The US dollar exchange rate slightly increases in Iraq, drawing attention from economists, traders, policymakers, and everyday citizens alike. Currency movements in Iraq carry particular significance because the Iraqi economy relies heavily on imports, oil revenues priced in dollars, and a delicate balance between monetary stability and inflation control. Even a modest fluctuation in the dollar-to-dinar rate can ripple across local markets, influencing prices of goods, business confidence, and household purchasing power.

In recent days, reports from financial markets and exchange houses indicate that the US dollar exchange rate slightly increases in Iraq, signaling renewed pressure on the Iraqi dinar. While the change may appear marginal on paper, its implications are far-reaching. From import costs and consumer inflation to central bank policy decisions, the dollar’s movement reflects both domestic economic conditions and broader global trends.

This article provides a comprehensive and human-centered analysis of why the US dollar exchange rate slightly increases in Iraq, how it affects the economy, and what the future may hold. By examining market dynamics, government policies, oil revenues, regional factors, and global monetary conditions, readers will gain a deeper understanding of the forces shaping Iraq’s currency market. The discussion flows naturally across key themes, ensuring clarity, relevance, and practical insight for anyone tracking Iraq’s economic trajectory.

Understanding the Current Dollar Exchange Rate in Iraq

The US dollar exchange rate slightly increases in Iraq when demand for the dollar outpaces supply within the local market. Iraq operates a managed exchange rate system where the Central Bank of Iraq plays a crucial role in stabilizing the dinar through currency auctions and regulatory measures. Despite these mechanisms, market forces still exert influence, particularly in the parallel or informal exchange market.

In Iraq, the official exchange rate set by the central bank often differs from the market rate observed in local exchange shops. When reports highlight that the US dollar exchange rate slightly increases in Iraq, they usually refer to movements in the market rate, which directly affects businesses and consumers. These changes may stem from seasonal demand, shifts in import activity, or changes in regulatory enforcement.

The Iraqi dinar’s sensitivity to the dollar reflects structural characteristics of the economy. With a high dependency on imported goods, demand for dollars remains consistently strong. As a result, even small disruptions in dollar supply or confidence can lead to noticeable exchange rate movements.

Key Factors Behind the Slight Increase in the US Dollar Exchange Rate

Domestic Demand for the US Dollar

One of the primary reasons the US dollar exchange rate slightly increases in Iraq is rising domestic demand. Iraqi traders, importers, and investors often require dollars to pay for foreign goods, services, and investments. When import activity accelerates, demand for the dollar naturally rises, placing upward pressure on the exchange rate.

Seasonal factors also play a role. Periods of increased consumer spending, such as religious holidays or major commercial cycles, tend to boost imports. As importers rush to secure dollars, the local currency weakens slightly, causing the US dollar exchange rate to increase in Iraq.

Central Bank Policies and Currency Auctions

The Central Bank of Iraq manages liquidity through daily dollar auctions, which aim to meet market demand and stabilize the dinar. However, tighter compliance measures and anti-money laundering regulations can limit access to dollars for some participants. When fewer dollars circulate in the market, the US dollar exchange rate slightly increases in Iraq due to constrained supply.

While these measures strengthen transparency and financial integrity in the long term, they can create short-term fluctuations. Market participants often react quickly to policy adjustments, amplifying even minor shifts in the exchange rate.

Impact of Global Economic Conditions on Iraq’s Currency Market

US Monetary Policy and the Strong Dollar Effect

Global factors significantly influence why the US dollar exchange rate slightly increases in Iraq. When the US Federal Reserve adopts a tighter monetary stance, higher interest rates strengthen the dollar globally. A stronger dollar increases its value against many currencies, including the Iraqi dinar.

As global investors seek safety in dollar-denominated assets, demand for the US currency rises worldwide. Iraq, being integrated into global oil and trade systems, inevitably feels these effects. The result is a gradual upward movement in the local dollar exchange rate.

