The question why crypto is falling today is once again dominating investor discussions across global markets. From seasoned traders to long-term holders, everyone is trying to understand the forces driving the latest pullback in digital assets. Bitcoin, Ethereum, XRP, and Dogecoin have all experienced renewed selling pressure, triggering concern but also creating opportunities for strategic investors who understand the broader context.

Cryptocurrency markets are inherently volatile, yet price declines rarely occur without reason. The current downturn is not the result of a single trigger but rather a convergence of macroeconomic uncertainty, shifting investor sentiment, regulatory developments, and technical market structures. While many retail participants focus on short-term price movements, institutional players often look deeper, analyzing liquidity conditions, derivatives data, and on-chain metrics.

This article provides a comprehensive crypto market analysis explaining why the market is under pressure today. We will explore Bitcoin price weakness, Ethereum’s struggle at key levels, XRP’s legal and sentiment-driven volatility, and Dogecoin’s speculative nature. By the end, you will have a clearer picture of what is happening now, why prices are falling, and what could happen next.

Why Crypto Markets Are Under Pressure Today

Macroeconomic Uncertainty and Global Risk-Off Sentiment

One of the most important reasons crypto is falling today is the broader macroeconomic environment. Global financial markets have recently shifted into a risk-off mode as investors react to persistent inflation concerns, tighter financial conditions, and uncertainty around economic growth. When traditional markets become volatile, speculative assets such as cryptocurrencies are often the first to face sell-offs.

High interest rates continue to reduce liquidity across markets. Capital that once flowed freely into high-risk, high-reward assets is now seeking safer returns in government bonds and cash-equivalent instruments. As liquidity tightens, digital assets feel the impact almost immediately.

In addition, geopolitical tensions and concerns about global trade have reinforced defensive positioning among investors. This shift in sentiment directly affects crypto prices, as many participants still view digital assets as risk-on instruments rather than safe havens.

Strengthening Dollar and Its Impact on Crypto Prices

Another key factor behind why crypto is down today is the strength of the US dollar. Historically, there has been an inverse relationship between the dollar index and cryptocurrency prices. When the dollar strengthens, it often puts downward pressure on Bitcoin and altcoins.

A stronger dollar reduces the appeal of alternative assets and makes speculative investments less attractive for international investors. This dynamic has played out repeatedly in previous market cycles and remains highly relevant today.

Bitcoin Price Analysis: Why BTC Is Leading the Decline

Bitcoin’s Role as the Market Anchor

Bitcoin remains the dominant force in the cryptocurrency market, and when BTC falls, the rest of the market usually follows. Understanding why Bitcoin is falling today is crucial to understanding the broader crypto downturn.

Bitcoin has recently struggled to maintain key psychological and technical support levels. Each failed attempt to reclaim higher resistance zones has emboldened short-term sellers, leading to increased downside pressure. This behavior is typical during periods of uncertainty, when traders prioritize capital preservation over aggressive risk-taking.

Technical Factors Driving Bitcoin Weakness

From a technical perspective, Bitcoin has shown signs of exhaustion after previous rallies. Momentum indicators have cooled, and trading volume has declined, suggesting reduced buying interest at current levels. When demand weakens, even modest selling pressure can result in sharp price declines.

Additionally, liquidation events in the derivatives market have amplified Bitcoin’s downside moves. Overleveraged long positions are often forced to close during sudden price drops, accelerating the decline and reinforcing bearish sentiment.

Investor Psychology and Bitcoin Sentiment

Market psychology plays a major role in Bitcoin price movements. Fear-driven selling often becomes self-reinforcing, as falling prices trigger stop-loss orders and panic exits. This emotional response is a major reason Bitcoin price drops sharply during uncertain periods, even without catastrophic fundamental news.

Ethereum Price Analysis: Network Strength Versus Market Pressure

Why Ethereum Is Falling Today Despite Strong Fundamentals

Ethereum’s price decline has puzzled many investors, especially given its strong network fundamentals and ongoing ecosystem development. However, understanding why Ethereum is down today requires separating long-term value from short-term market dynamics.

Ethereum remains highly correlated with Bitcoin, meaning it rarely moves independently during broader market sell-offs. When Bitcoin weakens, Ethereum typically experiences equal or greater downside due to its higher beta.

