The world of cryptocurrency has evolved far beyond simple buying and selling. Today, savvy investors are discovering innovative ways to earn passive income with cryptocurrency, creating steady revenue streams without the constant need for active trading. Whether you’re a beginner looking to dip your toes into crypto income generation or an experienced investor seeking to diversify your portfolio, understanding how to earn passive income with cryptocurrency can transform your financial future. Passive income through cryptocurrency offers unique advantages over traditional investment methods. Unlike stocks or bonds, crypto markets operate 24/7, providing continuous earning opportunities. The decentralized nature of blockchain technology enables various income-generating mechanisms that were previously impossible in traditional finance. From staking rewards to liquidity provision, the cryptocurrency ecosystem presents multiple pathways for generating consistent returns.

In this comprehensive guide, we’ll explore proven strategies, risk management techniques, and practical steps to help you build a sustainable passive income stream through cryptocurrency investments.

What Is Cryptocurrency Passive Income?

Cryptocurrency passive income refers to earning digital assets or fiat currency through crypto investments without actively trading or managing positions daily. Unlike active trading, which requires constant market monitoring and decision-making, passive income strategies allow your cryptocurrency holdings to work for you automatically. The beauty of crypto passive income lies in its accessibility and variety. You don’t need to be a professional trader or have extensive technical knowledge to start earning. Many platforms have simplified the process, making it possible for anyone to participate in income-generating activities.

Key characteristics of cryptocurrency passive income include:

- Automated earnings: Your investments generate returns without daily intervention

- Compound growth: Many strategies allow reinvestment of earnings for exponential growth

- Diversification: Multiple income streams reduce overall portfolio risk

- Global accessibility: Available 24/7 regardless of your geographic location

Top Methods to Earn Passive Income with Cryptocurrency

Cryptocurrency Staking The Foundation of Passive Crypto Income

Staking represents one of the most popular and straightforward ways to earn passive income with cryptocurrency. This process involves holding and “staking” your crypto tokens in a network to support blockchain operations and earn rewards in return. When you stake cryptocurrency, you’re essentially participating in the network’s security and validation process. Proof-of-Stake (PoS) blockchains reward stakers with newly minted tokens and transaction fees. Popular staking cryptocurrencies include Ethereum 2.0, Cardano (ADA), Solana (SOL), and Polkadot (DOT).

Benefits of Cryptocurrency Staking:

- Predictable returns ranging from 4-20% annually

- Low barrier to entry for most networks

- Supports blockchain security and decentralization

- Available on major exchanges and dedicated platforms

How to Start Staking:

- Choose a suitable cryptocurrency for staking

- Select a reliable staking platform or validator

- Transfer your tokens to the staking contract

- Monitor your rewards and compound when possible

DeFi Yield Farming and Liquidity Mining

Decentralized Finance (DeFi) protocols offer sophisticated methods to earn passive income with cryptocurrency through yield farming and liquidity mining. These strategies involve providing liquidity to decentralized exchanges and earning fees plus token rewards. Yield farming typically offers higher returns than traditional staking but comes with increased complexity and risk. Popular DeFi platforms like Uniswap, SushiSwap, and Curve Finance allow users to deposit cryptocurrency pairs into liquidity pools and earn a share of trading fees.

Key DeFi Income Strategies:

