Few technologies have sparked as much debate in recent years as Bitcoin. At the center of this debate lies a persistent question: does Bitcoin mining harm the environment, or can it coexist with sustainable energy systems? Headlines often highlight energy consumption figures without context, framing Bitcoin mining as inherently wasteful. However, a closer examination reveals a more nuanced reality—one in which green Bitcoin mining can actually strengthen power grids, accelerate renewable deployment, and improve energy market efficiency.

The conversation around Bitcoin mining has matured significantly. Industry participants, policymakers, and energy experts increasingly acknowledge that the relationship between digital asset infrastructure and energy systems is complex. Mining operations are not monolithic. Their impact depends heavily on location, energy sourcing, grid structure, and regulatory frameworks.

This article explores the concept of green mining, explains how mining interacts with electrical grids, and clarifies common misconceptions about Bitcoin mining’s environmental footprint. By analyzing energy economics, grid stabilization mechanisms, renewable integration, and technological innovation, we provide a comprehensive view of how sustainable Bitcoin mining can align with broader climate and energy objectives.

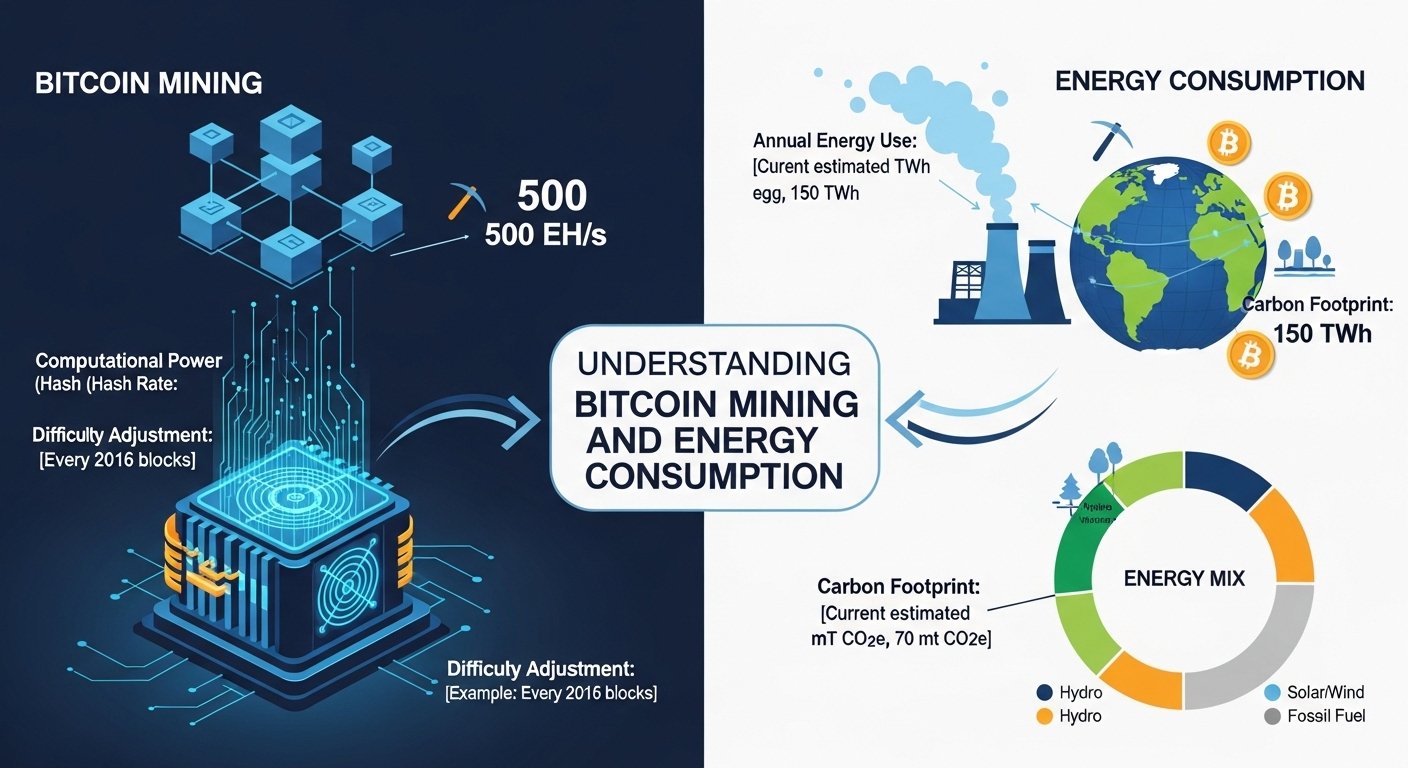

Understanding Bitcoin Mining and Energy Consumption

To understand green Bitcoin mining, one must first understand how Bitcoin mining works. Mining is the process through which transactions on the Bitcoin network are verified and new bitcoins are issued. This process relies on the Proof-of-Work consensus mechanism, which requires computational effort to secure the network.