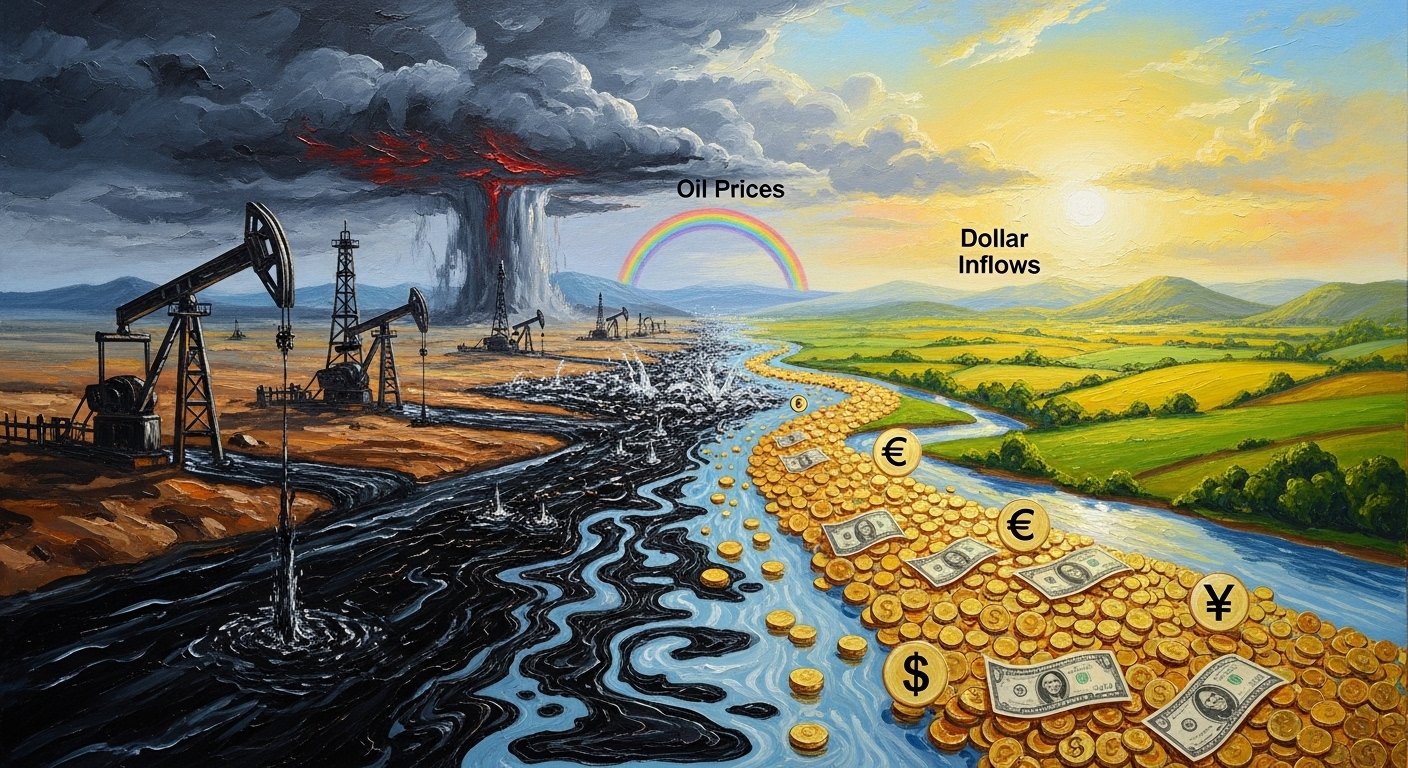

Oil Prices and Dollar Inflows

Iraq’s economy depends heavily on oil exports, which generate revenue in US dollars. When oil prices remain stable or rise, dollar inflows increase, supporting the dinar. However, fluctuations or delays in oil revenue transfers can temporarily reduce dollar supply in local markets.

In such cases, the US dollar exchange rate slightly increases in Iraq despite strong overall export performance.This dynamic highlights the complex relationship between oil markets and currency stability. While oil revenue provides long-term support, short-term timing issues can still affect exchange rates.

Effects of the Exchange Rate Increase on the Iraqi Economy

Inflation and Consumer Prices

When the US dollar exchange rate slightly increases in Iraq, import costs rise. Since Iraq imports a significant portion of its food, consumer goods, and industrial inputs, higher dollar prices translate into higher retail prices. Even a small increase can affect inflation expectations, particularly for low- and middle-income households.Merchants often pass increased costs on to consumers, leading to higher prices for essentials. This dynamic underscores why exchange rate stability remains a top priority for policymakers.