Gas Fees, Scaling, and Market Expectations

Although Ethereum has made significant progress in improving scalability and reducing transaction costs, market expectations often move faster than technological upgrades. When anticipated improvements fail to immediately reflect in price action, short-term traders lose patience and exit positions.

This disconnect between Ethereum fundamentals and price performance contributes to near-term volatility. Investors focused on daily price charts may overlook the long-term growth of decentralized finance, staking, and smart contract adoption on the Ethereum network.

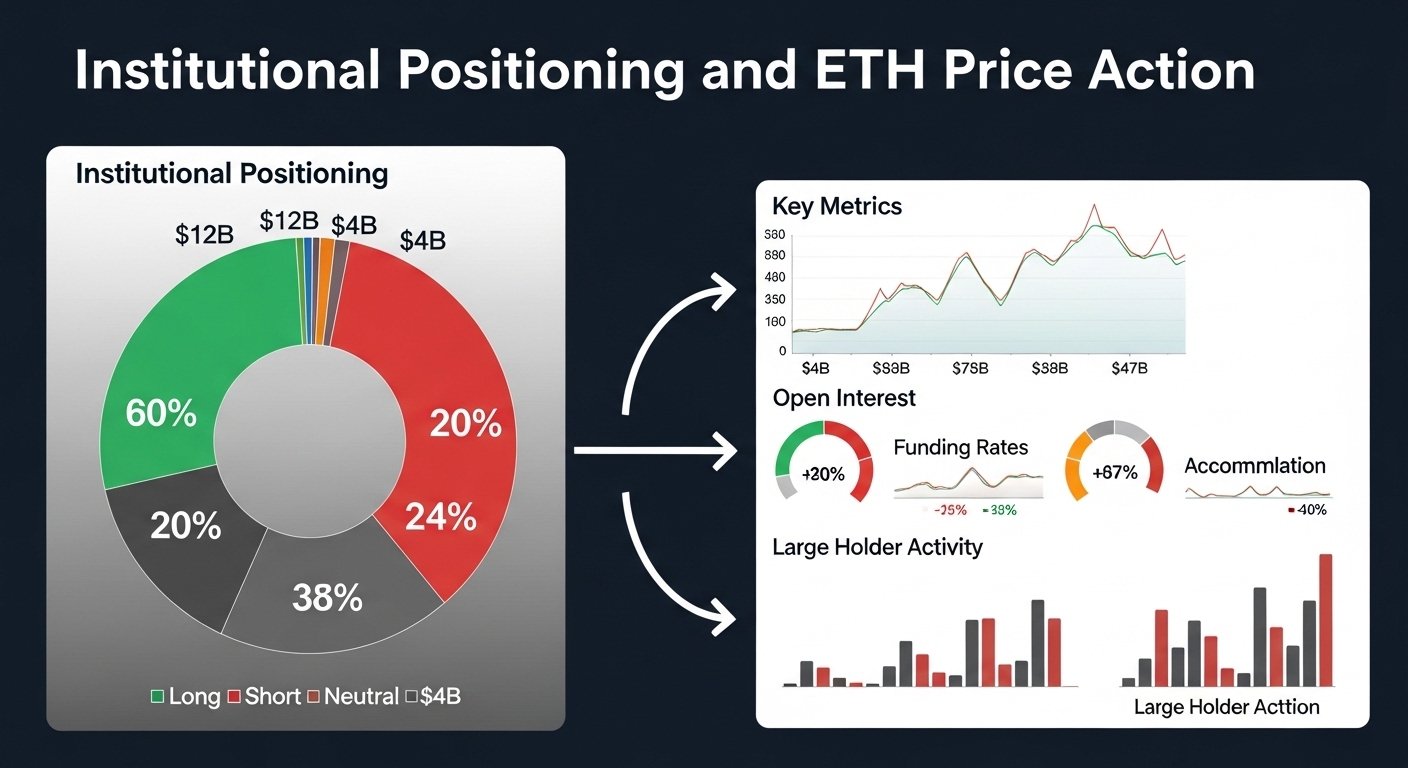

Institutional Positioning and ETH Price Action

Institutional investors increasingly view Ethereum as a strategic asset, but their participation does not eliminate volatility. In times of market stress, even institutions rebalance portfolios, temporarily reducing exposure to ETH and other altcoins.