Mining computers perform cryptographic calculations. The first to solve a cryptographic puzzle adds a new block to the blockchain and receives a reward. This computational competition consumes electricity, and it is this electricity consumption that fuels environmental criticism.

However, focusing solely on total energy consumption without context leads to misleading conclusions. Energy consumption does not automatically equal environmental harm. The critical question is the energy source. If mining is powered by fossil fuels, the carbon footprint may be significant. If powered by renewable energy sources, the environmental impact changes dramatically.

Moreover, energy intensity must be evaluated relative to the security provided. Bitcoin mining secures a decentralized monetary network valued in the hundreds of billions of dollars. The energy used is not arbitrary; it underpins a censorship-resistant financial infrastructure.

The Core Misconception: Energy Use vs. Energy Waste

A common misconception is that Bitcoin mining “wastes” electricity. In reality, electricity cannot be stored efficiently at scale without dedicated infrastructure. In many regions, excess energy production is curtailed because supply exceeds demand.

Energy Curtailment and Stranded Power

Renewable energy facilities frequently produce surplus electricity during periods of low demand. Wind turbines may be shut down during strong wind events. Solar farms may curtail output during midday oversupply. This curtailed energy is effectively wasted because it cannot be transmitted or stored economically.

Bitcoin mining can act as a flexible energy consumer that absorbs this excess generation. Mining facilities can rapidly scale consumption up or down, making them ideal for utilizing stranded power. Instead of wasting renewable electricity, grids can redirect it toward mining operations.

In regions with remote hydroelectric resources or natural gas flaring sites, Bitcoin mining has emerged as a solution for monetizing otherwise unused energy. This shifts the narrative from waste to energy optimization.

Green Bitcoin Mining: What It Really Means

Green Bitcoin mining refers to mining operations powered primarily by low-carbon or renewable energy sources such as hydro, wind, solar, geothermal, and nuclear power.

Renewable Integration and Load Flexibility

Unlike traditional industrial facilities, Bitcoin miners can operate as interruptible loads. They can power down within minutes if grid demand spikes. This flexibility provides grid operators with a powerful tool for balancing supply and demand.

As renewable energy penetration increases, grids face intermittency challenges. Solar and wind generation fluctuate based on weather conditions. Flexible demand is essential to maintaining stability. Bitcoin mining can function as demand response infrastructure, adjusting consumption dynamically. This dynamic load management improves grid stability and reduces reliance on peaker plants, which are often powered by fossil fuels and activated during demand surges.

Stabilizing Power Grids Through Demand Response

Power grids must constantly balance generation and consumption. Even slight imbalances can cause frequency deviations, risking blackouts or equipment damage.

How Mining Supports Grid Stability

Bitcoin miners can participate in demand response programs. When electricity demand rises—such as during heatwaves—miners can curtail operations, freeing capacity for residential and commercial users. This responsiveness distinguishes mining from many other industrial processes that require continuous operation. Data centers for cloud computing, for example, often cannot shut down rapidly without disrupting services. Mining facilities, in contrast, are inherently adaptable. By acting as controllable loads, miners enhance grid resilience and support energy reliability. In markets where demand response is compensated, mining can improve the economics of renewable-heavy grids.

Environmental Footprint: A Data-Driven Perspective

Critics frequently cite Bitcoin’s total electricity consumption, but total consumption alone is an incomplete metric. Carbon intensity, energy mix, and marginal generation sources must be considered.

The Shift Toward Cleaner Energy

Over the past several years, mining operations have migrated toward regions with abundant renewable energy. Hydropower in parts of North America and Scandinavia, wind energy in Texas, and geothermal power in Iceland are examples of cleaner energy powering mining infrastructure.

Mining’s mobility encourages competition for low-cost energy, which increasingly means renewable energy. Solar and wind are now among the cheapest forms of electricity generation globally. As a result, green Bitcoin mining is economically attractive. Furthermore, some mining operations utilize methane capture technology at oil fields and landfills. Methane is a potent greenhouse gas. Capturing and combusting it for electricity can reduce overall emissions compared to venting.

Economic Incentives and Renewable Expansion

Energy developers face financial risk when investing in new renewable projects. Revenue uncertainty can hinder capital allocation.

Mining as a Financial Backstop

Bitcoin mining can provide a consistent buyer of electricity in early project phases. By guaranteeing baseline demand, miners improve project bankability. This is especially relevant for remote renewable installations lacking robust transmission infrastructure.

In this way, mining can accelerate renewable build-out. Instead of competing with green energy, miners may support its expansion by acting as anchor customers. The presence of flexible demand also reduces curtailment risk. Developers can oversize renewable installations knowing that excess power can be monetized through mining operations.

Addressing Carbon Emissions Concerns

Carbon emissions remain central to the Bitcoin mining debate. It is important to distinguish between legacy mining practices and emerging green mining models.

