Global financial markets have entered a cautious phase as investors reassess risk following renewed weakness in technology stocks. Against this backdrop, crypto markets post minor losses amid tech sell-off, reflecting the increasingly close connection between digital assets and traditional risk markets. While cryptocurrencies were once viewed as independent alternatives to equities, recent market cycles have shown that macroeconomic pressures, interest rate expectations, and movements in major stock indices now significantly influence crypto prices.

What stands out in the current environment is not the presence of losses, but their relatively modest scale. Instead of sharp crashes or panic-driven sell-offs, digital assets have experienced controlled pullbacks, suggesting a more mature and disciplined market structure. Bitcoin and Ethereum, along with other major cryptocurrencies, have largely maintained key support levels, signaling that long-term confidence remains intact despite short-term uncertainty.

This article explores why crypto markets post minor losses amid tech sell-off, examining the forces driving technology stocks lower, the growing correlation between equities and cryptocurrencies, and the role of investor psychology. It also analyzes how Bitcoin, Ethereum, and the broader crypto ecosystem are responding, while offering insight into what this phase may mean for the future of digital assets.

The Tech Sell-Off and Its Broader Market Influence

Why Technology Stocks Are Declining

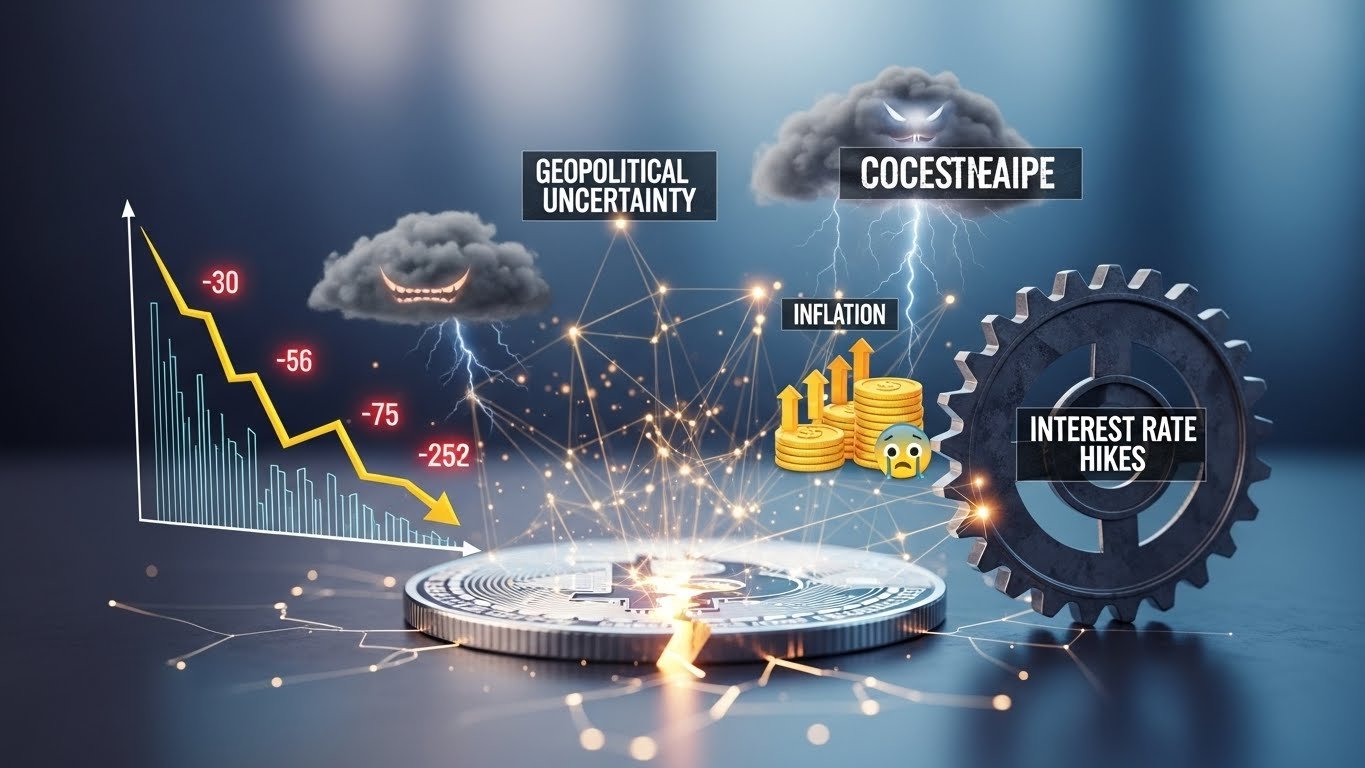

The recent decline in technology stocks has been fueled by a combination of high valuations, slowing growth expectations, and persistent concerns over monetary policy. As central banks maintain a cautious stance on interest rates, borrowing costs remain elevated, putting pressure on growth-oriented companies whose valuations depend heavily on future earnings. This environment has made investors more selective, leading to profit-taking across major technology names.

Because technology stocks play a dominant role in global equity indices, their weakness has had a ripple effect across financial markets. When tech stocks retreat, overall risk sentiment tends to weaken, prompting investors to reduce exposure to assets perceived as volatile. This shift in sentiment helps explain why crypto markets post minor losses amid tech sell-off, even in the absence of crypto-specific negative news.

Growing Correlation Between Crypto and Equities

Over the past few years, the relationship between cryptocurrencies and equity markets has strengthened considerably. Bitcoin and Ethereum are now widely held by institutional investors who also trade technology stocks, exchange-traded funds, and other risk assets. As a result, portfolio rebalancing during periods of equity market stress often affects digital assets as well.

