mining difficulty adjustments ensure consistent block production times while maintaining network stability. These automatic adjustments demonstrate Bitcoin’s self-regulating mechanisms that contribute to its long-term viability.

Geographic distribution of mining operations continues to evolve, with miners seeking regions with favorable regulatory environments and low-cost renewable energy. This trend supports Bitcoin’s long-term sustainability and regulatory compliance.

Energy Consumption and Environmental Considerations

Bitcoin mining’s energy consumption remains a topic of ongoing discussion, with increasing focus on renewable energy sources. The industry’s transition toward sustainable energy sources addresses environmental concerns while maintaining network security.

Carbon neutrality initiatives within the Bitcoin mining industry are gaining momentum, with several major mining operations committing to renewable energy sources. These developments help address regulatory and public relations challenges.

Energy efficiency improvements in mining hardware continue to reduce the environmental impact per unit of mining hash rate. These technological advances make Bitcoin mining more sustainable and cost-effective.

Cryptocurrency Market Trends Affecting Bitcoin

Altcoin Performance and Market Dynamics

The broader cryptocurrency market’s performance influences Bitcoin through various correlation effects and capital flows. Strong altcoin performance can sometimes divert investment away from Bitcoin, while market downturns typically increase Bitcoin’s relative appeal.

Market dominance metrics show Bitcoin’s share of total cryptocurrency market capitalization fluctuating based on relative performance and investor sentiment. Understanding these dynamics helps predict Bitcoin’s price movements relative to the broader market.

Cross-asset correlations between Bitcoin and traditional financial markets continue to evolve. These relationships affect Bitcoin’s role as a portfolio diversifier and hedge against traditional market risks.

DeFi and Institutional Products

Decentralized finance (DeFi) applications built on Bitcoin and Bitcoin-backed assets are expanding the cryptocurrency’s utility beyond simple value storage. These developments increase demand for Bitcoin while creating new use cases.

Institutional financial products based on Bitcoin continue to proliferate, making the cryptocurrency more accessible to traditional investors. These products increase Bitcoin’s market liquidity and price stability.

Custody solutions and insurance products for Bitcoin are improving, addressing key concerns that prevent some institutional investors from participating in the cryptocurrency market. These infrastructure improvements support continued institutional adoption.