- Liquidity Provision: Supply tokens to DEX pools for trading fees

- Yield Farming: Stake LP tokens for additional token rewards

- Lending Protocols: Lend crypto assets on platforms like Aave and Compound

- Automated Vaults: Use platforms like Yearn Finance for optimized yields

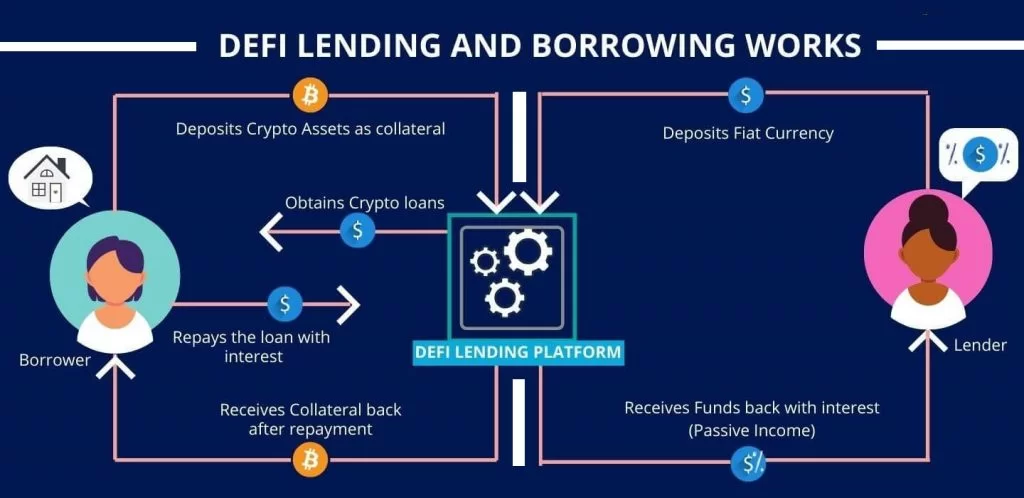

Cryptocurrency Lending and Borrowing Platforms

Crypto lending platforms provide another excellent avenue to earn passive income with cryptocurrency. These platforms connect lenders with borrowers, allowing you to earn interest on your idle crypto holdings. Centralized lending platforms like BlockFi, Celsius, and Nexo offer user-friendly interfaces and insurance coverage. Decentralized lending protocols such as Aave and Compound provide higher yields but require more technical knowledge.

Lending Platform Features:

- Interest rates typically range from 3-12% annually

- Flexible terms and instant liquidity options

- Multiple supported cryptocurrencies

- Compound interest opportunities

Crypto Mining and Cloud Mining

While traditional cryptocurrency mining requires significant hardware investment and technical expertise, cloud mining services have made this income stream accessible to everyone. Cloud mining allows you to rent mining power from established mining farms and earn cryptocurrency rewards.

Mining Income Options:

- Cloud Mining Services: Rent hash power without hardware investment

- Mining Pools: Join collective mining efforts for steady returns

- Proof-of-Stake Mining: Participate in newer consensus mechanisms

- Mobile Mining Apps: Simple apps for small-scale mining

Cryptocurrency Masternodes

Running masternodes represents an advanced method to earn passive income with cryptocurrency. Masternodes are full network nodes that perform additional functions beyond basic transaction validation, earning higher rewards in return. Masternode requirements vary by cryptocurrency but typically involve holding a specific amount of tokens as collateral. Popular masternode cryptocurrencies include Dash, PIVX, and Zcoin.

Advanced Strategies for Maximizing Crypto Passive Income

Dollar-Cost Averaging (DCA) with Automated Investing

Implementing a systematic Dollar-Cost Averaging strategy combined with automated reinvestment can significantly enhance your passive income potential. This approach involves making regular purchases regardless of market conditions and automatically staking or lending new acquisitions. Many platforms now offer automated DCA services that purchase and stake cryptocurrencies on your behalf. This strategy reduces timing risk while ensuring consistent participation in income-generating activities.

Cross-Chain Yield Optimization

Advanced investors can maximize returns by diversifying across multiple blockchain networks. Different chains offer varying yield opportunities, and spreading investments can optimize returns while reducing concentration risk. Cross-chain bridges enable asset movement between networks, allowing participation in the most profitable opportunities across the crypto ecosystem.

Arbitrage and Market Making

Sophisticated traders can earn passive income through automated arbitrage strategies and market making activities. These methods involve providing liquidity and capturing price differences across various exchanges and platforms. While these strategies require more capital and technical knowledge, they can generate consistent returns in various market conditions.