However, the correlation is not absolute. While cryptocurrencies have followed equities lower, the magnitude of their declines has been limited. This suggests that while macro factors influence crypto prices, internal market dynamics and long-term conviction continue to provide support.

Bitcoin’s Role in Market Stability

Bitcoin has once again demonstrated its importance as the anchor of the crypto market. Despite broader market weakness, Bitcoin’s losses have been relatively contained, with prices holding above critical technical and psychological support zones. This stability has played a key role in preventing a deeper market-wide decline.

On-chain data and trading activity indicate that long-term holders are not rushing to sell. Instead, many investors appear to be viewing the current pullback as a temporary reaction to external pressures rather than a signal of a structural breakdown. This behavior reinforces the narrative that crypto markets post minor losses amid tech sell-off because underlying confidence in Bitcoin remains strong.

Institutional Participation and Reduced Volatility

Institutional involvement has significantly altered Bitcoin’s market dynamics. With pension funds, asset managers, and publicly listed companies holding Bitcoin as part of diversified portfolios, price movements are increasingly shaped by strategic allocation decisions rather than speculative trading alone. This has contributed to reduced volatility during periods of market stress.

The presence of institutional capital also brings a longer investment horizon, which helps absorb short-term selling pressure. As a result, Bitcoin has become more resilient during macro-driven downturns, even as it remains sensitive to broader financial conditions.

Ethereum and the Broader Altcoin Market

Ethereum has mirrored Bitcoin’s performance, posting modest losses while maintaining overall structural strength. As the leading smart contract platform, Ethereum’s value is closely tied to the growth of decentralized applications, decentralized finance, and blockchain-based innovation. These long-term fundamentals continue to attract investors, limiting downside risk during periods of uncertainty.

The fact that Ethereum has not experienced sharp declines reinforces the idea that crypto markets post minor losses amid tech sell-off due to selective risk reduction rather than widespread fear. Investors appear willing to hold assets with strong utility and development activity, even as they reduce exposure elsewhere.

Selective Weakness Among Altcoins

While major cryptocurrencies have shown resilience, some smaller altcoins have faced more pronounced declines. Projects with weaker fundamentals, limited liquidity, or speculative narratives have been more vulnerable to shifts in risk sentiment. This differentiation suggests that investors are becoming more discerning, favoring quality over hype.