XRP Price Analysis: Legal Uncertainty and Market Volatility

Why XRP Price Is Under Pressure Today

XRP has long been influenced by legal developments and regulatory sentiment. Understanding why XRP is falling today requires recognizing how sensitive the asset is to news and speculation. Even minor regulatory headlines can trigger outsized price movements in XRP, as traders react quickly to perceived changes in legal risk. This heightened sensitivity makes XRP more volatile during broader market downturns.

Market Sentiment and XRP Trading Behavior

XRP often attracts short-term traders looking for rapid gains, which can exacerbate price swings. When market sentiment turns negative, these traders tend to exit quickly, leading to sharper declines compared to more established assets. Despite this volatility, long-term supporters argue that XRP’s utility in cross-border payments remains intact. However, short-term price action is driven more by sentiment than by adoption metrics.

Dogecoin Price Analysis: Meme Coin Reality Check

Why Dogecoin Is Falling Today

Dogecoin’s decline highlights the speculative nature of meme-based cryptocurrencies. While Dogecoin has achieved mainstream recognition, its price is still largely driven by social sentiment and broader market trends.

When enthusiasm fades and risk appetite declines, meme coins are often the first assets investors sell. This explains why Dogecoin price is dropping today more aggressively than some other cryptocurrencies.

Social Media Influence and DOGE Volatility

Dogecoin’s reliance on social media hype makes it particularly vulnerable during bearish periods. When online discussions shift from optimism to caution, DOGE can lose momentum quickly. Without consistent fundamental drivers, Dogecoin’s price movements often reflect broader market psychology rather than intrinsic value.

Broader Crypto Market Trends Influencing Prices

Altcoin Weakness and Capital Rotation

Another reason crypto is falling today is capital rotation within the market. During uncertain periods, investors often move funds from smaller altcoins into Bitcoin or stablecoins, reducing overall market capitalization.This rotation creates the impression of widespread weakness, even when some assets are merely consolidating rather than collapsing.

Declining Trading Volume and Market Liquidity

Lower trading volume is a warning sign for any financial market. Reduced participation means fewer buyers are available to absorb selling pressure, resulting in sharper price declines. In the current environment, declining liquidity has magnified downside moves across the crypto market, reinforcing bearish trends.

Is This a Temporary Dip or the Start of a Larger Downtrend?

Historical Context of Crypto Market Corrections

Historically, cryptocurrency markets have experienced frequent corrections within longer-term uptrends. Understanding why crypto prices fall during these phases can help investors avoid emotional decision-making. Past cycles show that sharp declines are often followed by periods of consolidation and eventual recovery, provided fundamental adoption continues.

Key Levels and Signals to Watch

Investors should pay attention to support and resistance zones, on-chain activity, and macroeconomic signals. These indicators provide valuable insight into whether the current downturn is temporary or indicative of a deeper correction.

Conclusion

The answer to why crypto is falling today lies in a combination of macroeconomic pressure, shifting investor sentiment, technical weakness, and reduced liquidity. Bitcoin’s decline has set the tone for the market, while Ethereum, XRP, and Dogecoin have followed suit due to correlation and asset-specific factors.

While short-term price action may appear discouraging, it is important to remember that volatility is a defining feature of cryptocurrency markets. For long-term investors, periods of fear often present opportunities to reassess strategies and identify value. Staying informed, disciplined, and patient remains essential in navigating the evolving crypto landscape.

FAQs

Q: Why is crypto falling today suddenly?

Crypto is falling today due to a mix of macroeconomic uncertainty, stronger dollar conditions, reduced liquidity, and bearish market sentiment affecting risk assets globally.

Q: Is Bitcoin the main reason the crypto market is down?

Yes, Bitcoin often leads market movements. When Bitcoin falls, it typically drags altcoins like Ethereum, XRP, and Dogecoin down with it.

Q: Should I be worried about Ethereum’s price drop?

Ethereum’s decline is largely tied to broader market trends rather than fundamental weakness. Long-term adoption and network growth remain strong.

Q: Why does XRP react so strongly to market news?

XRP is highly sensitive to regulatory and legal developments, making it more volatile than many other cryptocurrencies during uncertain periods.

Q: Will Dogecoin recover after this dip?

Dogecoin’s recovery depends heavily on market sentiment and renewed interest. As a meme coin, it tends to outperform during bullish phases and underperform during downturns.

Also More: Crypto Market Slides $467B as Bitcoin Hits Post-Election Low