Risk Management for Cryptocurrency Passive Income

Understanding Smart Contract Risks

DeFi protocols rely on smart contracts, which can contain bugs or vulnerabilities. Always research protocol audit reports and consider the track record of development teams before committing significant funds.

Risk Mitigation Strategies:

- Diversify across multiple protocols

- Start with small amounts to test platforms

- Use audited and established protocols

- Monitor protocol governance and updates

Regulatory Considerations and Tax Implications

Cryptocurrency passive income is subject to taxation in most jurisdictions. Understanding local regulations and maintaining proper records is crucial for compliance.

Tax Planning Tips:

- Track all income-generating activities

- Understand staking reward taxation

- Consider tax-advantaged accounts where available

- Consult with crypto-savvy tax professionals

Platform and Counterparty Risk

Centralized platforms carry counterparty risk, as demonstrated by various exchange collapses. Diversifying across platforms and using decentralized alternatives can reduce this risk.

Getting Started Your First Steps to Crypto Passive Income

Setting Up Your Crypto Wallet and Exchange Accounts

Begin your passive income journey by establishing secure cryptocurrency storage and trading accounts. Hardware wallets provide the highest security for long-term holdings, while exchange accounts enable easy access to staking and lending services.

Essential Setup Steps:

- Create accounts on reputable exchanges

- Set up hardware wallet for secure storage

- Complete identity verification processes

- Enable two-factor authentication

- Start with small amounts to learn platforms

Choosing Your First Passive Income Strategy

New investors should begin with simple, low-risk strategies before exploring more complex options. Staking major cryptocurrencies on established exchanges provides an excellent starting point.

Beginner-Friendly Options:

- Exchange-based staking (Coinbase, Binance, Kraken)

- High-yield savings accounts for stablecoins

- Simple DeFi lending on major protocols

- Automated investment services

Building a Diversified Passive Income Portfolio

As you gain experience, gradually diversify your passive income streams across different strategies, cryptocurrencies, and platforms. This approach maximizes returns while minimizing risks.

Portfolio Diversification Framework:

- 40% Staking major cryptocurrencies

- 30% DeFi yield farming and lending

- 20% Stablecoin high-yield accounts

- 10% Experimental strategies and new opportunities

Common Mistakes to Avoid

Chasing Unsustainable High Yields

Extremely high yields often indicate unsustainable tokenomics or high risk. Focus on realistic, sustainable returns rather than chasing the highest advertised rates.

Neglecting Security Practices

Proper security measures are essential for protecting your passive income investments. Use strong passwords, enable 2FA, and never share private keys or seed phrases.

Inadequate Research and Due Diligence

Always research platforms, protocols, and cryptocurrencies before investing. Understanding the underlying technology and business model helps identify legitimate opportunities and avoid scams.

Future Trends in Cryptocurrency Passive Income

Institutional Adoption and Regulation

Growing institutional interest in cryptocurrency is driving the development of more sophisticated passive income products. Regulatory clarity will likely expand opportunities for mainstream adoption.

Layer 2 Solutions and Scalability

Blockchain scalability improvements are reducing transaction costs and enabling new passive income opportunities. Layer 2 solutions like Polygon and Optimism offer innovative yield generation methods.

Integration with Traditional Finance

The convergence of traditional finance and DeFi is creating hybrid products that combine the best of both worlds, offering institutional-grade security with DeFi yields.

Conclusion

Learning how to earn passive income with cryptocurrency opens doors to financial opportunities that didn’t exist just a few years ago. From simple staking to sophisticated DeFi strategies, the crypto ecosystem offers multiple pathways for generating steady returns on your digital assets. Success in cryptocurrency passive income requires patience, continuous learning, and careful risk management. Start with simple strategies, gradually diversify your approach, and always prioritize security and due diligence. As the cryptocurrency space continues to evolve, new opportunities will emerge for those prepared to adapt and learn.