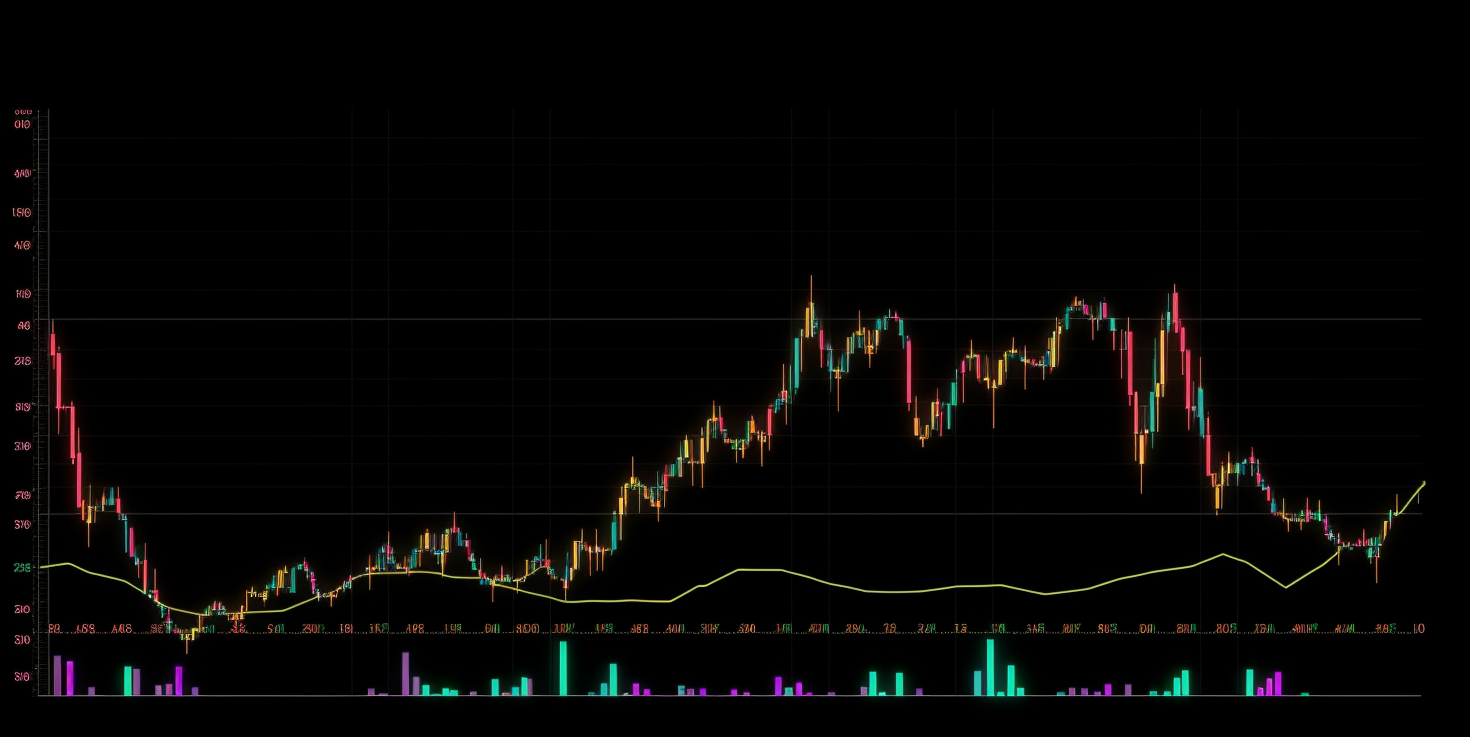

Technical Analysis: Charts and Patterns

Support and Resistance Levels

Technical analysis reveals several key support and resistance levels that are likely to influence Bitcoin’s price movements through 2025. Understanding these levels helps investors make informed decisions about entry and exit points.

Fibonacci retracement levels provide additional insights into potential price targets and reversal points. These mathematical relationships often coincide with significant price movements in Bitcoin and other financial assets.

Volume profile analysis shows where significant trading activity has occurred, indicating price levels where buyers and sellers are likely to become active. This information helps predict potential support and resistance zones.

Trend Analysis and Momentum Indicators

Long-term trend analysis shows Bitcoin maintaining its upward trajectory despite periodic corrections and consolidations. The overall trend remains bullish based on various timeframe analyses.

Momentum indicators such as RSI and MACD provide insights into the strength and sustainability of current price movements. These tools help identify potential reversal points and continuation patterns.

Moving average analysis reveals the health of Bitcoin’s long-term trend and provides dynamic support and resistance levels. Different timeframe moving averages offer insights into both short-term and long-term price dynamics.

Future Outlook: Beyond 2025

Long-Term Bitcoin Adoption Scenarios

Long-term adoption scenarios for Bitcoin suggest continued growth driven by technological improvements, regulatory clarity, and increasing institutional acceptance. These factors support sustained price appreciation beyond 2025.

Global financial system integration of Bitcoin could fundamentally change the cryptocurrency’s role and valuation. Such integration would likely result in significantly higher prices as Bitcoin becomes essential financial infrastructure.

Central bank digital currency (CBDC) development could either compete with or complement Bitcoin depending on implementation approaches. The relationship between CBDCs and Bitcoin will likely influence long-term adoption and pricing.

Technology Evolution and Scalability

Bitcoin’s technology continues to evolve through various improvement proposals and layer-two solutions. These developments address scalability concerns while maintaining the network’s security and decentralization principles.

Lightning Network adoption continues to grow, making Bitcoin more practical for everyday transactions and micropayments. Increased utility typically translates to higher demand and price appreciation over time.

Smart contract capabilities being developed for Bitcoin could expand its use cases beyond simple value transfer and storage. These capabilities would increase Bitcoin’s competitiveness with other blockchain platforms

Conclusion

The analysis of bitcoin price prediction 2025 news today reveals a complex but generally optimistic outlook for the world’s leading cryptocurrency. Multiple factors including institutional adoption, regulatory developments, technological improvements, and macroeconomic conditions are converging to support continued price appreciation through 2025.

However, investors must remember that cryptocurrency markets remain highly volatile and unpredictable. While expert predictions provide valuable insights, they should be combined with thorough personal research and appropriate risk management strategies. The key to successful Bitcoin investment lies in understanding both the opportunities and risks while maintaining a long-term perspective

LEARN MORE:Bitcoin News Today Price Prediction Analysis – Latest Market Insights 2025