Transitioning Energy Mix

As global electricity grids decarbonize, Bitcoin mining naturally becomes cleaner. Mining operations tend to relocate to jurisdictions with competitive energy pricing. Increasingly, those prices are driven by renewable energy.

Additionally, regulatory frameworks are encouraging transparency. Many public mining companies publish sustainability reports detailing energy sources and emissions metrics. It is inaccurate to portray Bitcoin mining as uniformly fossil-fuel-dependent. The industry is heterogeneous and evolving rapidly.

Technological Innovation and Energy Efficiency

Mining hardware efficiency has improved significantly over time. Modern application-specific integrated circuits (ASICs) deliver more hash power per watt than earlier generations.

Efficiency Gains and Cooling Innovations

Advanced cooling techniques such as immersion cooling systems enhance thermal management and extend hardware lifespan. Efficient cooling reduces overall energy waste and increases operational stability.

Innovation in semiconductor design continues to drive improvements in performance-per-watt ratios. These efficiency gains reduce the environmental impact per unit of network security. As hardware evolves, the overall energy efficiency of green Bitcoin mining improves, reinforcing the alignment between sustainability and economic viability.

Policy, Regulation, and Public Perception

Public discourse often lags behind technological and operational realities. Policymakers sometimes respond to outdated data or incomplete analyses.

Balanced Regulatory Approaches

Effective regulation should distinguish between carbon-intensive operations and green mining initiatives. Blanket bans risk stifling innovation and pushing mining to less transparent jurisdictions. Instead, incentives for renewable-powered mining and methane mitigation projects can align industry growth with environmental goals. Transparent reporting standards, carbon accounting frameworks, and energy disclosure requirements improve accountability without undermining technological progress.

The Broader Context: Bitcoin Mining in the Energy Ecosystem

Bitcoin mining should not be evaluated in isolation. Every major industry consumes energy. Data centers, gold mining, banking infrastructure, and manufacturing all require electricity. The relevant comparison is not zero consumption but relative efficiency and utility. Bitcoin mining secures a decentralized monetary system that operates globally without centralized control. When powered by renewables, green Bitcoin mining integrates into the broader clean energy transition. Rather than destabilizing grids, it can enhance flexibility, monetize excess production, and incentivize renewable development.

Future Outlook: Toward Sustainable Digital Infrastructure

The trajectory of energy markets suggests continued growth in renewable capacity. As grids become more decentralized and distributed generation increases, flexible loads will be critical. Bitcoin mining’s inherent adaptability positions it as a candidate for integration into future smart grids. With improved storage technologies, expanded transmission networks, and advanced forecasting tools, the synergy between mining and renewable energy could deepen.

Emerging research explores co-locating mining facilities with solar farms, wind installations, and geothermal plants. This model reduces transmission losses and maximizes local energy utilization. The long-term viability of green Bitcoin mining depends on continued transparency, technological innovation, and responsible governance. If these conditions are met, mining can complement—not contradict—climate objectives.

Conclusion

The narrative surrounding Bitcoin mining is often oversimplified. While energy consumption is real and significant, it does not inherently equate to environmental harm. The impact of mining depends on energy sourcing, grid integration, and operational practices.

Green Bitcoin mining demonstrates that mining can utilize renewable energy, reduce curtailment, support grid stability, and incentivize clean energy expansion. By functioning as a flexible load and participating in demand response programs, mining operations can enhance grid resilience.

As global energy systems transition toward lower-carbon sources, Bitcoin mining will likely become progressively cleaner. Policymakers, industry participants, and analysts must evaluate mining within the broader context of energy economics and technological innovation. Rather than viewing Bitcoin mining as a threat to sustainability, it may be more accurate to consider it a potential catalyst for smarter, more adaptive energy systems.

FAQs

Q: Is Bitcoin mining inherently bad for the environment?

No. The environmental impact depends on the energy source used. When powered by renewable or low-carbon energy, green Bitcoin mining can significantly reduce emissions compared to fossil-fuel-powered operations.

Q: How does Bitcoin mining stabilize power grids?

Mining operations can rapidly adjust electricity consumption, participating in demand response programs. This flexibility helps balance supply and demand, improving grid reliability.

Q: What is energy curtailment, and how does mining help?

Energy curtailment occurs when excess electricity cannot be used or stored and must be wasted. Bitcoin mining can absorb surplus renewable energy, reducing curtailment and improving efficiency.

Q: Can Bitcoin mining promote renewable energy growth?

Yes. Mining can provide consistent demand for renewable projects, improving financial viability and encouraging further renewable capacity development.

Q: Will Bitcoin mining become more sustainable over time?

As global grids decarbonize and mining hardware becomes more efficient, the sustainability of Bitcoin mining is likely to improve, particularly with continued growth in renewable energy adoption.

Also More: Bitcoin Miners Pivot to Powering AI Inside the New Compute Rush