At the same time, many established altcoins with clear use cases and active communities have managed to weather the downturn. This selective approach highlights the evolving maturity of the crypto market, where not all assets move in unison during periods of stress.

Macroeconomic Forces Shaping Crypto Sentiment

Macroeconomic conditions remain a dominant influence on digital asset prices. Expectations surrounding interest rates, inflation, and economic growth continue to shape investor behavior across all markets. When central banks signal prolonged tightening or caution, risk assets often come under pressure.

Despite these headwinds, the limited scale of recent losses suggests that much of the negative outlook may already be priced in. This pricing efficiency supports the observation that crypto markets post minor losses amid tech sell-off rather than reacting with extreme volatility.

Global Liquidity and Capital Flows

Global liquidity conditions also play a crucial role in determining crypto market performance. When liquidity tightens, speculative assets tend to suffer. However, relatively stable currency markets and gradual adjustments in monetary policy have helped prevent abrupt capital outflows from the crypto space. This balance has allowed digital assets to consolidate rather than collapse, even as investors remain cautious.

Investor Psychology and Market Maturity

A Shift Away From Panic Selling

One of the most significant changes in the current market cycle is the reduction in panic-driven behavior. Previous downturns were often marked by sharp, emotional sell-offs as retail investors rushed to exit positions. In contrast, the current phase has been characterized by measured responses and consolidation.

This shift in behavior indicates that investors are becoming more experienced and disciplined. As crypto markets post minor losses amid tech sell-off, many participants appear focused on long-term value rather than short-term price fluctuations.

The Influence of Long-Term Holders

Long-term holders continue to provide stability during periods of uncertainty. By maintaining positions despite short-term losses, these investors help create a price floor and reduce volatility. Their presence reflects growing confidence in the future of blockchain technology and digital assets.

Regulatory Environment and Market Confidence

Gradual Progress Toward Regulatory Clarity

Regulation has long been a source of uncertainty for crypto markets. However, recent progress toward clearer regulatory frameworks in several major economies has helped reduce fear and speculation. While challenges remain, incremental improvements in clarity have reassured investors.

This evolving regulatory landscape has contributed to market stability, supporting the idea that crypto markets post minor losses amid tech sell-off because systemic risks are perceived as lower than in previous cycles. Outlook for Crypto Markets

Long-Term Growth Prospects Remain Strong

Looking beyond short-term fluctuations, the long-term outlook for digital assets remains positive. Adoption continues to expand across industries, and technological innovation within the blockchain space shows no signs of slowing. The current environment highlights a more resilient and mature market capable of navigating external challenges.

Conclusion

The recent market action demonstrates how far digital assets have come in terms of maturity and integration into the global financial system. As crypto markets post minor losses amid tech sell-off, they reflect broader risk sentiment while also showcasing growing resilience. Rather than experiencing dramatic declines, cryptocurrencies have responded with controlled pullbacks, supported by strong fundamentals, institutional participation, and long-term investor confidence.

While volatility remains an inherent feature of the crypto market, the current phase suggests a more balanced ecosystem. For investors, this period serves as a reminder that short-term fluctuations are often part of a larger growth story driven by innovation, adoption, and evolving market structures.

FAQs

Q. Is Bitcoin becoming more stable over time?

Bitcoin has shown signs of reduced volatility compared to earlier years due to increased liquidity, institutional adoption, and a growing base of long-term holders.

Q. Are minor losses a negative sign for crypto investors?

Minor losses during broader market sell-offs are common and do not necessarily indicate a long-term downturn. They often reflect consolidation rather than a fundamental weakness.

Q. How do interest rates affect cryptocurrency prices?

Higher interest rates tend to reduce risk appetite, which can put pressure on cryptocurrencies. Lower or stable rates generally support higher valuations for risk assets.

Q. What should investors watch in the coming weeks?

Investors should pay attention to central bank signals, equity market trends, and on-chain data to better understand potential future movements in crypto markets.