The Tipping Point: Corporate Blockchain Adoption

Adopt Blockchain, According to a 2024 Coinbase Institutional Report, we’ve recently reached a historic milestone: 60% of Fortune 500 firms are already using blockchain technology. At the same time, small and medium-sized businesses (SMBs) are driving an accelerating demand for stablecoins, with transaction volumes rising 300% from last year.

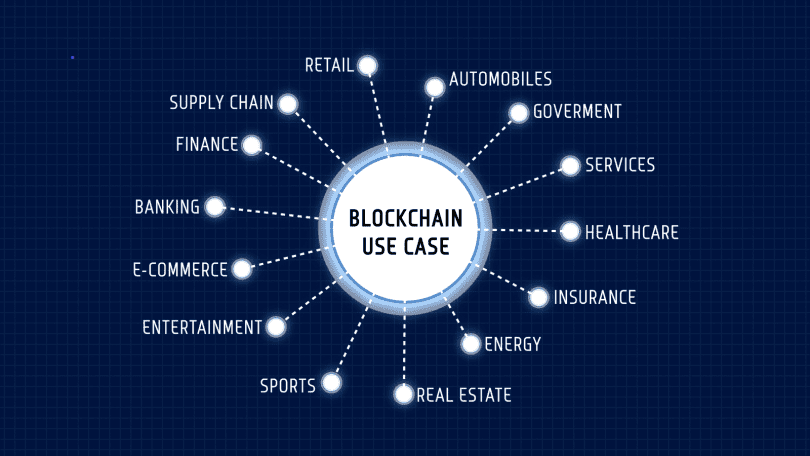

This isn’t simply a trend in the crypto world; it’s a big change in how businesses work. Let’s look at what is causing this wave of adoption.

Why are big companies like the Fortune 500 betting on blockchain?

Big companies like Walmart and JPMorgan are using blockchain for three main reasons:

1. The Supply Chain Revolution

- Walmart uses Hyperledger to keep track of food shipments in real time, which cuts down on spoiling by 30%.

- TradeLens from Maersk, which is based on blockchain, saves shipping paperwork by 80%.

2. Payments and assets that are tokenized

- In just a few weeks, BlackRock’s BUIDL fund (tokenized treasury bonds) reached $500 million.

- Visa and PayPal now use stablecoins to settle transactions across borders.

3. Stopping fraud and following the rules

- JPMorgan’s Onyx handles $1 billion worth of blockchain-based repo transactions per day.

- HSBC turns gold bars into tokens to do rid of the possibility of fake ones.

Small and medium-sized businesses are driving the stablecoin boom

Corporations are focusing on private blockchains, Adopt Blockchain, but small firms are all in on stablecoins:

- 📈 There has been a 300% rise in stablecoin transactions for small and medium-sized businesses (Circle 2024 Report).

- 💸 Why? Lower fees (compared to credit cards), fast settlements, and no delays from banks.

Real-World Use Cases:

- Freelancers getting paid in USDC (Upwork integrations)

- E-commerce companies using USDT (Shopify plugins)

- Latin American exporters using DAI to avoid hyperinflation

Coin Challenges with following the rules Stopping Full Adoption

There are still problems, even though things are getting better:

- ⚠ Uncertainty about regulations (SEC vs. CFTC disputes)

- ⚠ Problems with scalability (Ethereum L2s help, but they’re not ideal)

- ⚠ Businesses are still hesitant (Some still prefer private chains over DeFi)

What comes next?

Adopt Blockchain, The stablecoin market valuation will double, going from $160 billion to more than $300 billion.

More Fortune 500 companies are starting tokenized funds, with Goldman Sachs thought to be next.

🔮 Mergers of AI and blockchain, including smart contracts that change automatically based on market data

Questions and Answers

Q: What Fortune 500 firms use blockchain the most?

A: In the actual world, Walmart, JPMorgan, Amazon, and Maersk are the leaders.

Q: Why do small and medium-sized businesses prefer stablecoins to Bitcoin?

A: Price stability—there’s no possibility of prices going up or down when you pay suppliers or staff.

Q: Will this adoption last?

A: Yes, institutional custody solutions like Coinbase Prime are making businesses less afraid.

What do you think? Will businesses start using blockchain as much as they do cloud computing?