Business Confidence and Investment Climate

Currency stability plays a critical role in shaping investor confidence. A slight increase in the US dollar exchange rate in Iraq may raise concerns among local businesses about future costs and profitability. Import-dependent sectors feel immediate pressure, while exporters may benefit marginally.Foreign investors closely monitor exchange rate trends. While a modest increase does not necessarily signal instability, persistent upward movements could influence long-term investment decisions.

Role of the Parallel Market and Exchange Houses

Difference Between Official and Market Rates

In Iraq, the US dollar exchange rate slightly increases in Iraq is often more visible in the parallel market than in official channels. Exchange houses and street markets respond quickly to changes in supply and demand, reflecting real-time sentiment.The gap between the official rate and the market rate serves as an indicator of confidence in monetary policy. When the gap widens, it suggests market pressure; when it narrows, it reflects improved stability.

Regulatory Oversight and Market Behavior

Government efforts to regulate exchange houses aim to reduce speculation and stabilize rates. However, enforcement actions can temporarily disrupt dollar availability. In such situations, the US dollar exchange rate slightly increases in Iraq as traders adjust to new conditions.Over time, consistent regulation enhances transparency and reduces volatility, benefiting the broader economy.

Social and Political Dimensions of Currency Fluctuations

Public Perception and Trust in the Dinar

Currency movements carry psychological weight. When people hear that the US dollar exchange rate slightly increases in Iraq, concerns about purchasing power and savings often follow. Public trust in the dinar depends not only on actual economic conditions but also on perceptions shaped by media and social discourse.Clear communication from authorities helps manage expectations and prevent panic-driven demand for dollars.

Political Stability and Economic Confidence

Political developments also influence exchange rates. Periods of uncertainty can increase demand for safe assets like the US dollar. Conversely, political stability supports confidence in the dinar. Thus, the US dollar exchange rate slightly increases in Iraq may reflect not only economic factors but also the broader political environment.

Long-Term Implications for Iraq’s Monetary Policy

Balancing Stability and Reform

The Central Bank of Iraq faces the challenge of maintaining exchange rate stability while implementing financial reforms. Occasional movements, such as when the US dollar exchange rate slightly increases in Iraq, test the effectiveness of policy tools.Over the long term, diversifying the economy, strengthening domestic production, and improving financial infrastructure can reduce reliance on the dollar and enhance currency resilience.

Reducing Dollar Dependency

Efforts to promote digital payments, strengthen banking systems, and encourage local currency usage aim to reduce dollarization. As these reforms take hold, the impact of short-term fluctuations in the US dollar exchange rate in Iraq may diminish.

Future Outlook for the US Dollar Exchange Rate in Iraq

Looking ahead, the outlook depends on a combination of domestic reforms and global conditions. If oil revenues remain strong and monetary policy stays consistent, the dinar may stabilize. However, global uncertainties and regional developments could still influence trends.Analysts expect that while the US dollar exchange rate slightly increases in Iraq in the short term, long-term stability remains achievable through prudent policy and economic diversification.

Conclusion

The fact that the US dollar exchange rate slightly increases in Iraq reflects a complex interplay of domestic demand, central bank policy, global economic forces, and public sentiment. While the increase may appear modest, its effects extend across inflation, trade, investment, and daily life.

Understanding these dynamics helps businesses, consumers, and policymakers make informed decisions. With continued reforms, transparent regulation, and stable oil revenues, Iraq can manage exchange rate pressures and support sustainable economic growth. Monitoring currency trends remains essential, but confidence in long-term stability is equally important.

FAQs

Q: Why does the US dollar exchange rate slightly increase in Iraq?

The increase often results from higher demand for dollars, regulatory changes, or global factors such as US monetary policy and oil revenue fluctuations.

Q: Does a slight increase in the dollar rate affect everyday Iraqis?

Yes, even a small increase can raise import costs, leading to higher prices for consumer goods and essentials.

Q: How does the Central Bank of Iraq control the exchange rate?

The central bank uses currency auctions, regulatory measures, and monetary policy tools to manage dollar supply and stabilize the dinar.

Q: Is the increase in the dollar rate a sign of economic instability?

Not necessarily. A slight increase is common in managed exchange rate systems and does not automatically indicate long-term instability.

Q: What can reduce future dollar exchange rate fluctuations in Iraq?

Economic diversification, stronger banking systems, reduced dollar dependency, and consistent monetary policy can help stabilize exchange rates over time.

Also More: How the US Government Moves $14B in Bitcoin Safely